- Sweden

- /

- Electronic Equipment and Components

- /

- OM:HEXA B

Subdued Growth No Barrier To Hexagon AB (publ)'s (STO:HEXA B) Price

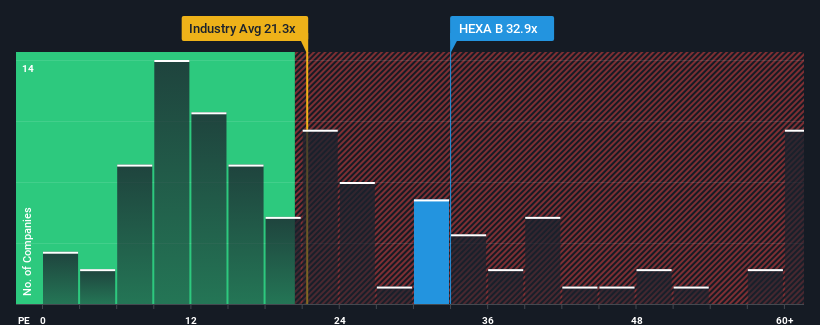

When close to half the companies in Sweden have price-to-earnings ratios (or "P/E's") below 22x, you may consider Hexagon AB (publ) (STO:HEXA B) as a stock to potentially avoid with its 32.9x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Hexagon hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Hexagon

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Hexagon's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 23% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 19% each year as estimated by the analysts watching the company. That's shaping up to be similar to the 20% per annum growth forecast for the broader market.

With this information, we find it interesting that Hexagon is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Bottom Line On Hexagon's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Hexagon currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Hexagon with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hexagon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:HEXA B

Hexagon

Provides geospatial and industrial enterprise solutions worldwide.

Solid track record, good value and pays a dividend.