Analyzing Multi-Chem And Two More Top Dividend Stocks On SGX

Reviewed by Simply Wall St

Amidst a dynamic global financial landscape, the Singapore market continues to offer intriguing opportunities for investors looking at stable returns through dividend stocks. In light of recent regulatory actions in international banking sectors emphasizing the importance of robust risk management and data governance, investors might consider the resilience and strategic compliance of companies as key factors when evaluating potential dividend stock investments in Singapore.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.90% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.76% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.07% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.72% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.71% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.69% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.51% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.81% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.70% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.00% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top SGX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited, primarily an investment holding company, operates in the distribution of information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of approximately SGD 271.19 million.

Operations: Multi-Chem Limited generates revenue from its IT business in India (SGD 40.56 million), Australia (SGD 54.60 million), Singapore (SGD 372.78 million), Greater China (SGD 34.96 million), and other regions totaling SGD 153.93 million, alongside a smaller PCB business in Singapore contributing SGD 1.79 million.

Dividend Yield: 8.1%

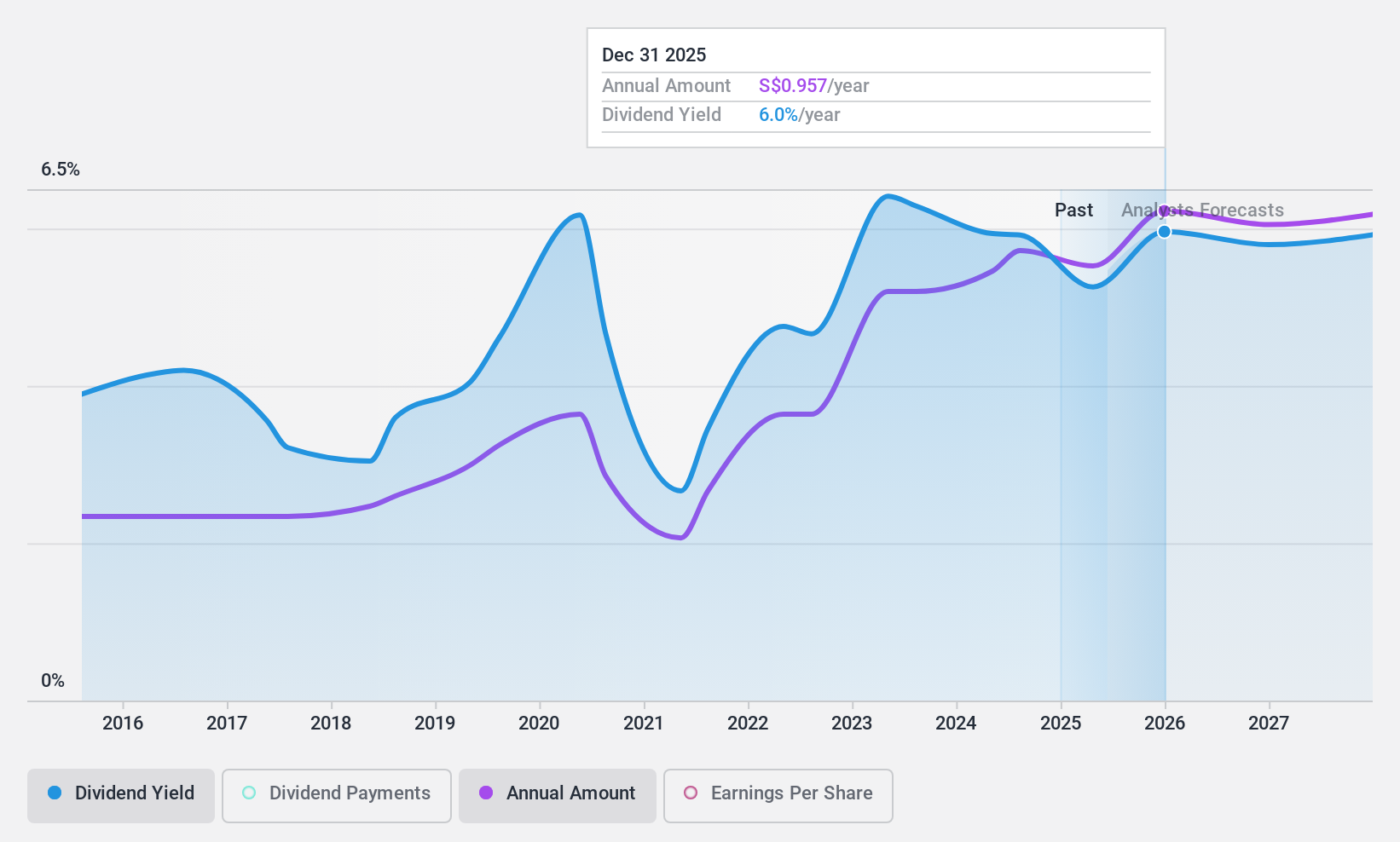

Multi-Chem Limited, a Singapore-based company, maintains a dividend payout ratio of 80.7% and a cash payout ratio of 88.1%, suggesting that its dividends are well-covered by both earnings and cash flows. However, the company's dividend track record over the past decade has been unstable and unreliable, marked by volatility in payments. Recent board changes include the appointment of Chong Teck Sin as Independent Non-Executive Director and Board Chairman on April 30, 2024, potentially influencing future financial strategies and governance.

- Click here to discover the nuances of Multi-Chem with our detailed analytical dividend report.

- Our expertly prepared valuation report Multi-Chem implies its share price may be lower than expected.

Oversea-Chinese Banking (SGX:O39)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oversea-Chinese Banking Corporation Limited operates a financial services business across Singapore, Malaysia, Indonesia, Greater China, and other Asia Pacific regions with a market capitalization of SGD 68.32 billion.

Operations: Oversea-Chinese Banking Corporation Limited generates its revenue through financial services across Singapore, Malaysia, Indonesia, Greater China, and other Asia Pacific regions.

Dividend Yield: 5.5%

Oversea-Chinese Banking Corporation has a mixed dividend profile, with a history of volatile payments despite recent growth in earnings by 14.6%. The dividends, yielding 5.53%, are below the top quartile in Singapore's market but are reasonably covered by earnings with a payout ratio of 52.9%. Recent activities include multiple fixed-income offerings and share repurchases, indicating active capital management but also reflecting challenges in maintaining stable dividend growth amidst financial expansions and obligations.

- Get an in-depth perspective on Oversea-Chinese Banking's performance by reading our dividend report here.

- Our valuation report unveils the possibility Oversea-Chinese Banking's shares may be trading at a discount.

Singapore Exchange (SGX:S68)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited (SGX: S68) operates as an integrated securities and derivatives exchange with related clearing houses in Singapore, boasting a market capitalization of SGD 10.36 billion.

Operations: Singapore Exchange Limited generates revenue primarily from two segments: Segment Adjustment at SGD 0.84 billion and Fixed Income, Currencies, and Commodities at SGD 0.37 billion.

Dividend Yield: 3.5%

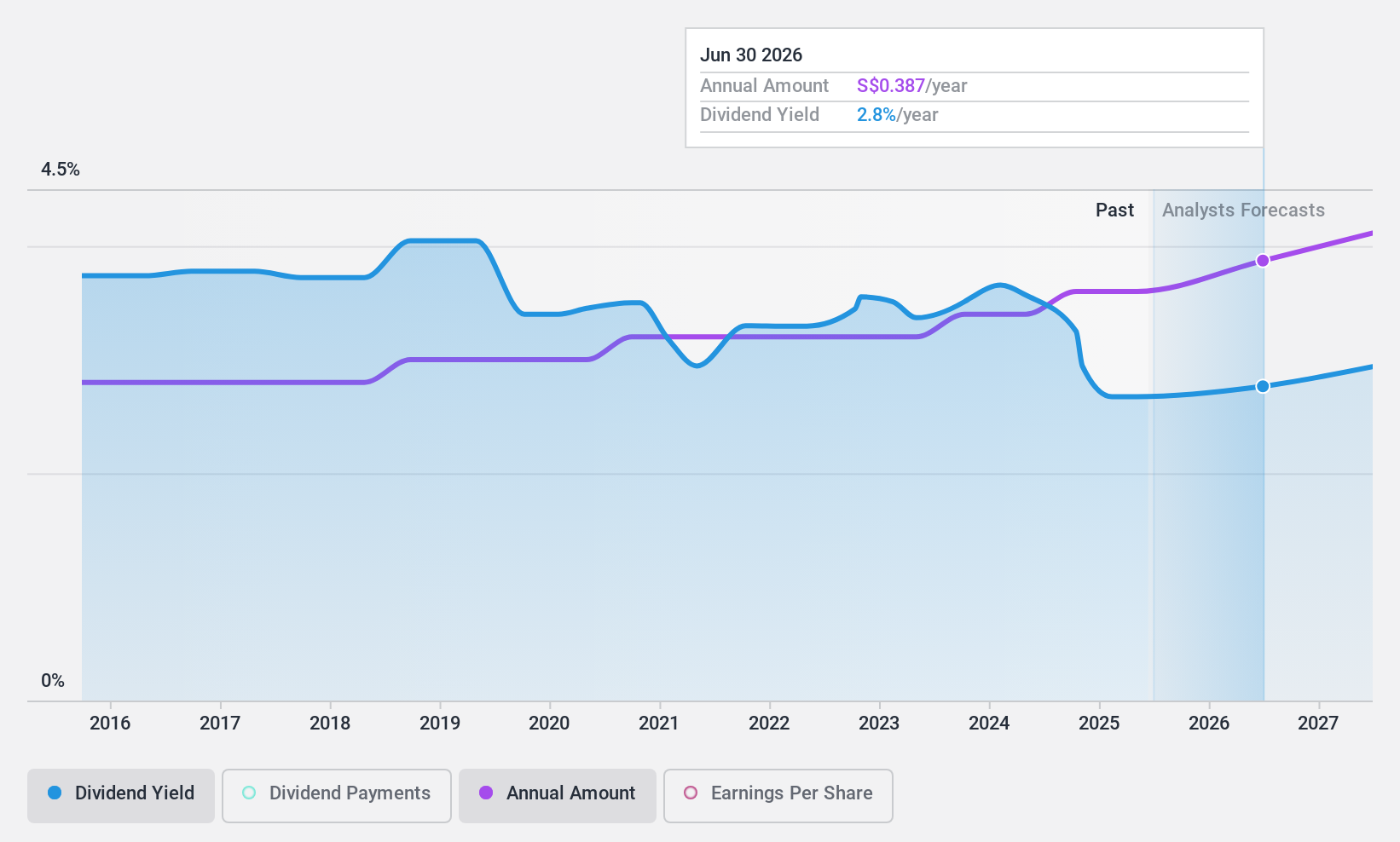

Singapore Exchange offers a consistent dividend yield of 3.51%, underpinned by stable dividends over the past decade and a recent increase. The dividends are well-covered by both earnings and cash flows, with payout ratios at 63% and 79.1% respectively, suggesting sustainability. Despite its reliability in dividend payments, its yield is lower than the top quartile of Singapore dividend stocks at 6.3%. Recent activities include participation in industry conferences, highlighting its active engagement in sectoral developments.

- Unlock comprehensive insights into our analysis of Singapore Exchange stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Singapore Exchange is priced higher than what may be justified by its financials.

Summing It All Up

- Delve into our full catalog of 20 Top SGX Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Multi-Chem, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AWZ

Multi-Chem

An investment holding company, distributes information technology products in Singapore, Greater China, Australia, India, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives