- Sweden

- /

- Medical Equipment

- /

- OM:XVIVO

Xvivo Perfusion And 2 More Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

Amid a complex global market environment, major U.S. indices have shown mixed results with growth stocks outperforming value stocks significantly, while geopolitical events and economic reports continue to influence investor sentiment. As investors navigate these conditions, identifying undervalued stocks that may be trading below their intrinsic value becomes crucial for potential long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.16 | CN¥52.08 | 49.8% |

| UMB Financial (NasdaqGS:UMBF) | US$122.36 | US$244.39 | 49.9% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.61 | CN¥76.93 | 49.8% |

| S Foods (TSE:2292) | ¥2742.00 | ¥5472.35 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP288.85 | CLP577.11 | 49.9% |

| Acerinox (BME:ACX) | €10.03 | €20.04 | 49.9% |

| NCSOFT (KOSE:A036570) | ₩204500.00 | ₩408990.47 | 50% |

| U.S. Physical Therapy (NYSE:USPH) | US$94.06 | US$187.03 | 49.7% |

| Equifax (NYSE:EFX) | US$265.29 | US$529.48 | 49.9% |

| Almacenes Éxito (BVC:EXITO) | COP2190.00 | COP4369.08 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Xvivo Perfusion (OM:XVIVO)

Overview: Xvivo Perfusion AB (publ) is a medical technology company that develops and markets machines and perfusion solutions for optimizing organ transplantation across various global regions, with a market cap of SEK14.57 billion.

Operations: The company's revenue segments comprise SEK81.19 million from Services, SEK501.47 million from Thoracic, and SEK167.94 million from Abdominal operations.

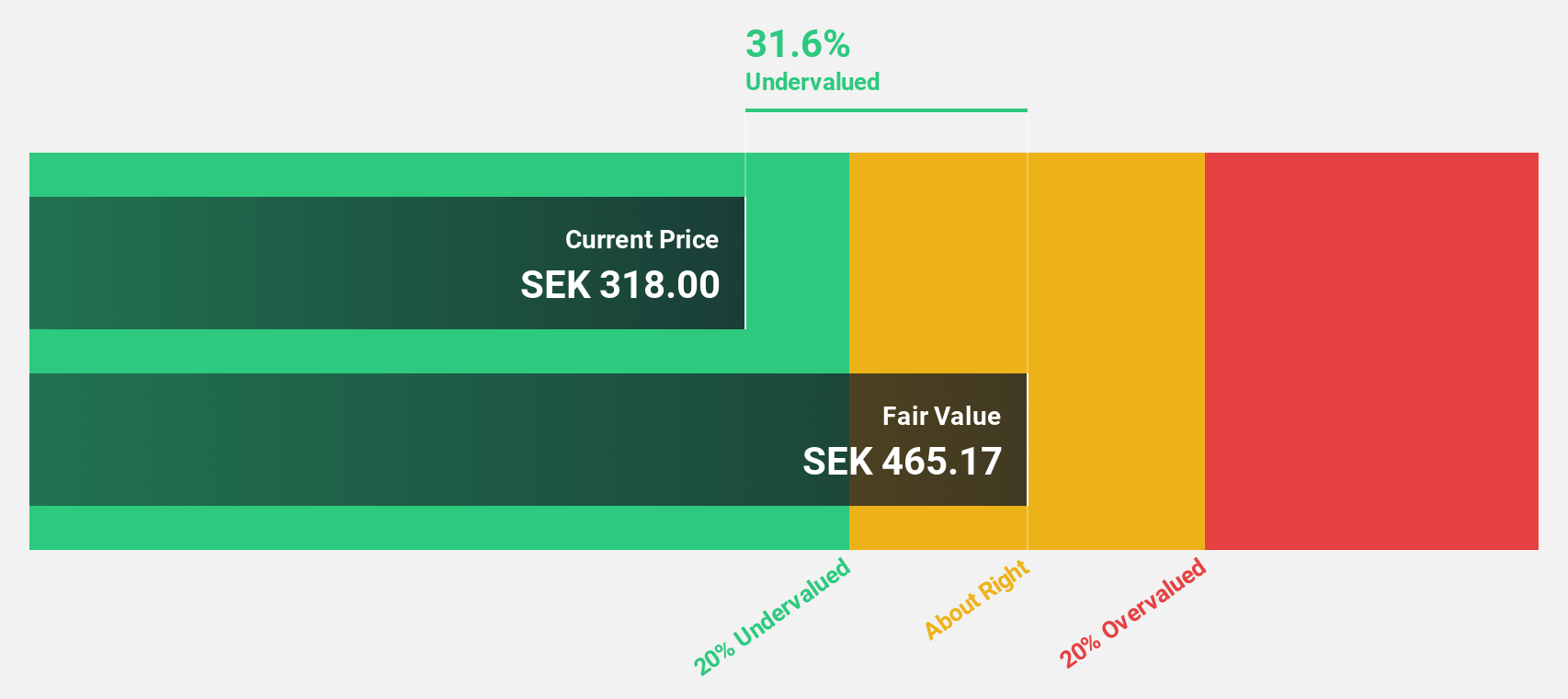

Estimated Discount To Fair Value: 42.3%

Xvivo Perfusion's recent financial performance highlights its potential as an undervalued stock based on cash flows. The company reported a significant increase in net income for the third quarter, with earnings growing by a very large percentage compared to the previous year. It is trading at 42.3% below its estimated fair value and expected to achieve substantial annual profit growth of 23%. However, insider selling has been significant recently, which could be a concern for investors.

- Our growth report here indicates Xvivo Perfusion may be poised for an improving outlook.

- Click here to discover the nuances of Xvivo Perfusion with our detailed financial health report.

Shanghai INT Medical Instruments (SEHK:1501)

Overview: Shanghai INT Medical Instruments Co., Ltd. operates in the medical instruments sector, focusing on the development and manufacturing of medical devices, with a market cap of HK$5.10 billion.

Operations: The company's revenue from the Cardiovascular Interventional Business segment amounts to CN¥718.71 million.

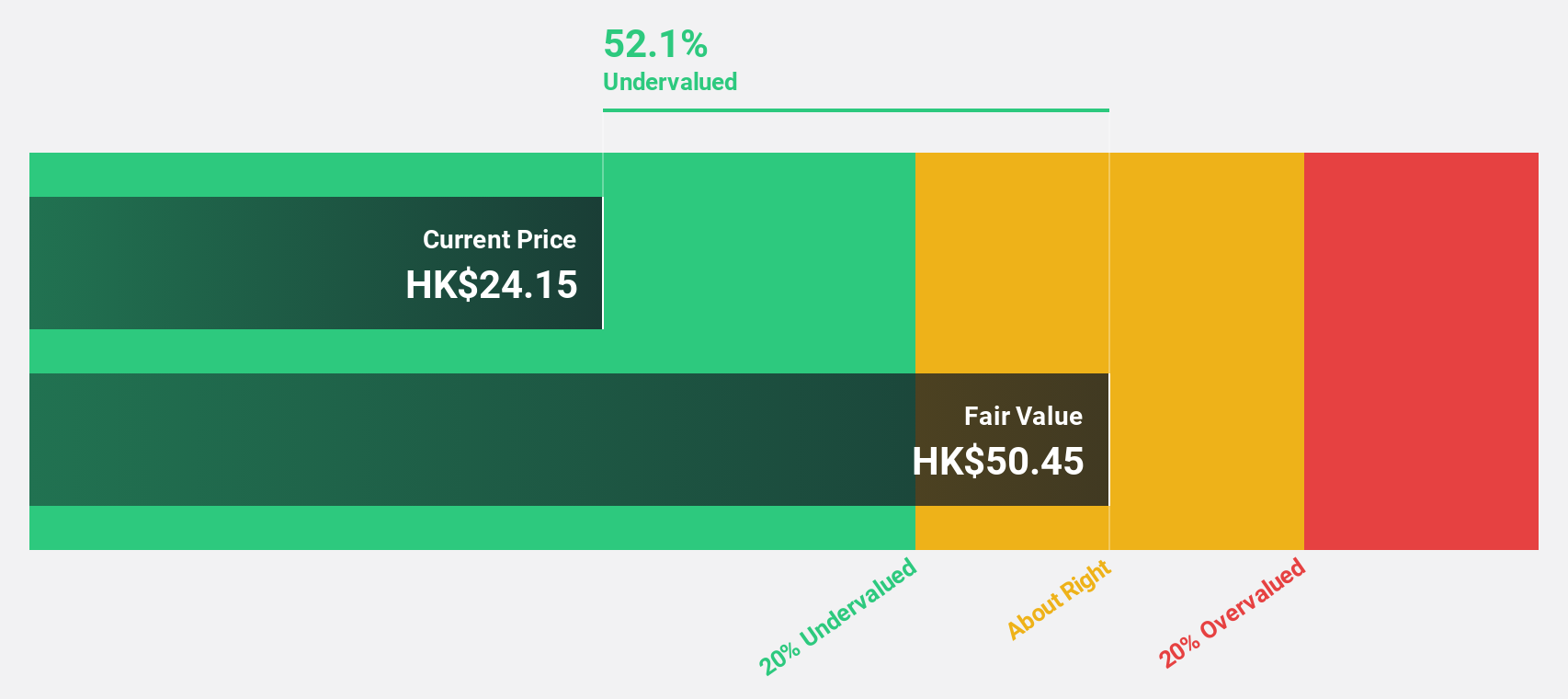

Estimated Discount To Fair Value: 46.4%

Shanghai INT Medical Instruments is trading at HK$28.95, significantly below its estimated fair value of HK$54.03, suggesting it may be undervalued based on cash flows. Revenue is projected to grow 28.7% annually, outpacing the Hong Kong market's 7.8%, while earnings are expected to rise by 27.2% per year over the next three years—well above the market average of 11.4%. However, shareholder dilution occurred last year and future return on equity is forecasted to remain low at 14.7%.

- Insights from our recent growth report point to a promising forecast for Shanghai INT Medical Instruments' business outlook.

- Navigate through the intricacies of Shanghai INT Medical Instruments with our comprehensive financial health report here.

IMMOFINANZ (WBAG:IIA)

Overview: IMMOFINANZ AG is a real estate company that acquires, develops, owns, rents, and manages properties primarily in Austria, Germany, Poland, the Czech Republic, Hungary, Romania, Slovakia and the Adriatic region with a market cap of €2.08 billion.

Operations: The company's revenue is primarily derived from its retail segment, which generates €298.13 million, and its office segment, contributing €237.95 million.

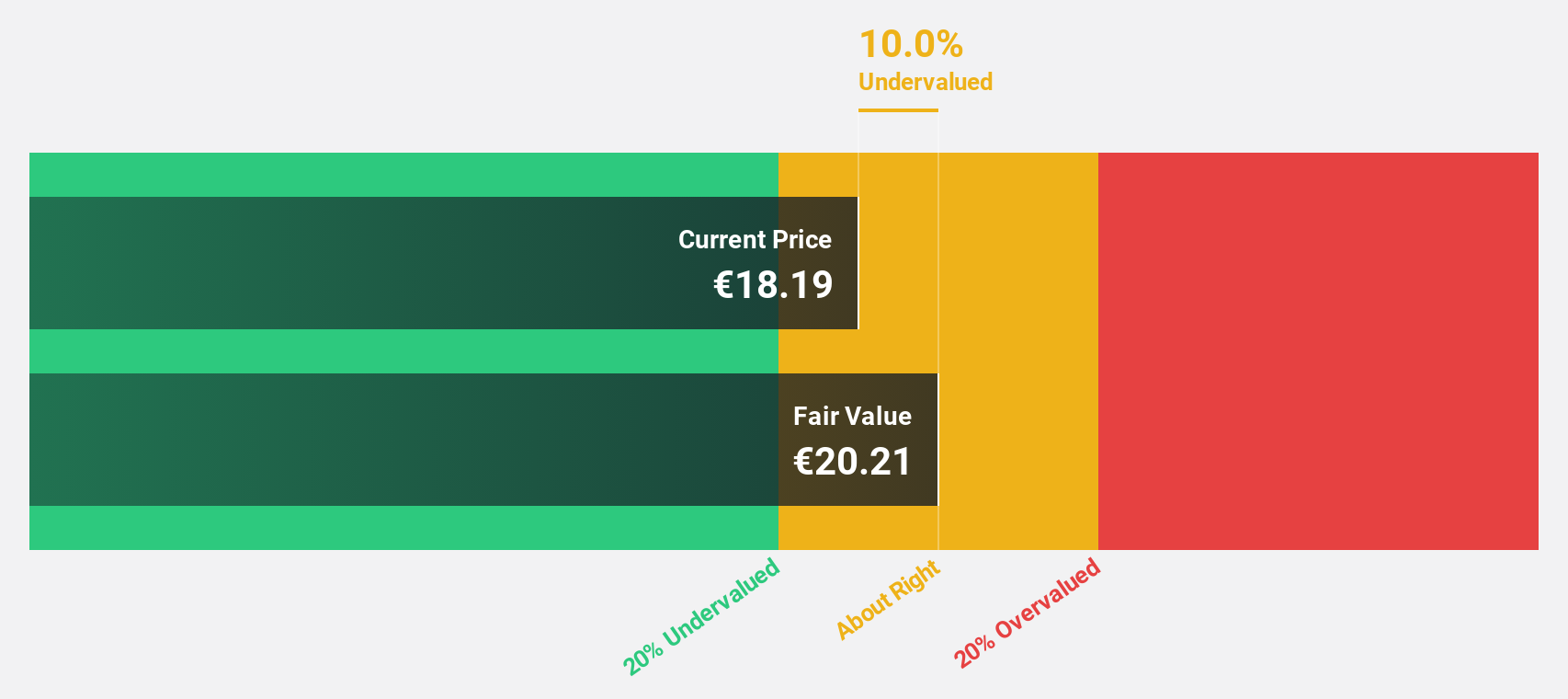

Estimated Discount To Fair Value: 27.9%

IMMOFINANZ is trading at €15.1, significantly below its estimated fair value of €20.95, indicating it might be undervalued based on cash flows. Despite a volatile share price recently and low forecasted return on equity (7.6%) in three years, the company is expected to become profitable within that timeframe with earnings growth projected at 70.61% annually. Recent earnings showed improved revenue but a sharp decline in quarterly net income compared to last year.

- Our earnings growth report unveils the potential for significant increases in IMMOFINANZ's future results.

- Take a closer look at IMMOFINANZ's balance sheet health here in our report.

Taking Advantage

- Discover the full array of 910 Undervalued Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:XVIVO

Xvivo Perfusion

A medical technology company, develops and markets machines and perfusion solutions for assessing usable organs and maintains in optimal condition pending transplantation in Sweden.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.