JLT Mobile Computers AB (publ) (STO:JLT) is reducing its dividend from last year's comparable payment to SEK0.20 on the 11th of May. However, the dividend yield of 3.8% is still a decent boost to shareholder returns.

View our latest analysis for JLT Mobile Computers

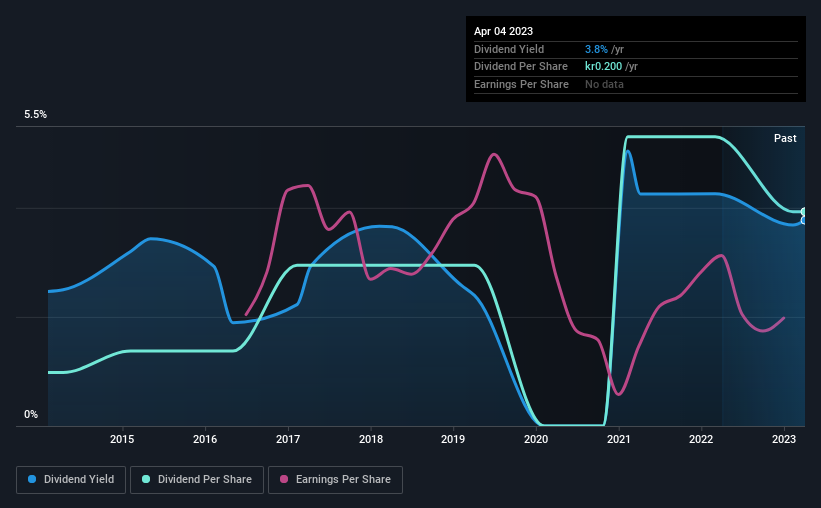

JLT Mobile Computers Is Paying Out More Than It Is Earning

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, the company was paying out 111% of what it was earning. Without profits and cash flows increasing, it would be difficult for the company to continue paying the dividend at this level.

If the company can't turn things around, EPS could fall by 5.5% over the next year. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 132%, which is definitely a bit high to be sustainable going forward.

JLT Mobile Computers' Dividend Has Lacked Consistency

JLT Mobile Computers has been paying dividends for a while, but the track record isn't stellar. This makes us cautious about the consistency of the dividend over a full economic cycle. The dividend has gone from an annual total of SEK0.05 in 2014 to the most recent total annual payment of SEK0.20. This implies that the company grew its distributions at a yearly rate of about 17% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Dividend Growth May Be Hard To Come By

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. JLT Mobile Computers has seen earnings per share falling at 5.5% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

JLT Mobile Computers' Dividend Doesn't Look Great

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. We don't think that this is a great candidate to be an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for JLT Mobile Computers (of which 2 are a bit concerning!) you should know about. Is JLT Mobile Computers not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:JLT

JLT Mobile Computers

Produces and sells rugged computing solutions in the Nordic countries, the rest of Europe, the Middle East, Africa, the Americas, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)