Bahnhof And 2 Other Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As European markets reach record levels, buoyed by a rally in technology stocks and expectations for lower U.S. borrowing costs, investors are increasingly looking toward small-cap opportunities that may benefit from this favorable environment. In this context, identifying promising stocks often involves seeking companies with strong fundamentals and growth potential that can thrive amid economic shifts and evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Bahnhof (OM:BAHN B)

Simply Wall St Value Rating: ★★★★★★

Overview: Bahnhof AB (publ) operates in the Internet and telecommunications sector across Sweden and Europe, with a market capitalization of SEK6.26 billion.

Operations: Bahnhof generates revenue primarily from its Internet and telecommunications services across Sweden and Europe. The company has reported a net profit margin of 12.5% in the latest financial period, reflecting its operational efficiency within the sector.

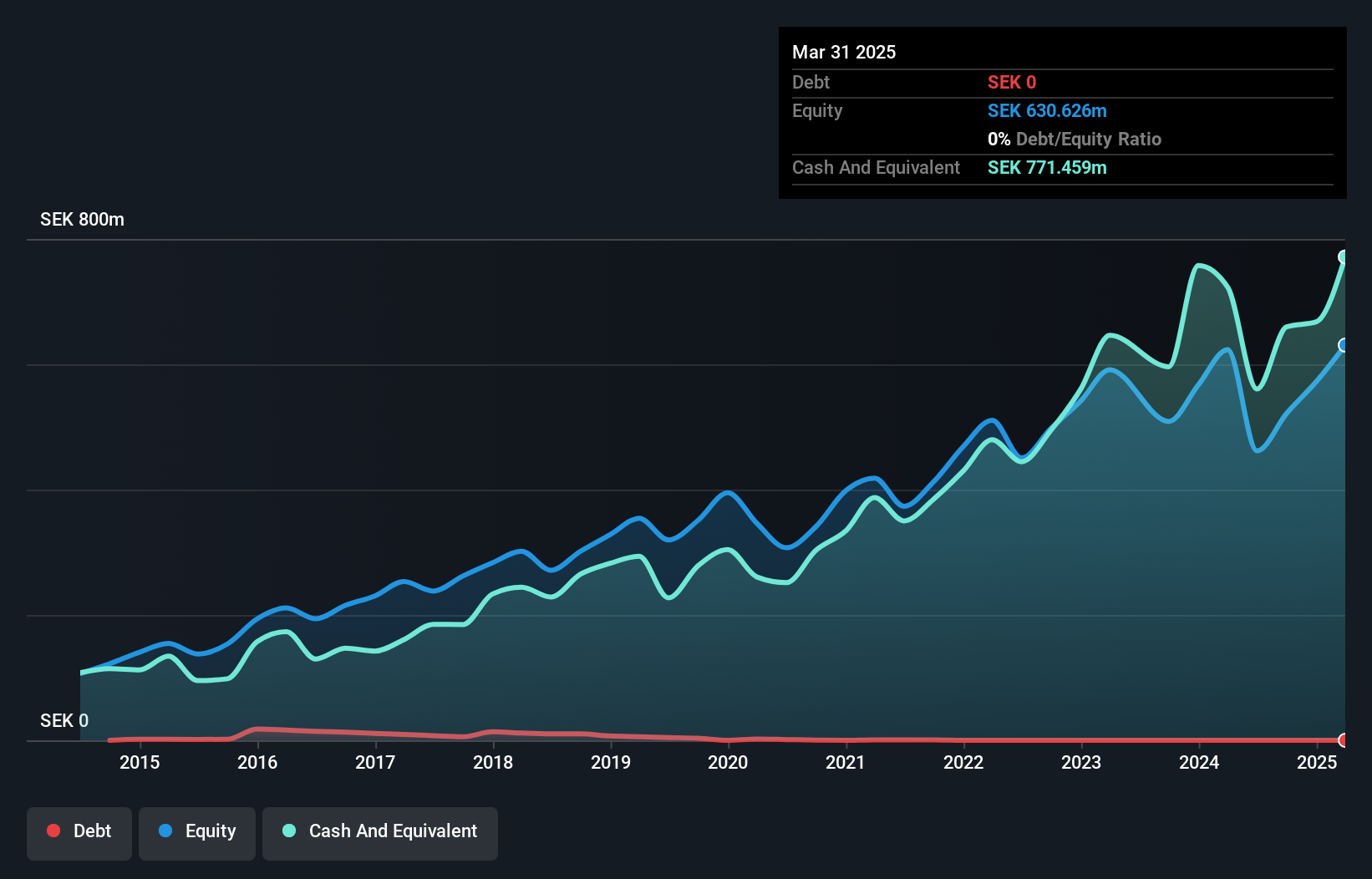

Bahnhof, a nimble player in the telecom sector, recently reported sales of SEK 548.47 million for Q2 2025, up from SEK 500.88 million the previous year. The company boasts high-quality earnings and operates debt-free, which suggests financial stability and reduced risk exposure. Despite trading at a discount of 15.4% below its estimated fair value, Bahnhof's earnings growth has lagged behind the industry average over the past year at -1.4%, compared to an industry growth of 6%. However, future prospects appear promising with earnings forecasted to grow by 8.49% annually.

- Click here and access our complete health analysis report to understand the dynamics of Bahnhof.

Assess Bahnhof's past performance with our detailed historical performance reports.

Haypp Group (OM:HAYPP)

Simply Wall St Value Rating: ★★★★★★

Overview: Haypp Group AB (publ) is an online retailer specializing in tobacco-free nicotine pouches and snus products, serving markets in Sweden, Norway, the rest of Europe, and the United States with a market capitalization of approximately SEK5.13 billion.

Operations: The company's revenue streams are divided into three main segments: Core (SEK2.71 billion), Growth (SEK875.19 million), and Emerging Market (SEK118.50 million).

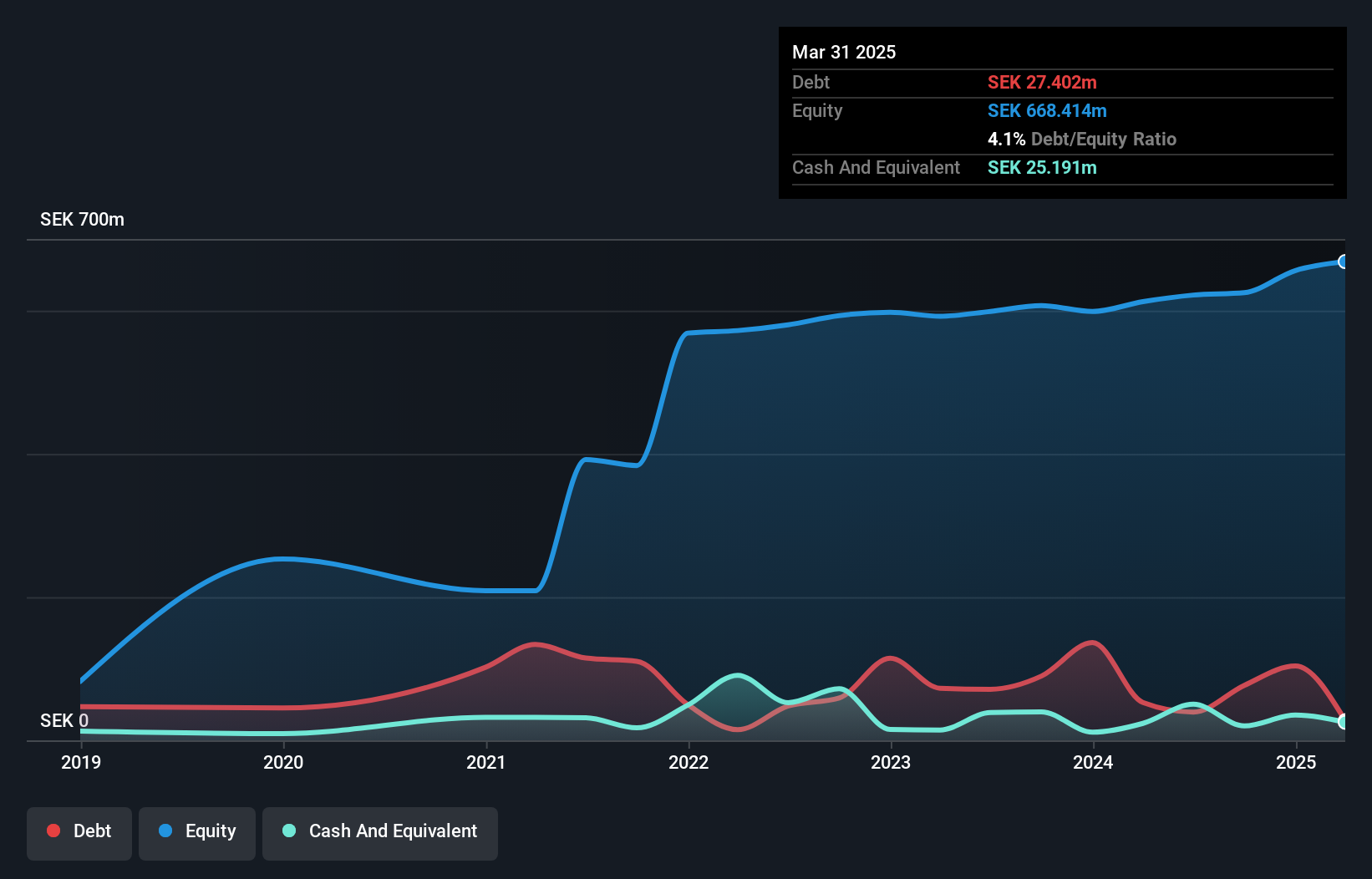

Haypp Group, a nimble player in the tobacco-free nicotine pouch market, has shown impressive financial strides. With a net debt to equity ratio at 1.1%, their balance sheet strength is satisfactory. Over the past year, earnings surged by 344%, outpacing industry norms of 11%. Their interest payments are comfortably covered by EBIT at 4.5 times coverage, reflecting solid operational performance. Recent announcements about resuming U.S. sales of Zyn products suggest strategic expansion efforts are underway, although regulatory scrutiny and investment demands may pose challenges. The company reported net income of SEK 8.65 million for Q2 2025 compared to SEK 0.03 million last year, indicating significant profitability improvements amidst evolving market dynamics.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions through its proprietary IT platform in Sweden, with a market capitalization of SEK 11.92 billion.

Operations: TF Bank's revenue primarily comes from credit cards (SEK 745.39 million), consumer lending (SEK 602.84 million), and e-commerce solutions excluding credit cards (SEK 396.96 million). The company's financial performance is influenced by its ability to effectively manage these revenue streams within the competitive digital banking sector in Sweden.

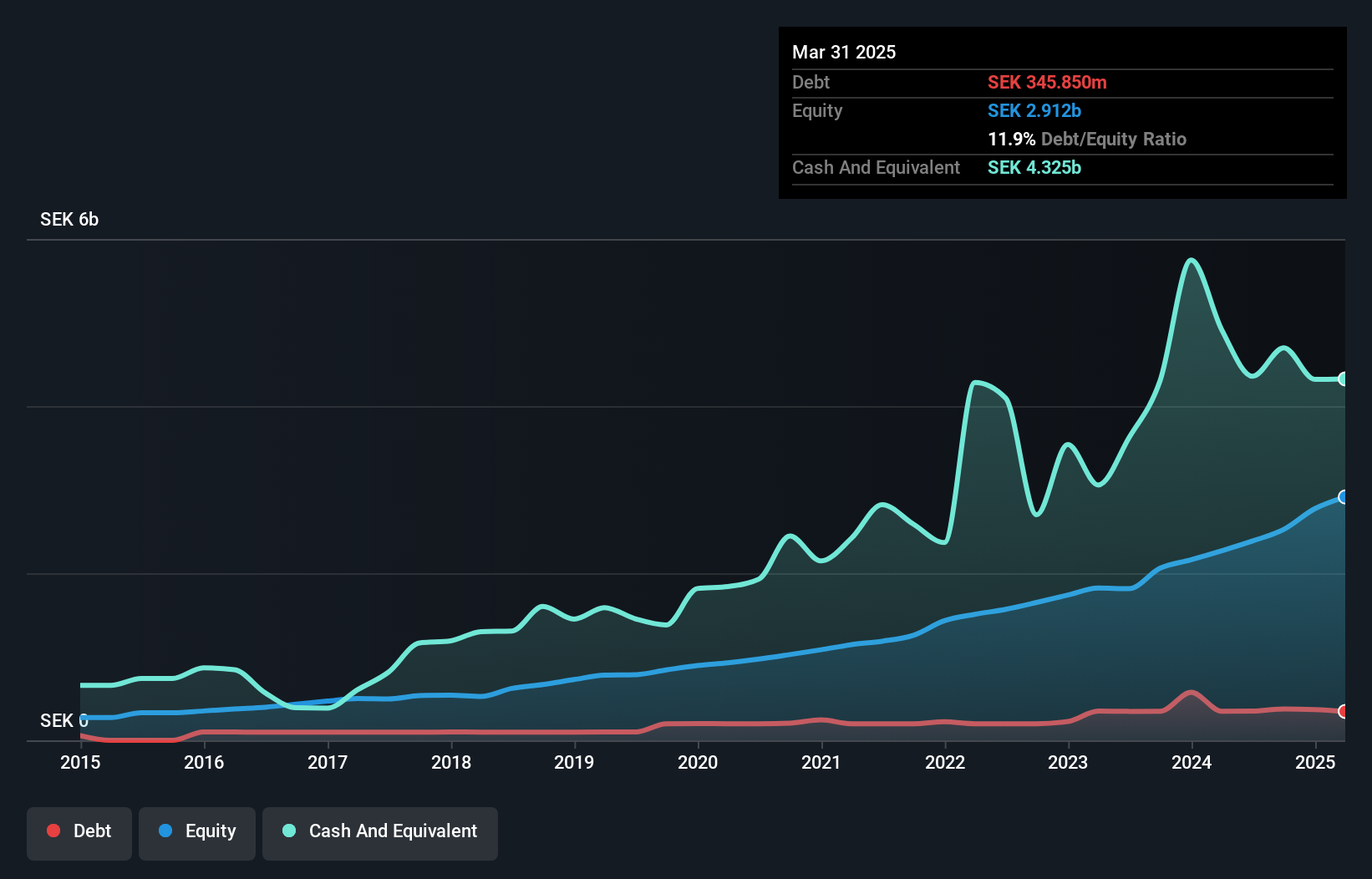

TF Bank, a smaller player in the financial sector, offers an intriguing profile with its SEK26.2 billion in total assets and SEK2.9 billion in equity. The bank's earnings growth of 56.7% last year outpaced the industry average of 1.4%, showcasing strong performance despite a high bad loan ratio of 4.5%. With deposits at SEK22.2 billion and loans at SEK21.7 billion, TF Bank maintains sufficient allowance for bad loans at 113%. Its price-to-earnings ratio stands attractively lower than the Swedish market average, hinting at potential value amidst its high-quality earnings backdrop and low-risk funding structure (96% from customer deposits).

Next Steps

- Explore the 330 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TF Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TFBANK

TF Bank

A digital bank, provides consumer banking services and e-commerce solutions through a proprietary IT platform in Sweden .

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives