- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

Exploring High Growth Tech Stocks In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing a notable shift with U.S. stocks climbing higher on the back of easing core inflation and robust bank earnings, while European indices rise amidst hopes for continued interest rate cuts. In this dynamic environment, high-growth tech stocks offer potential opportunities for investors seeking to capitalize on innovation and market momentum, particularly as economic indicators suggest a favorable backdrop for growth-oriented sectors.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1229 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market capitalization of €2.69 billion.

Operations: VusionGroup S.A. generates revenue primarily from installing and maintaining electronic shelf labels, amounting to €830.16 million.

VusionGroup's recent selection by The Fresh Market to implement its Vusion 360 technology across all 166 locations underscores its strategic penetration into North American markets. This deployment, set for 2025, integrates digital shelf labels and AI-driven inventory management systems, promising enhanced operational efficiency and data-driven decision-making for the grocery chain. Financially, VusionGroup is poised for significant growth with expected revenue increases at an annual rate of 23.5% and forecasted earnings growth of approximately 83.9% per year. Despite currently being unprofitable, these projections alongside a robust R&D investment strategy indicate a strong upward trajectory in both market presence and financial health.

- Delve into the full analysis health report here for a deeper understanding of VusionGroup.

Understand VusionGroup's track record by examining our Past report.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) specializes in providing products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK22.05 billion.

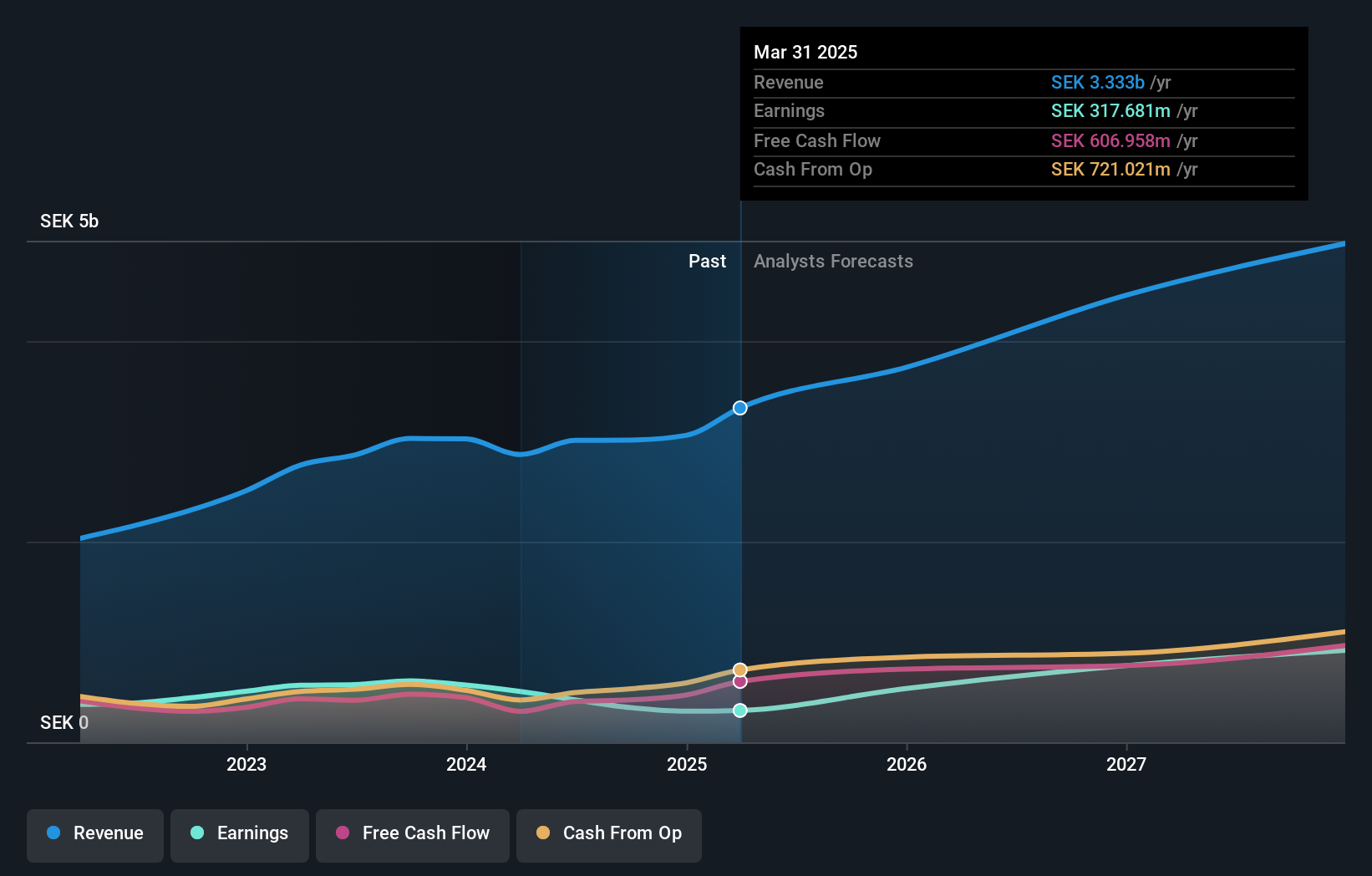

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, which reported SEK3.01 billion in sales.

Amidst a challenging year with earnings contraction of 43.5%, HMS Networks has managed to keep its strategic focus sharp, particularly in R&D investments which are crucial for maintaining technological edge in the communications sector. Despite a dip in profit margins from 20.2% to 11.5%, HMS's commitment to innovation is evident with an expected significant annual earnings growth of 41%. This growth trajectory is bolstered by revenue increases projected at 17.6% per year, outpacing the Swedish market's modest 1.2%. Additionally, the company maintains positive free cash flow, providing it with necessary liquidity for ongoing and future projects. With these figures in mind, HMS's ability to rebound and capitalize on its robust R&D strategy could set a solid foundation for future performance within an increasingly competitive tech landscape.

- Click here to discover the nuances of HMS Networks with our detailed analytical health report.

Evaluate HMS Networks' historical performance by accessing our past performance report.

Kingsoft (SEHK:3888)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kingsoft Corporation Limited operates in the entertainment and office software and services sectors across Mainland China, Hong Kong, and internationally, with a market capitalization of approximately HK$46.04 billion.

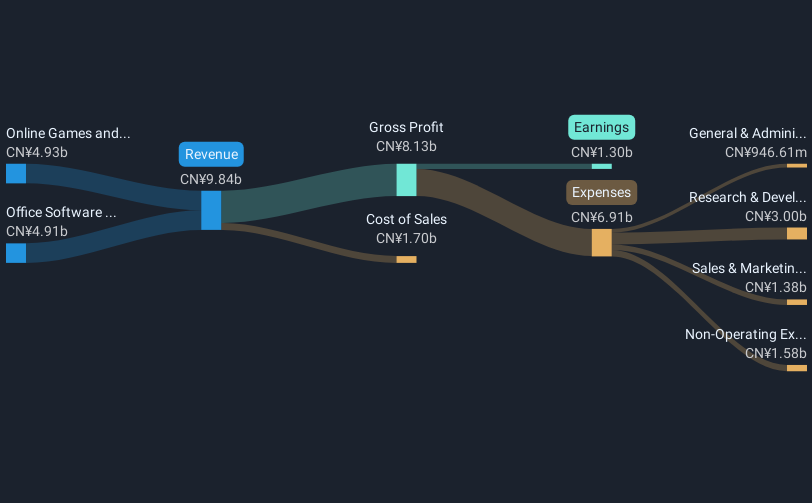

Operations: Kingsoft focuses on two primary revenue segments: Online Games, generating approximately CN¥4.93 billion, and Office Software and Services, contributing around CN¥4.91 billion.

Kingsoft's recent surge in net income to CNY 413.45 million from CNY 28.49 million highlights its robust earnings momentum, with a significant year-over-year increase in basic EPS from CNY 0.02 to CNY 0.31. This financial uplift is underpinned by a strategic emphasis on R&D, crucial for maintaining its competitive edge in the tech sector. The company's revenue growth at an annual rate of 13.8% and earnings growth forecast at 23.8% per year outpace the broader Hong Kong market trends, signaling strong future prospects amid aggressive industry competition.

- Get an in-depth perspective on Kingsoft's performance by reading our health report here.

Review our historical performance report to gain insights into Kingsoft's's past performance.

Turning Ideas Into Actions

- Dive into all 1229 of the High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Provides digitalization solutions for commerce in Europe, Asia, and North America.

High growth potential with adequate balance sheet.