- Sweden

- /

- Communications

- /

- OM:INCOAX

Need To Know: InCoax Networks AB (publ) (STO:INCOAX) Insiders Have Been Buying Shares

We often see insiders buying up shares in companies that perform well over the long term. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in InCoax Networks AB (publ) (STO:INCOAX).

Do Insider Transactions Matter?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

Check out our latest analysis for InCoax Networks

The Last 12 Months Of Insider Transactions At InCoax Networks

While there weren't any large insider transactions in the last twelve months, it's still worth looking at the trading.

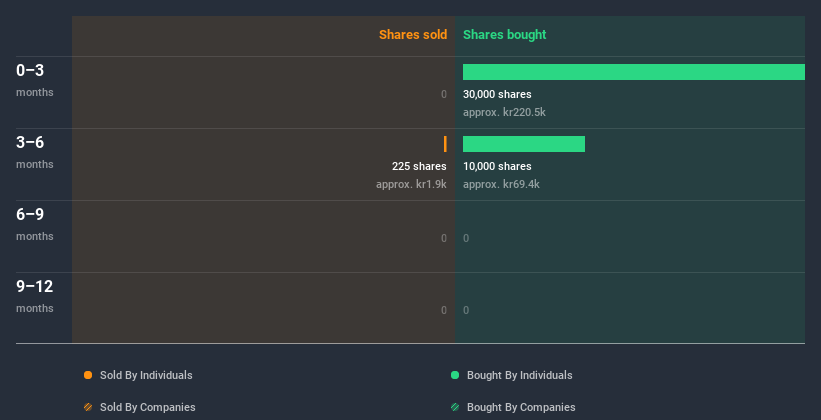

In the last twelve months insiders purchased 40.00k shares for kr289k. But they sold 225.00 shares for kr1.9k. Overall, InCoax Networks insiders were net buyers during the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

InCoax Networks is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Insiders at InCoax Networks Have Bought Stock Recently

There was some insider buying at InCoax Networks over the last quarter. Insiders purchased kr220k worth of shares in that period. It's good to see the insider buying, as well as the lack of recent sellers. However, in this case the amount invested recently is quite small.

Insider Ownership of InCoax Networks

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that InCoax Networks insiders own 48% of the company, worth about kr42m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At InCoax Networks Tell Us?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. When combined with notable insider ownership, these factors suggest InCoax Networks insiders are well aligned, and quite possibly think the share price is too low. Looks promising! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For instance, we've identified 5 warning signs for InCoax Networks (3 are a bit concerning) you should be aware of.

But note: InCoax Networks may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade InCoax Networks, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OM:INCOAX

InCoax Networks

InCoax Networks AB (publ) re-purposes existing property coaxial networks in fiber and fixed wireless access extension deployments for communication service providers in the European Union, North America, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in