- Sweden

- /

- Telecom Services and Carriers

- /

- OM:OVZON

Earnings Release: Here's Why Analysts Cut Their Ovzon AB (publ) (STO:OVZON) Price Target To kr15.00

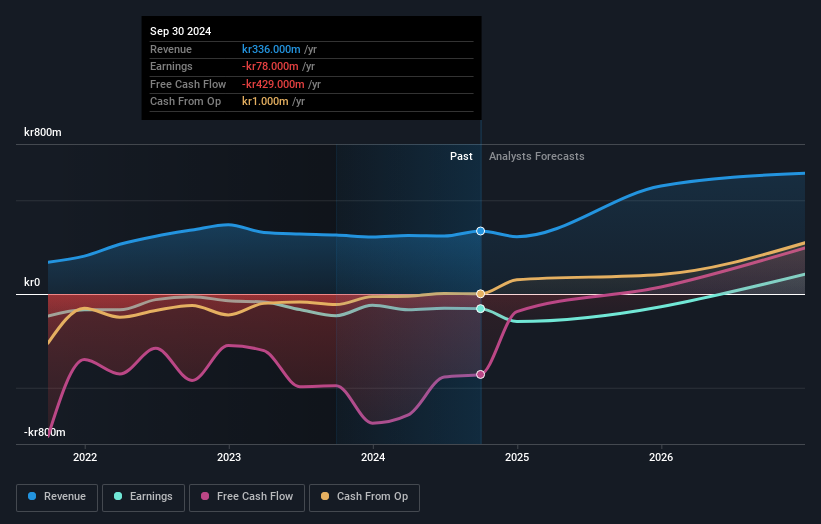

A week ago, Ovzon AB (publ) (STO:OVZON) came out with a strong set of third-quarter numbers that could potentially lead to a re-rate of the stock. The results were impressive, with revenues of kr95m exceeding analyst forecasts by 23%, and statutory losses of kr0.29 were likewise much smaller than the analysts had forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Ovzon after the latest results.

View our latest analysis for Ovzon

Taking into account the latest results, the consensus forecast from Ovzon's twin analysts is for revenues of kr575.9m in 2025. This reflects a huge 71% improvement in revenue compared to the last 12 months. The statutory loss per share is expected to greatly reduce in the near future, narrowing 88% to kr1.32. Yet prior to the latest earnings, the analysts had been anticipated revenues of kr590.9m and earnings per share (EPS) of kr0.93 in 2025. There looks to have been a significant drop in sentiment regarding Ovzon's prospects after these latest results, with a minor downgrade to revenues and the analysts now forecasting a loss instead of a profit.

The average price target fell 21% to kr15.00, implicitly signalling that lower earnings per share are a leading indicator for Ovzon's valuation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Ovzon's past performance and to peers in the same industry. It's clear from the latest estimates that Ovzon's rate of growth is expected to accelerate meaningfully, with the forecast 54% annualised revenue growth to the end of 2025 noticeably faster than its historical growth of 12% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 1.7% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Ovzon is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts are expecting Ovzon to become unprofitable next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At least one analyst has provided forecasts out to 2026, which can be seen for free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Ovzon (2 shouldn't be ignored) you should be aware of.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OVZON

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives