- Sweden

- /

- Communications

- /

- OM:MAVEN

Maven Wireless Sweden AB (Publ) (STO:MAVEN) Stocks Shoot Up 29% But Its P/S Still Looks Reasonable

The Maven Wireless Sweden AB (Publ) (STO:MAVEN) share price has done very well over the last month, posting an excellent gain of 29%. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

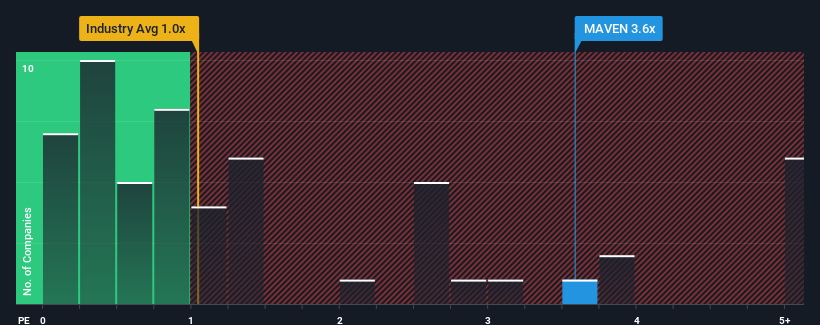

After such a large jump in price, given close to half the companies operating in Sweden's Communications industry have price-to-sales ratios (or "P/S") below 2.7x, you may consider Maven Wireless Sweden as a stock to potentially avoid with its 3.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Maven Wireless Sweden

What Does Maven Wireless Sweden's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Maven Wireless Sweden has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Maven Wireless Sweden's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Maven Wireless Sweden would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 121% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 0.3% shows it's a great look while it lasts.

In light of this, it's understandable that Maven Wireless Sweden's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

What We Can Learn From Maven Wireless Sweden's P/S?

Maven Wireless Sweden shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Maven Wireless Sweden revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Maven Wireless Sweden that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MAVEN

Maven Wireless Sweden

Provides various wireless solutions for indoor and tunnel coverage.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)