- Sweden

- /

- Communications

- /

- OM:HMS

August 2025's European Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As European markets experience a boost from easing trade tensions and optimism surrounding potential U.S. interest rate cuts, investors are increasingly focusing on growth companies with high insider ownership as potential opportunities. In this context, stocks with strong insider ownership can be appealing due to the alignment of interests between management and shareholders, particularly in an environment where strategic decisions could significantly impact company performance.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 94% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 66.8% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 39.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 63.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Here we highlight a subset of our preferred stocks from the screener.

Moltiply Group (BIT:MOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Moltiply Group S.p.A. is a holding company in the financial services industry with a market cap of €1.66 billion.

Operations: Moltiply Group S.p.A. generates revenue through its Mavriq Division, contributing €236.92 million, and Moltiply BPO&Tech, which adds €243.86 million.

Insider Ownership: 26%

Moltiply Group is poised for growth, with earnings forecast to grow significantly at 28.1% annually, outpacing the Italian market's 8.9%. Revenue growth is also expected to surpass the market average at 15.6% per year. Analysts predict a potential stock price increase of 29%, reflecting confidence in its prospects despite debt concerns not fully covered by operating cash flow. Recent earnings calls on August 8, 2025, provide further insights into its performance trajectory.

- Delve into the full analysis future growth report here for a deeper understanding of Moltiply Group.

- Our comprehensive valuation report raises the possibility that Moltiply Group is priced higher than what may be justified by its financials.

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing among industrial equipment globally, with a market cap of SEK22.34 billion.

Operations: The company's revenue segments include products that support global communication and information exchange among industrial equipment.

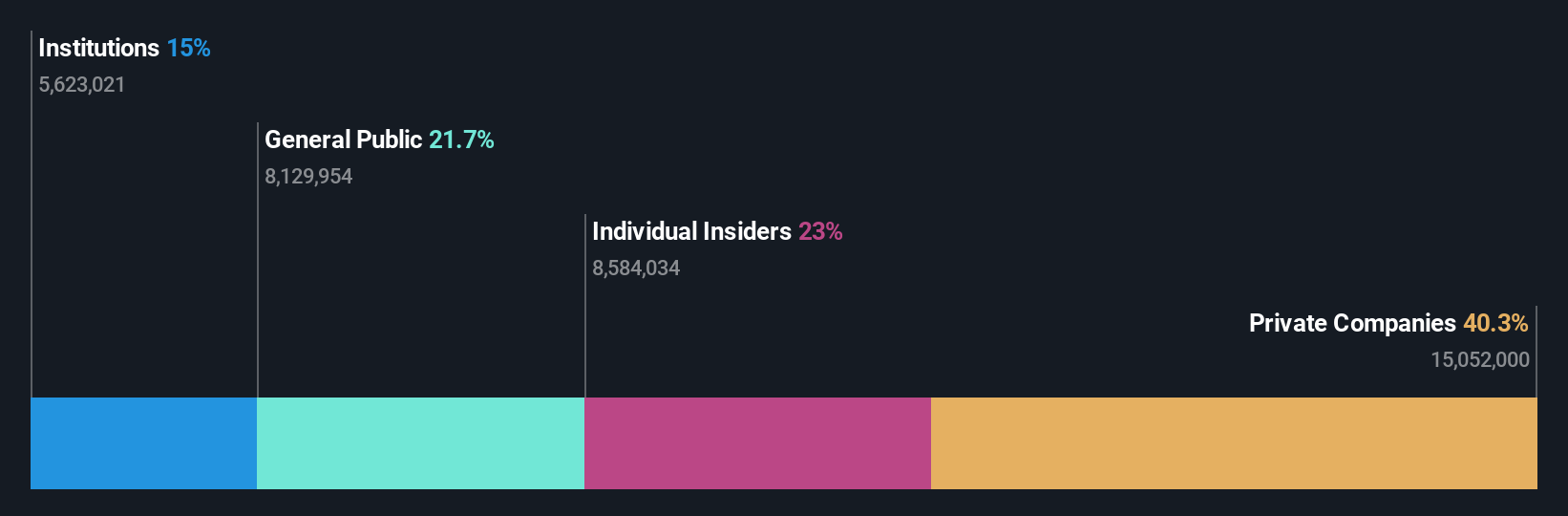

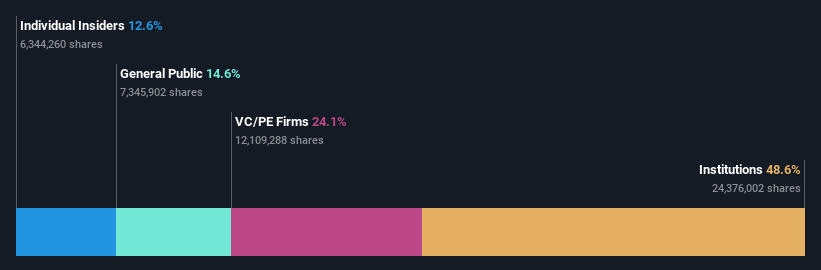

Insider Ownership: 12.3%

HMS Networks shows promising growth potential, with earnings expected to grow significantly at 33.5% annually, surpassing the Swedish market's 16.8%. Revenue is also forecast to increase faster than the market at 14.2% per year. Despite a high debt level, insider activity suggests confidence as more shares were bought than sold recently. The company reported improved net income for Q2 and six months ending June 2025, though sales remained relatively stable compared to last year.

- Dive into the specifics of HMS Networks here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of HMS Networks shares in the market.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products in Europe, with a market cap of approximately €6.31 billion.

Operations: The company's revenue segments include B2B at €1.01 billion and B2C at €9.98 billion, with a reconciliation amount of -€38.80 million.

Insider Ownership: 10.3%

Zalando SE is expected to outpace the German market with forecasted earnings growth of 21.3% annually and revenue growth of 9.6%, driven by its recent acquisition of ABOUT YOU. Despite trading at a significant discount to its estimated fair value, the company's return on equity is projected to be modest at 14.3%. Recent financial results show increased sales and net income for both Q2 and the first half of 2025, reflecting robust operational performance.

- Take a closer look at Zalando's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Zalando's current price could be quite moderate.

Where To Now?

- Reveal the 212 hidden gems among our Fast Growing European Companies With High Insider Ownership screener with a single click here.

- Curious About Other Options? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HMS Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HMS

HMS Networks

Engages in the provision of products that enable industrial equipment to communicate and share information worldwide.

Solid track record with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in