- Sweden

- /

- Commercial Services

- /

- OM:NORVA

European Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

Amidst the backdrop of global trade uncertainties and economic policy shifts, European markets have experienced mixed performances, with the pan-European STOXX Europe 600 Index recently snapping a ten-week streak of gains. In this environment, investors may find opportunities in stocks that are estimated to be trading below their intrinsic value, offering potential for growth as market conditions stabilize and economic policies evolve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sword Group (ENXTPA:SWP) | €33.00 | €64.77 | 49.1% |

| Airbus (ENXTPA:AIR) | €163.12 | €320.31 | 49.1% |

| Comet Holding (SWX:COTN) | CHF233.00 | CHF461.06 | 49.5% |

| TF Bank (OM:TFBANK) | SEK364.00 | SEK719.55 | 49.4% |

| Wienerberger (WBAG:WIE) | €34.86 | €68.58 | 49.2% |

| adidas (XTRA:ADS) | €226.80 | €451.85 | 49.8% |

| Xplora Technologies (OB:XPLRA) | NOK27.60 | NOK54.21 | 49.1% |

| Star7 (BIT:STAR7) | €6.15 | €12.26 | 49.8% |

| Waystream Holding (OM:WAYS) | SEK18.28 | SEK35.95 | 49.2% |

| Galderma Group (SWX:GALD) | CHF96.52 | CHF189.57 | 49.1% |

Let's explore several standout options from the results in the screener.

eVISO (BIT:EVISO)

Overview: eVISO S.p.A. operates a platform utilizing artificial intelligence for the commodities market, mainly in Italy, with a market cap of €239.67 million.

Operations: The company's revenue segments consist of Light at €213.39 million, Services at €6.87 million, Gas Sales at €3.87 million, and Smartmele at €0.12 million.

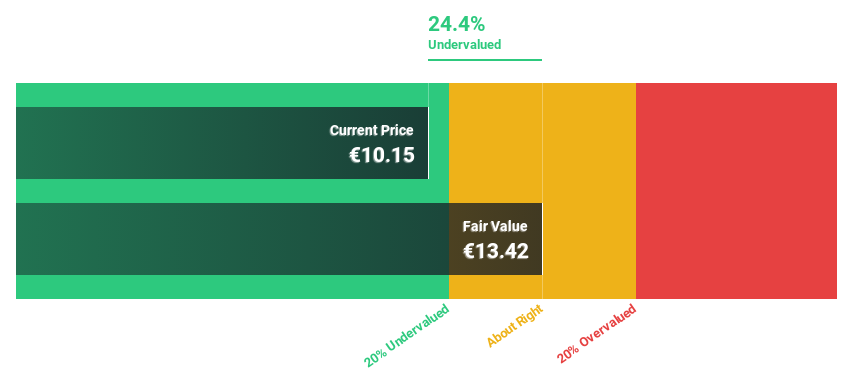

Estimated Discount To Fair Value: 25.6%

eVISO, trading at €9.98, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of €13.42. The company's earnings and revenue are forecast to grow substantially at 28.9% and 22.4% per year respectively, outpacing the Italian market averages of 7.7% and 4.1%. Having recently become profitable, eVISO's return on equity is projected to be high in three years at 28.3%, reinforcing its potential as an undervalued stock based on cash flows in Europe.

- According our earnings growth report, there's an indication that eVISO might be ready to expand.

- Click here to discover the nuances of eVISO with our detailed financial health report.

NCAB Group (OM:NCAB)

Overview: NCAB Group AB (publ) manufactures and sells printed circuit boards (PCBs) across Sweden, the Nordic region, the rest of Europe, North America, and Asia with a market cap of approximately SEK9.48 billion.

Operations: The company's revenue segments are divided as follows: East SEK215 million, Europe SEK1.78 billion, Nordic SEK822 million, and North America SEK800 million.

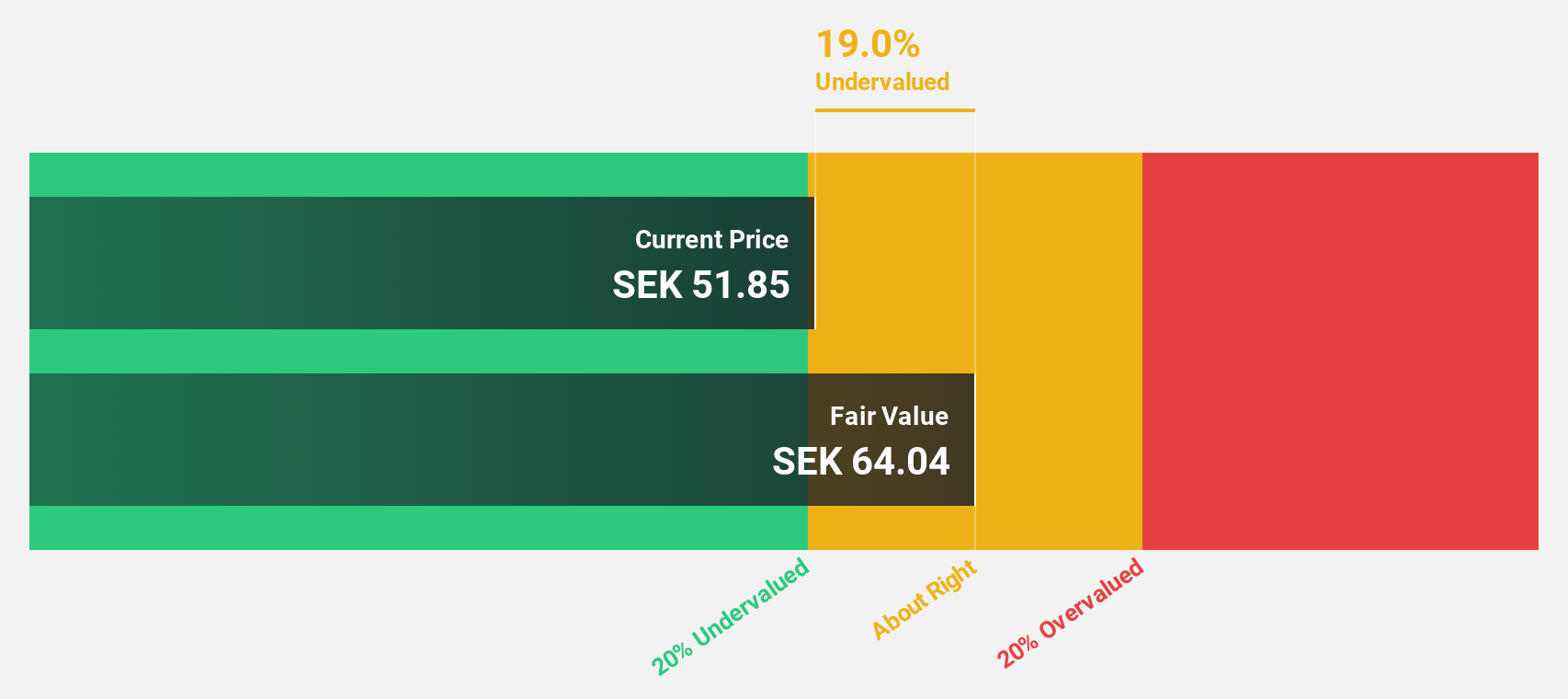

Estimated Discount To Fair Value: 25.9%

NCAB Group, trading at SEK50.7, is significantly undervalued with a fair value estimate of SEK68.43 based on discounted cash flow analysis. Despite high debt levels, its earnings are forecast to grow substantially at 23.5% annually, outpacing the Swedish market's average growth rate. Analysts agree on a potential stock price rise by 35.3%. Recent efforts in mergers and acquisitions aim to enhance geographical presence and market share in the fragmented printed circuit board industry.

- Our comprehensive growth report raises the possibility that NCAB Group is poised for substantial financial growth.

- Dive into the specifics of NCAB Group here with our thorough financial health report.

Norva24 Group (OM:NORVA)

Overview: Norva24 Group AB (Publ) offers underground infrastructure maintenance services in Northern Europe, with a market cap of SEK6.59 billion.

Operations: The company generates revenue from its Waste Management segment, amounting to NOK3.63 billion.

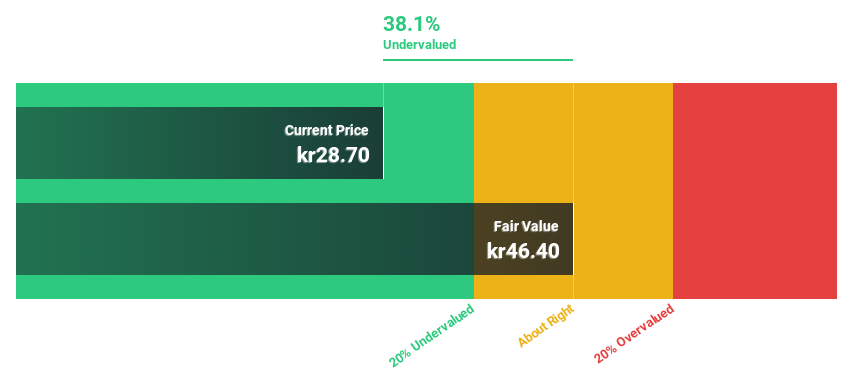

Estimated Discount To Fair Value: 40.9%

Norva24 Group is trading at SEK36.25, significantly below its estimated fair value of SEK61.3 based on discounted cash flow analysis. Despite a volatile share price and lower profit margins compared to last year, earnings are expected to grow substantially at 20.7% annually, outpacing the Swedish market's growth rate. Recent buybacks and revenue increases highlight strategic efforts to enhance shareholder value, though net income has decreased from NOK 226.6 million to NOK 176.8 million year-over-year.

- Insights from our recent growth report point to a promising forecast for Norva24 Group's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Norva24 Group.

Summing It All Up

- Click here to access our complete index of 201 Undervalued European Stocks Based On Cash Flows.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Norva24 Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Norva24 Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NORVA

Norva24 Group

Provides underground infrastructure maintenance services in Northern Europe.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives