Time To Worry? Analysts Just Downgraded Their Sensys Gatso Group AB (publ) (STO:SENS) Outlook

The analysts covering Sensys Gatso Group AB (publ) (STO:SENS) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

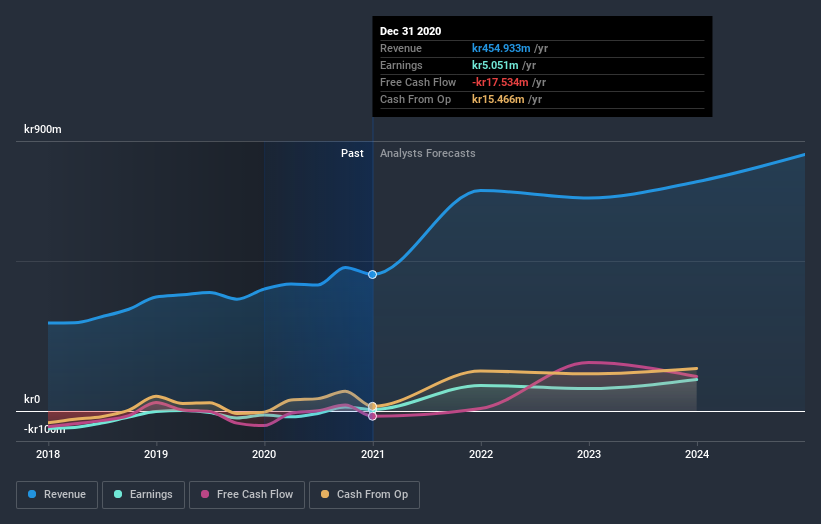

Following the downgrade, the latest consensus from Sensys Gatso Group's two analysts is for revenues of kr735m in 2021, which would reflect a major 62% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of kr849m in 2021. The consensus view seems to have become more pessimistic on Sensys Gatso Group, noting the measurable cut to revenue estimates in this update.

Check out our latest analysis for Sensys Gatso Group

Of course, another way to look at these forecasts is to place them into context against the industry itself. One thing stands out from these estimates, which is that Sensys Gatso Group is forecast to grow faster in the future than it has in the past, with revenues expected to display 62% annualised growth until the end of 2021. If achieved, this would be a much better result than the 0.7% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 8.2% per year. So it looks like Sensys Gatso Group is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Sensys Gatso Group this year. They're also forecasting more rapid revenue growth than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Sensys Gatso Group after today.

Uncomfortably, our automated valuation tool also suggests that Sensys Gatso Group stock could be overvalued following the downgrade. Shareholders could be left disappointed if these estimates play out. Learn why, and examine the assumptions that underpin our valuation by visiting our free platform here to learn more about our valuation approach.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you decide to trade Sensys Gatso Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:SGG

Sensys Gatso Group

Designs, develops, owns, operates, markets, and sells traffic management and enforcement solutions to nations, cities, and fleet owners in Sweden and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026