As the European Central Bank's recent interest rate cuts have buoyed major stock indexes across the continent, Sweden's market is drawing attention for its potential in dividend stocks. In this environment of monetary easing, investors may find value in companies that offer reliable dividends, which can provide a steady income stream amid fluctuating economic conditions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.74% | ★★★★★★ |

| Zinzino (OM:ZZ B) | 3.36% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.82% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 5.00% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.67% | ★★★★★☆ |

| Bilia (OM:BILI A) | 5.41% | ★★★★☆☆ |

| Loomis (OM:LOOMIS) | 3.98% | ★★★★☆☆ |

| Afry (OM:AFRY) | 3.11% | ★★★★☆☆ |

| Bahnhof (OM:BAHN B) | 3.75% | ★★★★☆☆ |

| Bulten (OM:BULTEN) | 3.49% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Swedish Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden, with a market cap of SEK1.82 billion.

Operations: Bredband2 i Skandinavien AB (publ) generates revenue through its National Broadband Service segment, which accounts for SEK1.65 billion.

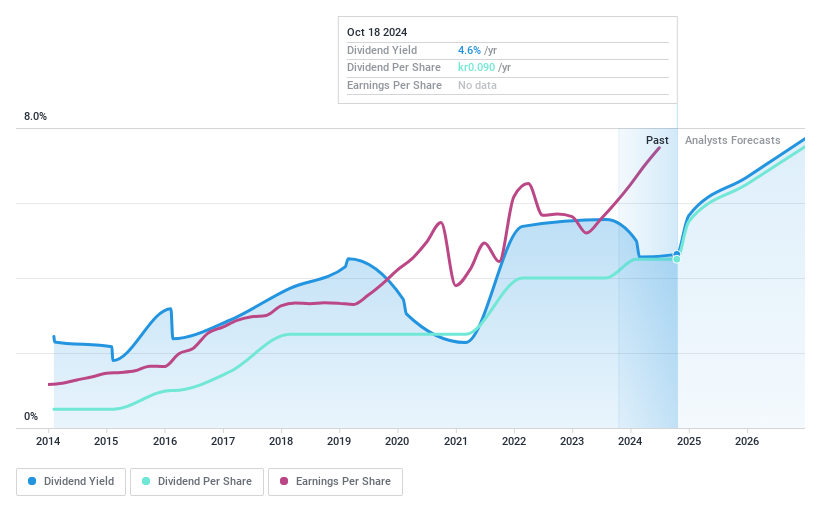

Dividend Yield: 4.7%

Bredband2 i Skandinavien offers a compelling dividend profile with reliable and stable payouts over the past decade. Its dividends are well-covered, boasting a cash payout ratio of 39.1% and an earnings payout ratio of 87.6%. The company’s recent performance shows robust growth, with net income rising to SEK 24.35 million in Q2 2024, supporting its attractive dividend yield of 4.74%, placing it among the top tier in Sweden's market.

- Dive into the specifics of Bredband2 i Skandinavien here with our thorough dividend report.

- The valuation report we've compiled suggests that Bredband2 i Skandinavien's current price could be inflated.

Ework Group (OM:EWRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ework Group AB (publ) offers comprehensive talent solutions specializing in IT/OT, R&D, engineering, and business development across Sweden, Denmark, Norway, Finland, Slovakia, and Poland with a market cap of SEK2.31 billion.

Operations: Ework Group AB (publ) generates revenue through its provision of talent solutions in IT/OT, R&D, engineering, and business development across multiple European countries including Sweden, Denmark, Norway, Finland, Slovakia, and Poland.

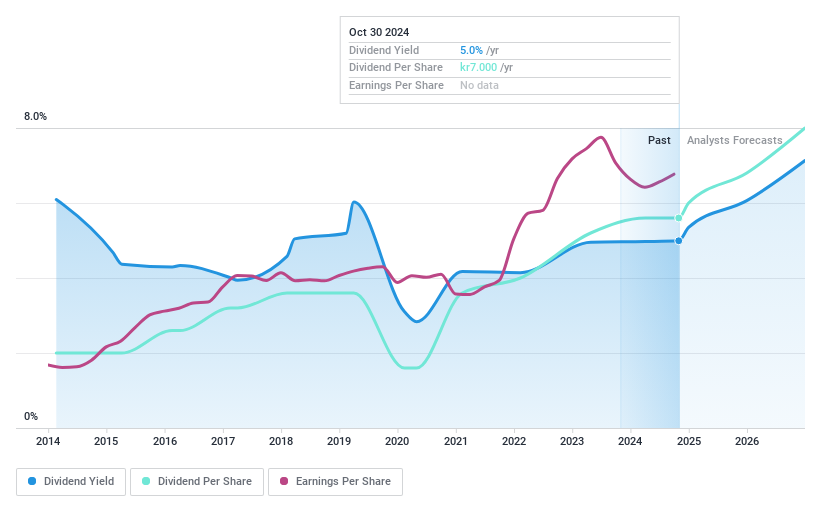

Dividend Yield: 5.2%

Ework Group's dividend yield of 5.22% ranks in the top 25% among Swedish dividend payers, yet its sustainability is questionable due to a high payout ratio of 91.9%, indicating dividends are not well covered by earnings. Despite a history of volatility and unreliability in dividend payments, cash flows sufficiently cover the current payout with a cash payout ratio of 61.6%. Recent earnings growth reflects positively on profitability, but insider selling raises concerns.

- Get an in-depth perspective on Ework Group's performance by reading our dividend report here.

- Our valuation report here indicates Ework Group may be undervalued.

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HEXPOL AB (publ) is involved in the development, manufacture, and sale of polymer compounds and engineered products across Sweden, Europe, the Americas, and Asia with a market cap of approximately SEK36.06 billion.

Operations: HEXPOL's revenue is primarily derived from its HEXPOL Compounding segment, which generated SEK20.18 billion, and its HEXPOL Engineered Products segment, contributing SEK1.61 billion.

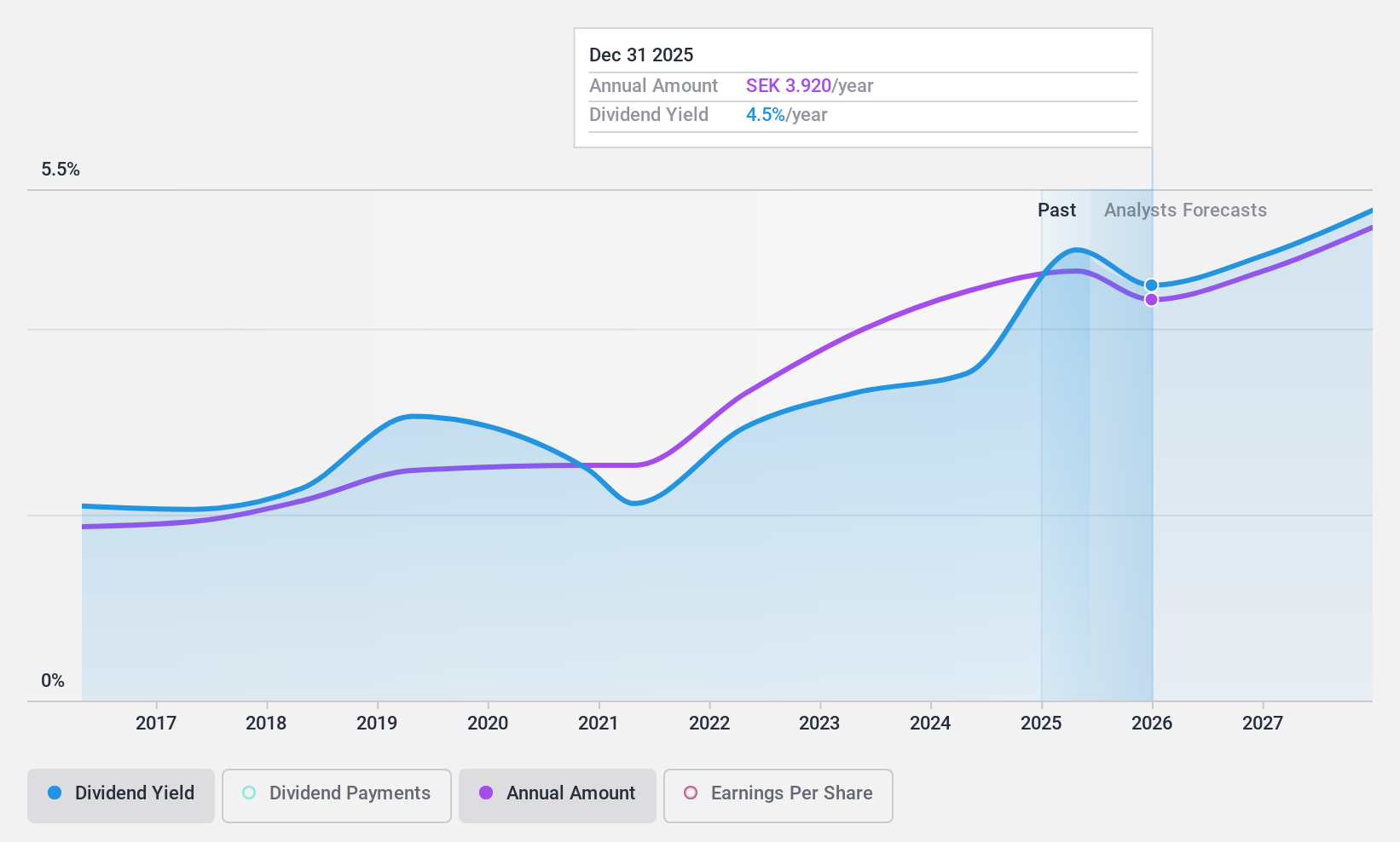

Dividend Yield: 3.8%

HEXPOL offers a modest dividend yield of 3.82%, below the top quartile of Swedish dividend payers. However, its dividends are well-covered by both earnings and cash flows, with payout ratios of 55.4% and 57.8% respectively, indicating sustainability. The company has maintained stable and growing dividends over the past decade, enhancing reliability for investors seeking consistent income streams. Trading significantly below estimated fair value suggests potential upside in stock price appreciation alongside dividend returns.

- Click to explore a detailed breakdown of our findings in HEXPOL's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of HEXPOL shares in the market.

Summing It All Up

- Investigate our full lineup of 21 Top Swedish Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade HEXPOL, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HEXPOL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HPOL B

HEXPOL

Develops, manufactures, and sells various polymer compounds and engineered gaskets, seals, and wheels in Sweden, rest of Europe, the United States, rest of the Americas, and Asia.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives