How Recent Interest Rate Volatility Impacts OCBC’s Current Market Value in 2025

Reviewed by Bailey Pemberton

If you’re sitting on the fence about Oversea-Chinese Banking, you’re not alone. Many investors are weighing up their options, especially given the bank’s impressive 19.5% price surge over the past year and more than doubling in the last five years. Short-term ups and downs, like a 3.1% gain over the past week and a flat showing in the past month, reflect a market that’s watching closely for the next big move. Big news on the regional economic front, including volatility in global interest rates and increasing optimism in the Asian financial sector, have certainly contributed to recent investor appetite, hinting at both growth potential and shifting risk perceptions.

Now, with a value score of 4 out of 6, meaning the stock appears undervalued in most of the key checks we’ll discuss, it’s no wonder many are asking: is this a great entry point, or should you wait for another pullback? Let’s break down the different valuation approaches that financial pros use to size up Oversea-Chinese Banking, and I’ll also let you in on a more holistic way to think about value that goes beyond the usual checks.

Why Oversea-Chinese Banking is lagging behind its peers

Approach 1: Oversea-Chinese Banking Excess Returns Analysis

The Excess Returns model looks at how much value a company can generate over and above its cost of equity. Instead of just focusing on profits, this approach considers how efficiently Oversea-Chinese Banking is using shareholders’ money to create returns year after year.

For Oversea-Chinese Banking, the current book value stands at SGD12.92 per share, and the bank is expected to deliver a stable earnings per share of SGD1.71, based on the weighted future Return on Equity estimates from 15 analysts. The assessed cost of equity is SGD1.02 per share, meaning the company’s excess return, or value created beyond investors’ required return, is SGD0.70 per share. Furthermore, the average Return on Equity is a solid 11.92%, and analysts project the stable book value to climb to SGD14.37 per share in future years, according to 13 analysts.

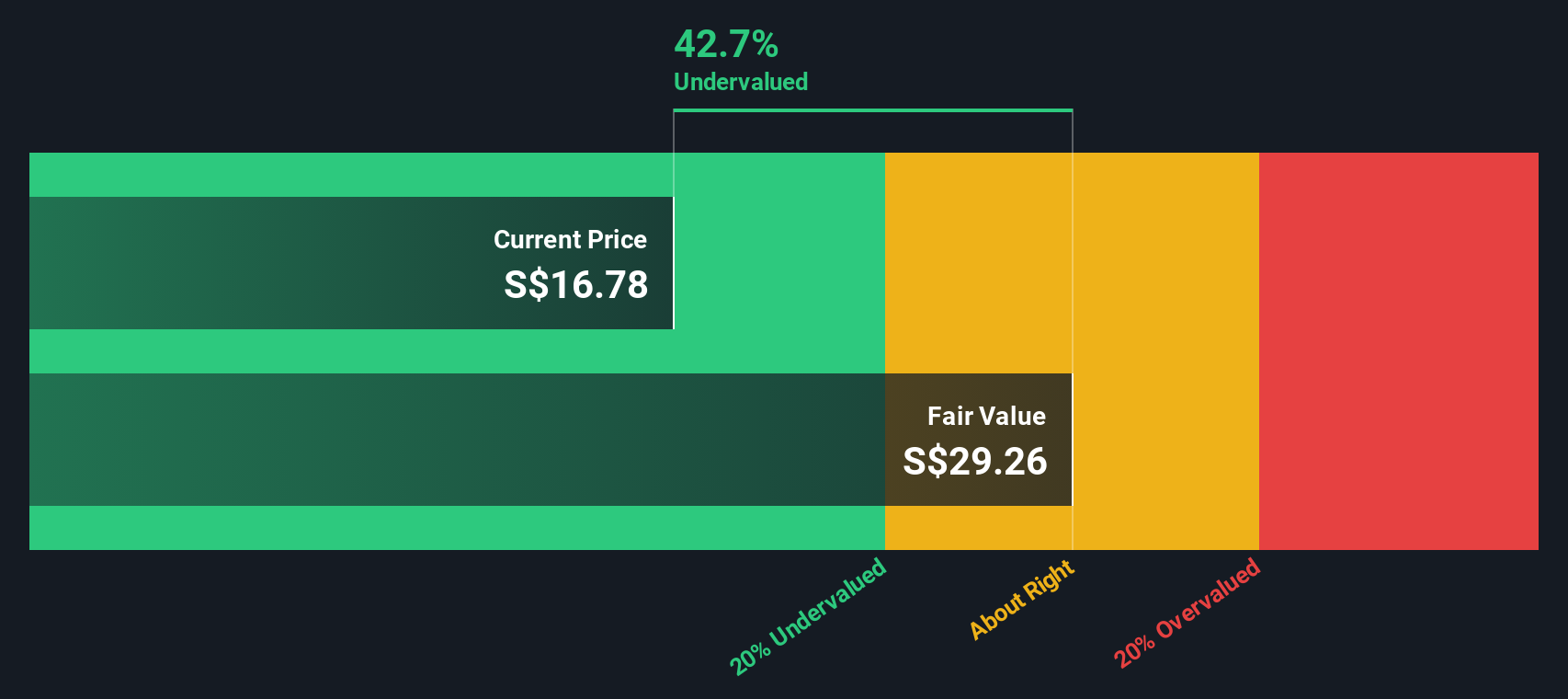

Based on the Excess Returns approach, the estimated intrinsic value for Oversea-Chinese Banking is SGD29.26 per share. Compared to recent share prices, this suggests a notable discount of 42.5%, indicating the stock is significantly undervalued at its current level.

Result: UNDERVALUED

Our Excess Returns analysis suggests Oversea-Chinese Banking is undervalued by 42.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Oversea-Chinese Banking Price vs Earnings

For established, consistently profitable companies like Oversea-Chinese Banking, the price-to-earnings (PE) ratio is a popular way to measure valuation. The PE ratio tells us how much investors are willing to pay for each dollar of the company’s earnings, which can help compare companies of different sizes across the same industry.

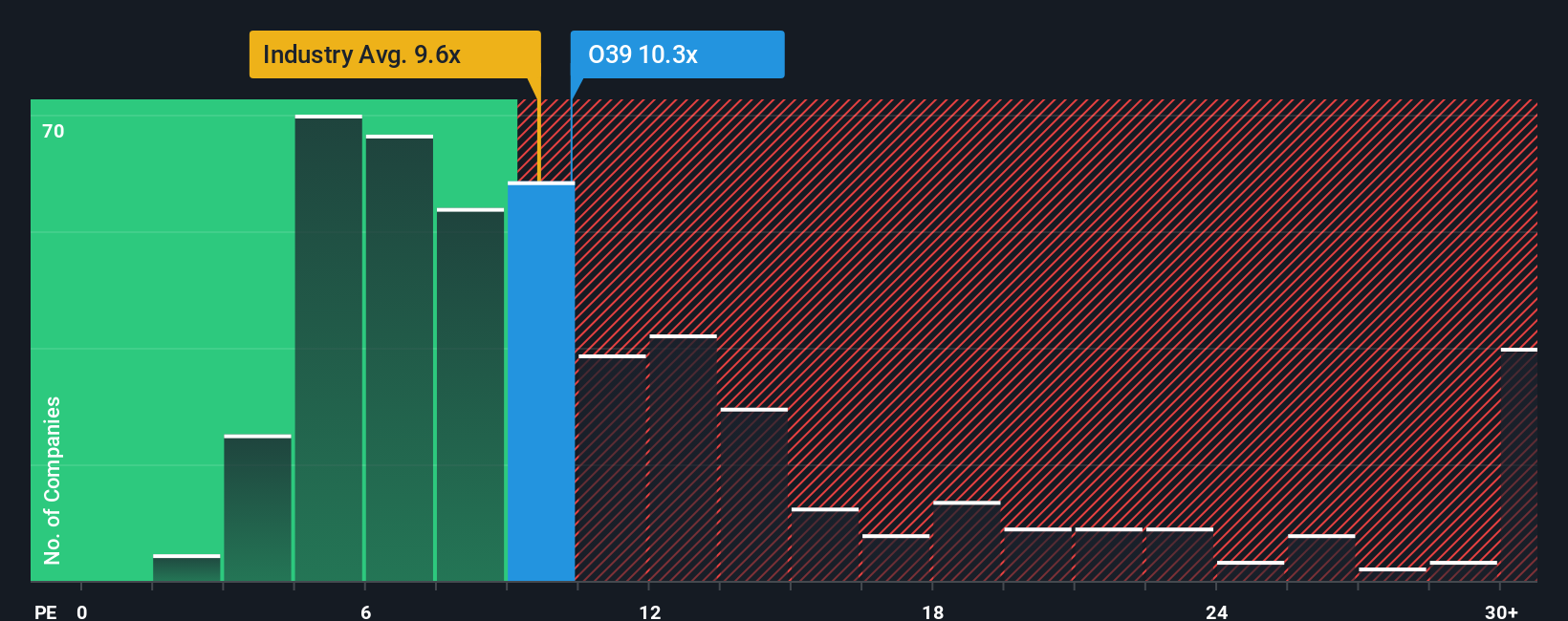

A company’s PE ratio is shaped by expectations for its future growth and the risks it faces. Generally, higher growth prospects justify a higher PE, while higher risk or unpredictable earnings usually mean the market assigns a lower PE. Comparing to benchmarks, Oversea-Chinese Banking’s current PE ratio stands at 10.4x, closely aligned with the industry average of 10.3x and slightly below the broader peer group’s average of 11.9x.

This is where the Simply Wall St “Fair Ratio” comes into play. The Fair Ratio, 10.6x in this case, is a proprietary metric that takes into account the company’s specific earnings growth rates, profit margins, risks, industry context, and market cap. Unlike simple peer or industry comparisons, the Fair Ratio is tailored to Oversea-Chinese Banking’s unique financial profile and offers a more holistic perspective on what the PE ratio should be.

With Oversea-Chinese Banking’s current PE at 10.4x, just 0.2x shy of its Fair Ratio, the stock appears to be trading at roughly its fair value based on earnings. There is no major undervaluation or premium here, meaning investors can view the current price as ABOUT RIGHT given the company’s fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Oversea-Chinese Banking Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple and powerful concept, serving as your own story or perspective about a company. It connects the fundamental numbers you expect (like future fair value, revenue, and profit margins) with the reasons and assumptions behind them. Narratives bridge the gap between the company’s strategy and the numbers, allowing you to see how a business plan, industry shift, or market development translates into a concrete financial forecast and an estimated fair value.

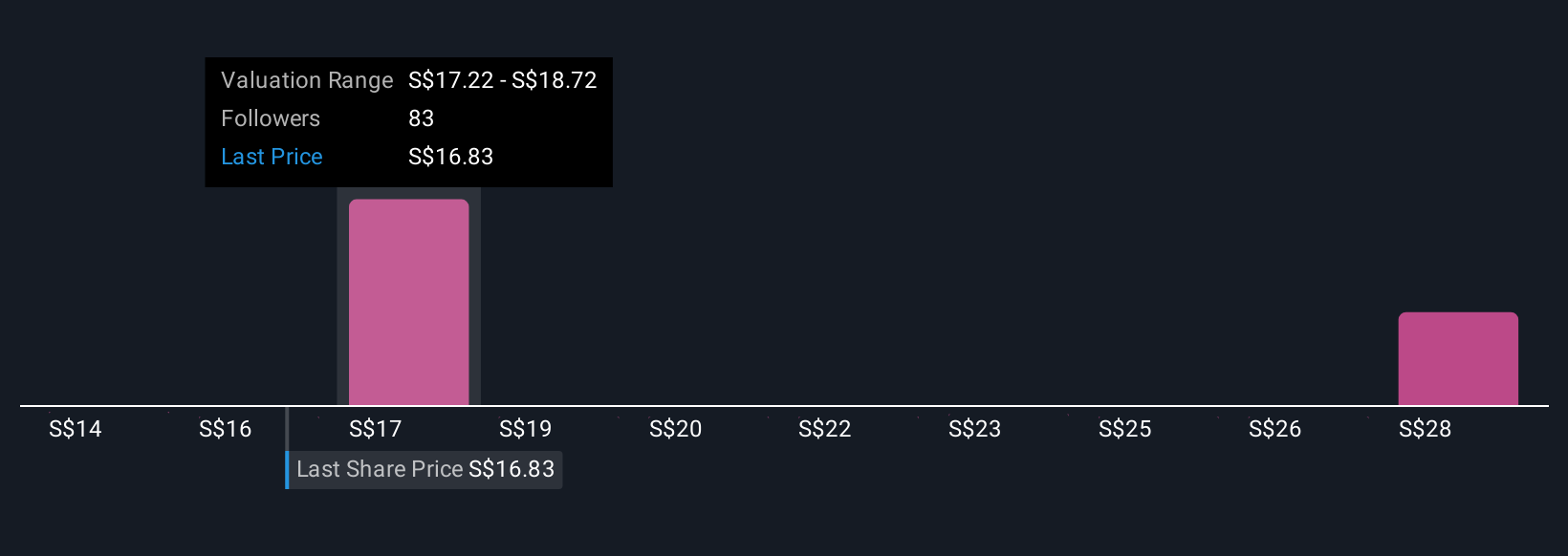

On Simply Wall St’s Community page, Narratives are designed to be easy to use and are trusted by millions of investors. They help you make smarter buy or sell decisions by comparing the Fair Value (based on your narrative or shared community perspectives) to the current market price. Since Narratives get automatically updated with new information, such as earnings, important news, or strategic changes, you can see your investment thesis evolve in real time. For Oversea-Chinese Banking, for example, the most optimistic investor narrative currently values the stock at SGD20.15, while the most cautious sees fair value at just SGD15.08, highlighting how different perspectives can lead to different investment conclusions.

Do you think there's more to the story for Oversea-Chinese Banking? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:O39

Oversea-Chinese Banking

Provides financial services in Singapore, Malaysia, Indonesia, Greater China, rest of the Asia Pacific, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)