As global markets navigate the effects of rising U.S. Treasury yields and cautious monetary policies, European indices, including Sweden's, have experienced declines amid expectations of slower policy easing by central banks. Within this context, identifying high-growth tech stocks in Sweden involves looking for companies that demonstrate resilience and innovation despite broader market pressures.

Top 10 High Growth Tech Companies In Sweden

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Truecaller | 20.45% | 21.76% | ★★★★★★ |

| Xbrane Biopharma | 57.35% | 128.38% | ★★★★★★ |

| Biovica International | 81.67% | 78.55% | ★★★★★★ |

| Bonesupport Holding | 36.32% | 76.69% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| BioArctic | 42.38% | 98.40% | ★★★★★★ |

| Yubico | 20.52% | 42.18% | ★★★★★★ |

| InCoax Networks | 43.77% | 115.54% | ★★★★★★ |

| Waystream Holding | 19.26% | 94.62% | ★★★★★☆ |

| Skolon | 32.37% | 135.49% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Cint Group (OM:CINT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cint Group AB (publ) offers software solutions for digital insights and research technology on a global scale, with a market capitalization of SEK2.67 billion.

Operations: Cint Group AB generates revenue primarily through its Cint Exchange and Media Measurement segments, with contributions of €140.89 million and €52.24 million respectively.

Cint Group, amid a challenging landscape, shows signs of robust potential with its earnings forecast to surge by 146.5% annually. Despite current unprofitability, the company is expected to pivot into profitability within three years, outpacing average market growth predictions significantly. Recent strategic executive shifts aim to enhance customer experience and streamline operations, reflecting a proactive approach in governance that could catalyze its long-term growth trajectory. Moreover, with R&D expenses marked at 0.6% of revenue—higher than the Swedish market's average—Cint is investing in innovation which could further secure its competitive edge in the evolving tech landscape.

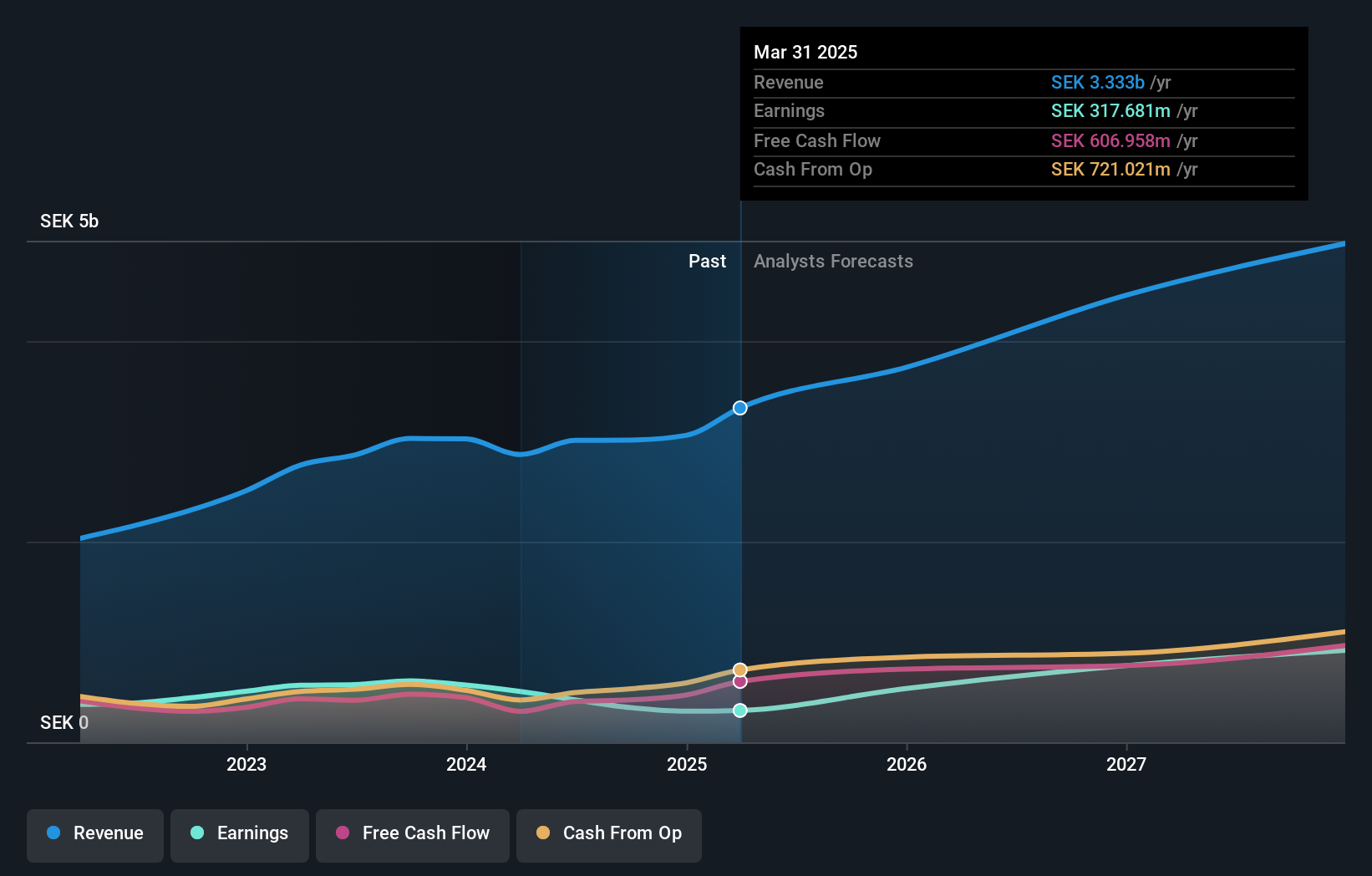

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK19.72 billion.

Operations: HMS Networks AB (publ) generates revenue primarily from its Wireless Communications Equipment segment, which contributes SEK3.01 billion. The company's operations focus on enabling communication and information exchange for industrial equipment on a global scale.

Amid recent shifts, HMS Networks has restructured into three divisions to enhance focus and drive efficiencies, a move poised to save SEK 40 million annually from 2025. Despite a challenging quarter with net income dropping to SEK 95 million from SEK 172 million year-over-year, the company's strategic reorganization and acquisitions like Red Lion Controls signal robust preparation for future demands in industrial communication technologies. Notably, HMS's revenue growth forecast at an impressive 19% per year outpaces the broader Swedish market's projection of just 0.2%, underscoring its potential in a rapidly evolving sector.

- Delve into the full analysis health report here for a deeper understanding of HMS Networks.

Examine HMS Networks' past performance report to understand how it has performed in the past.

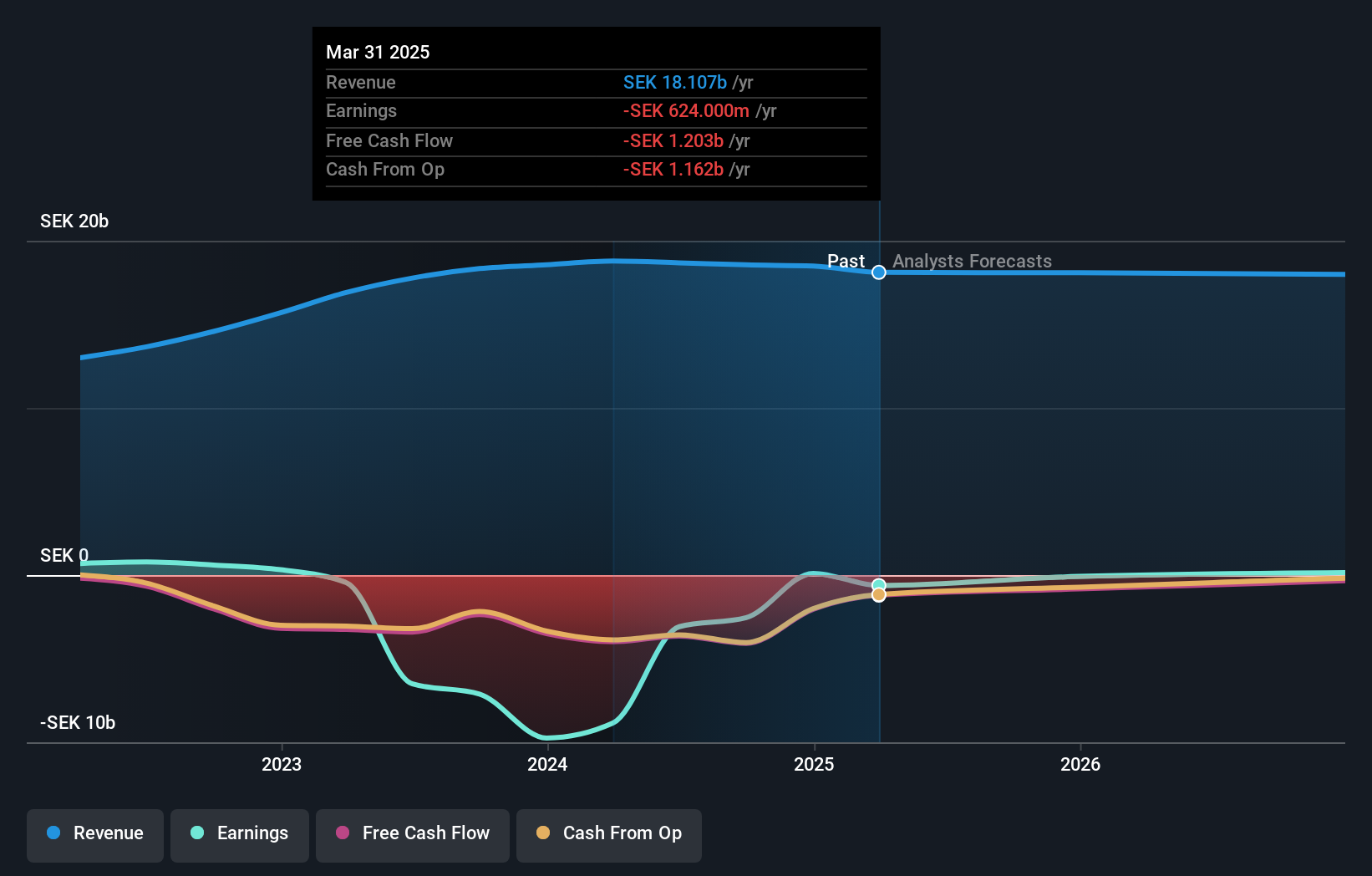

Viaplay Group (OM:VPLAY B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Viaplay Group AB (publ) is an entertainment provider operating in Sweden, the rest of the Nordics, Europe, and internationally with a market capitalization of SEK3.25 billion.

Operations: Viaplay Group generates revenue primarily through its streaming services, offering a range of entertainment content across Sweden, the Nordics, Europe, and other international markets. The company's cost structure involves significant investment in content acquisition and production to support its diverse portfolio.

Viaplay Group's recent earnings highlight a significant recovery with a net loss reduction to SEK 148 million from SEK 693 million year-over-year, showcasing effective cost management and operational improvements. Despite a slight dip in quarterly sales to SEK 4,412 million from SEK 4,536 million, the company's year-to-date sales remain stable at SEK 13,653 million. Impressively, Viaplay is poised for substantial growth with earnings expected to surge by 116.1% annually. This forecast aligns with strategic expansions and content enhancements aimed at outpacing the modest Swedish market growth of 0.3%.

- Click here and access our complete health analysis report to understand the dynamics of Viaplay Group.

Explore historical data to track Viaplay Group's performance over time in our Past section.

Make It Happen

- Unlock more gems! Our Swedish High Growth Tech and AI Stocks screener has unearthed 82 more companies for you to explore.Click here to unveil our expertly curated list of 85 Swedish High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VPLAY B

Viaplay Group

Operates as an entertainment provider company in Sweden, rest of Nordics, rest of Europe, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives