- Sweden

- /

- Communications

- /

- OM:HMS

3 Growth Companies Insiders Own With Earnings Growth Up To 51%

Reviewed by Simply Wall St

As global markets continue to react to political developments and economic indicators, U.S. stocks have been marching toward record highs, buoyed by optimism around softer tariffs and artificial intelligence investments. In this environment of cautious optimism, growth companies with high insider ownership can offer intriguing opportunities for investors, as they often signal confidence in the company's future prospects and alignment between management and shareholders' interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Underneath we present a selection of stocks filtered out by our screen.

BioArctic (OM:BIOA B)

Simply Wall St Growth Rating: ★★★★★★

Overview: BioArctic AB (publ) is a Swedish company that develops biological drugs for central nervous system disorders, with a market cap of SEK19.23 billion.

Operations: The company's revenue is derived from its biotechnology segment, amounting to SEK167.14 million.

Insider Ownership: 33.9%

Earnings Growth Forecast: 51.3% p.a.

BioArctic is poised for significant growth, with revenue expected to increase by 41.4% annually, outpacing the market. Despite a volatile share price and no substantial insider buying recently, it trades at 37.5% below fair value estimates. The company has secured a lucrative agreement with Bristol Myers Squibb for its PyroGlu-Ab antibody program, potentially earning up to US$1.25 billion in milestone payments alongside royalties, which could enhance profitability and support future growth initiatives.

- Get an in-depth perspective on BioArctic's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility BioArctic's shares may be trading at a discount.

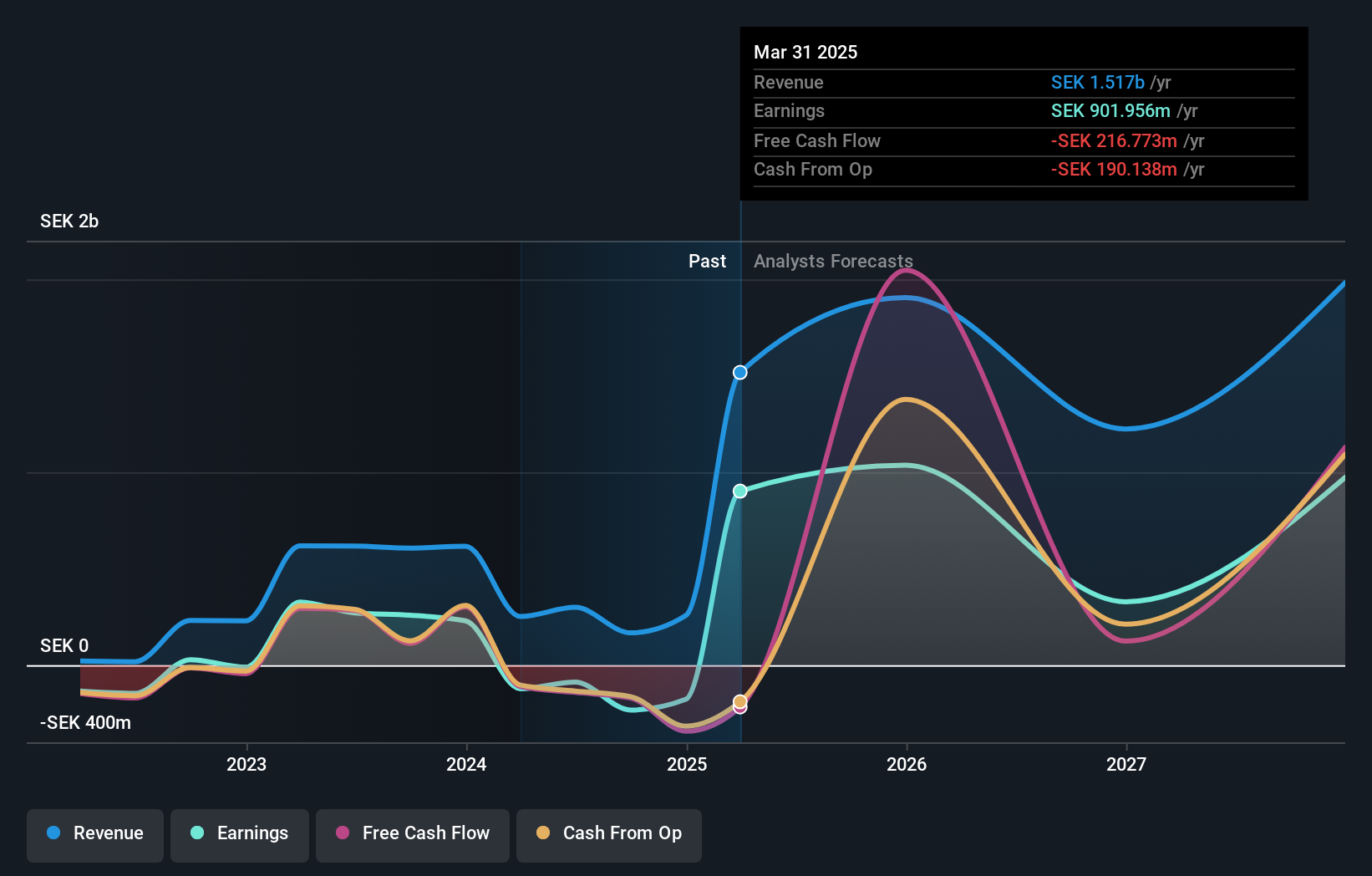

HMS Networks (OM:HMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HMS Networks AB (publ) provides products that facilitate communication and information sharing for industrial equipment globally, with a market cap of SEK23.06 billion.

Operations: Revenue Segments (in millions of SEK): Wireless Communications Equipment: 3012.72

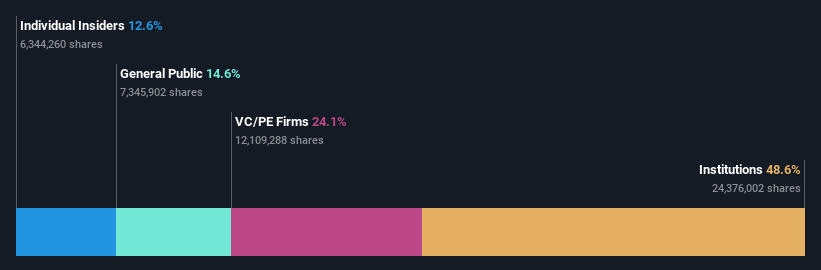

Insider Ownership: 12.6%

Earnings Growth Forecast: 41% p.a.

HMS Networks is set for robust growth, with earnings projected to rise 41% annually, surpassing the Swedish market. Revenue growth at 17.6% per year is also strong but below the high-growth threshold. Despite a recent decline in profit margins from 20.2% to 11.5%, insider activity shows more buying than selling recently, though not in large volumes. The stock trades slightly below fair value but carries a high level of debt that warrants attention.

- Dive into the specifics of HMS Networks here with our thorough growth forecast report.

- According our valuation report, there's an indication that HMS Networks' share price might be on the expensive side.

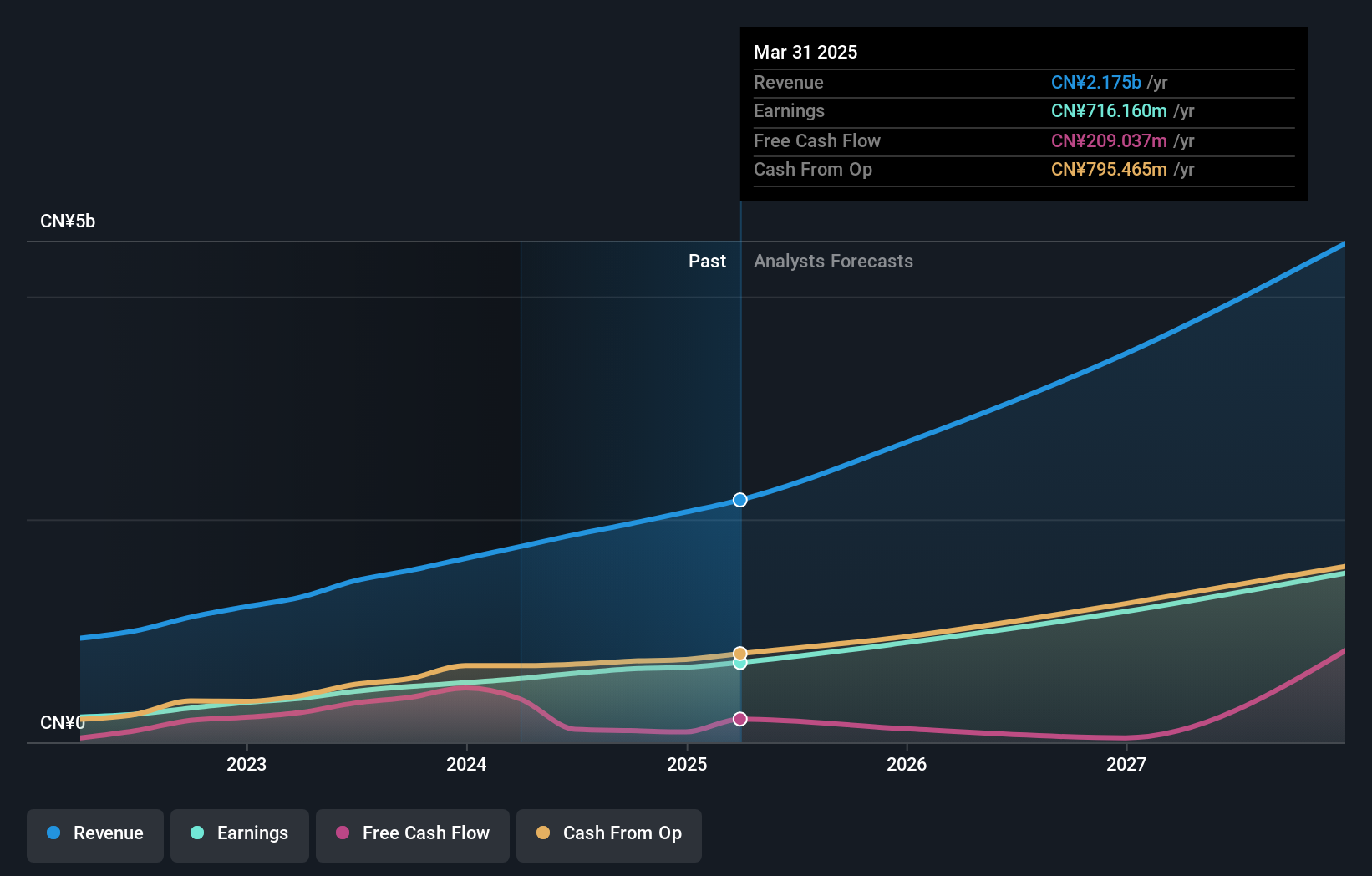

APT Medical (SHSE:688617)

Simply Wall St Growth Rating: ★★★★★★

Overview: APT Medical Inc. focuses on the research, development, manufacturing, and supply of electrophysiology and vascular interventional medical devices in China with a market cap of CN¥35.92 billion.

Operations: The company's revenue is primarily derived from its medical products segment, totaling CN¥1.96 billion.

Insider Ownership: 22%

Earnings Growth Forecast: 28.8% p.a.

APT Medical is poised for substantial growth, with earnings expected to rise significantly, outpacing the Chinese market. Revenue is forecasted to grow at 29.1% annually, well above the market average of 13.4%. Despite no recent insider trading activity, the company's high-quality earnings and anticipated return on equity of 29.7% in three years highlight its strong financial health. Recent events include an upcoming shareholders meeting in January 2025 and a Q3 earnings call last November.

- Delve into the full analysis future growth report here for a deeper understanding of APT Medical.

- Insights from our recent valuation report point to the potential overvaluation of APT Medical shares in the market.

Taking Advantage

- Click through to start exploring the rest of the 1462 Fast Growing Companies With High Insider Ownership now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if HMS Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HMS

HMS Networks

Engages in the provision of products that enable industrial equipment to communicate and share information worldwide.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives