3 Growth Companies With High Insider Ownership Boasting 98% Earnings Growth

Reviewed by Simply Wall St

In a week marked by mixed results across major U.S. stock indexes, growth stocks have outperformed their value counterparts significantly, driven by strong performances in sectors like consumer discretionary and information technology. This trend highlights the market's current preference for companies that demonstrate robust potential for expansion, particularly those with high insider ownership which can indicate confidence in the company's future prospects. In this context, identifying growth companies with substantial insider stakes becomes crucial as it often aligns management's interests with shareholders', potentially enhancing long-term value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's dive into some prime choices out of the screener.

OCI Holdings (KOSE:A010060)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OCI Holdings Company Ltd. and its subsidiaries offer a range of chemical products and energy solutions across South Korea, the United States, China, other parts of Asia, Europe, and internationally with a market capitalization of ₩1.16 trillion.

Operations: The company's revenue is derived from its Basic Chemical Division, which accounts for ₩2.26 trillion, the Urban Development Business Sector with ₩567.84 million, and the Energy Solution Division contributing ₩490.19 million.

Insider Ownership: 28.3%

Earnings Growth Forecast: 48.3% p.a.

OCI Holdings has announced a share buyback program worth KRW 10 billion to enhance shareholder value. Despite recent financial challenges, including a net loss in Q3 2024, the company is trading at a significant discount to its estimated fair value. Analysts forecast OCI's earnings will grow significantly over the next three years, outpacing market growth. However, profit margins have declined from last year, and its dividend remains inadequately covered by free cash flows.

- Click here to discover the nuances of OCI Holdings with our detailed analytical future growth report.

- The valuation report we've compiled suggests that OCI Holdings' current price could be quite moderate.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

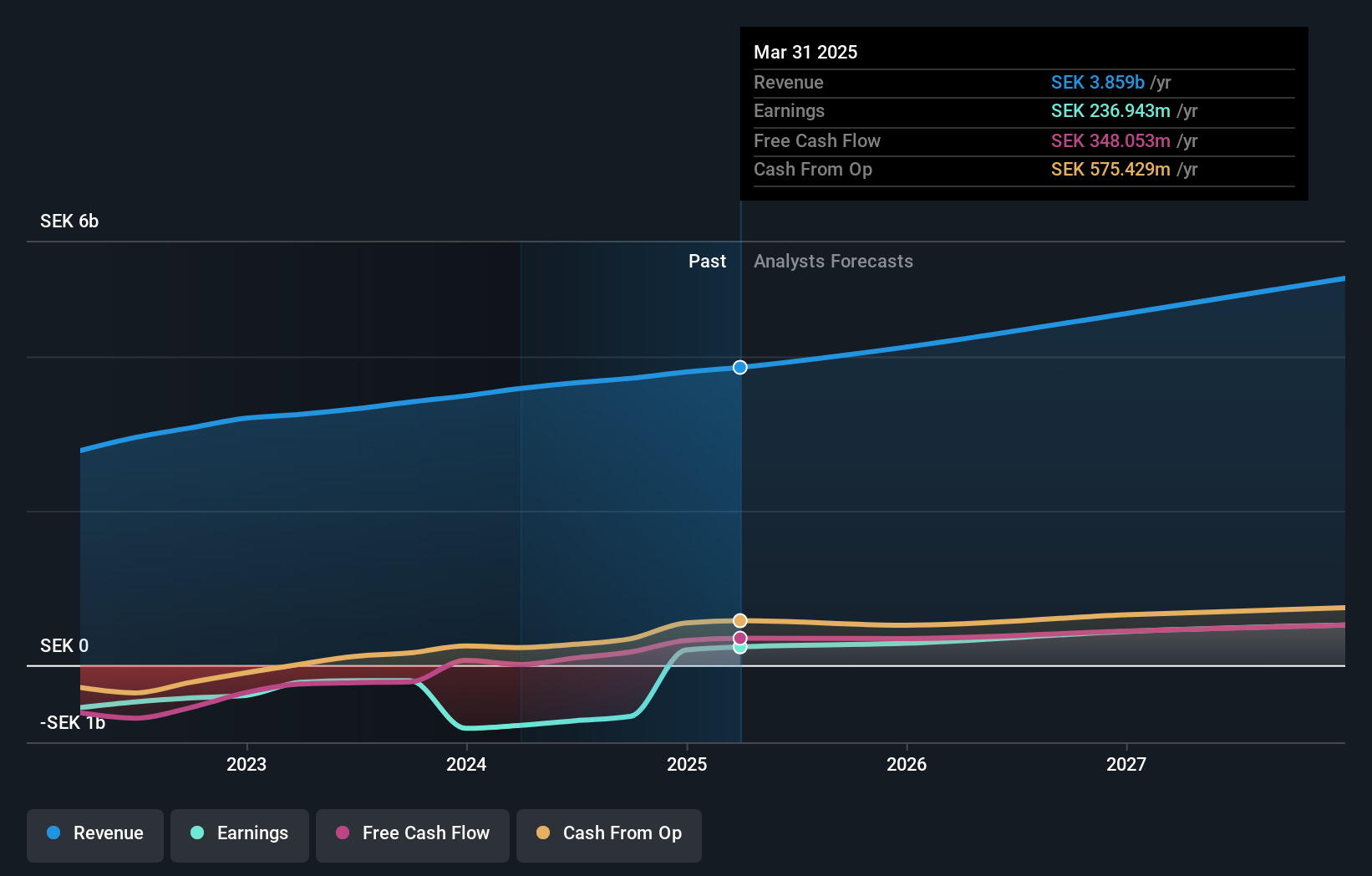

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK5.25 billion.

Operations: The company's revenue is primarily derived from its Books segment, which generated SEK859.34 million.

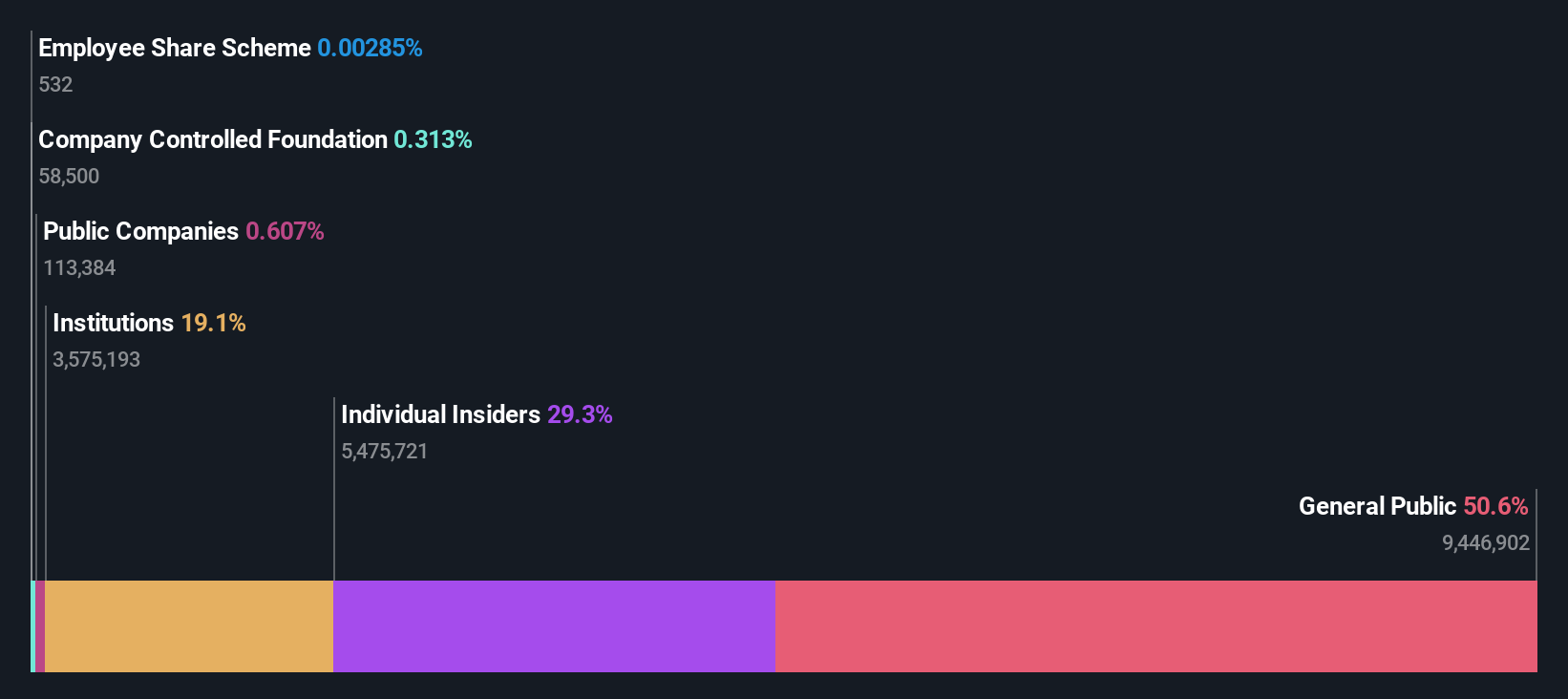

Insider Ownership: 18.7%

Earnings Growth Forecast: 98.3% p.a.

Storytel has demonstrated strong financial performance with Q3 2024 sales of SEK 954.02 million, up from SEK 895.76 million a year ago, and a net income of SEK 51.36 million compared to a previous loss. Despite no substantial insider buying recently, the company is trading well below its estimated fair value and is expected to become profitable within three years, with revenue growth forecasted at 9.6% annually, outpacing the Swedish market average.

- Delve into the full analysis future growth report here for a deeper understanding of Storytel.

- Our valuation report here indicates Storytel may be overvalued.

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Sunrise Elc Technology Co., Ltd manufactures and sells precision components, with a market cap of CN¥5.53 billion.

Operations: Unfortunately, I cannot provide a summary of the company's revenue segments as the necessary information is missing from the provided text. If you have additional details or data regarding their revenue breakdown, please share it for further assistance.

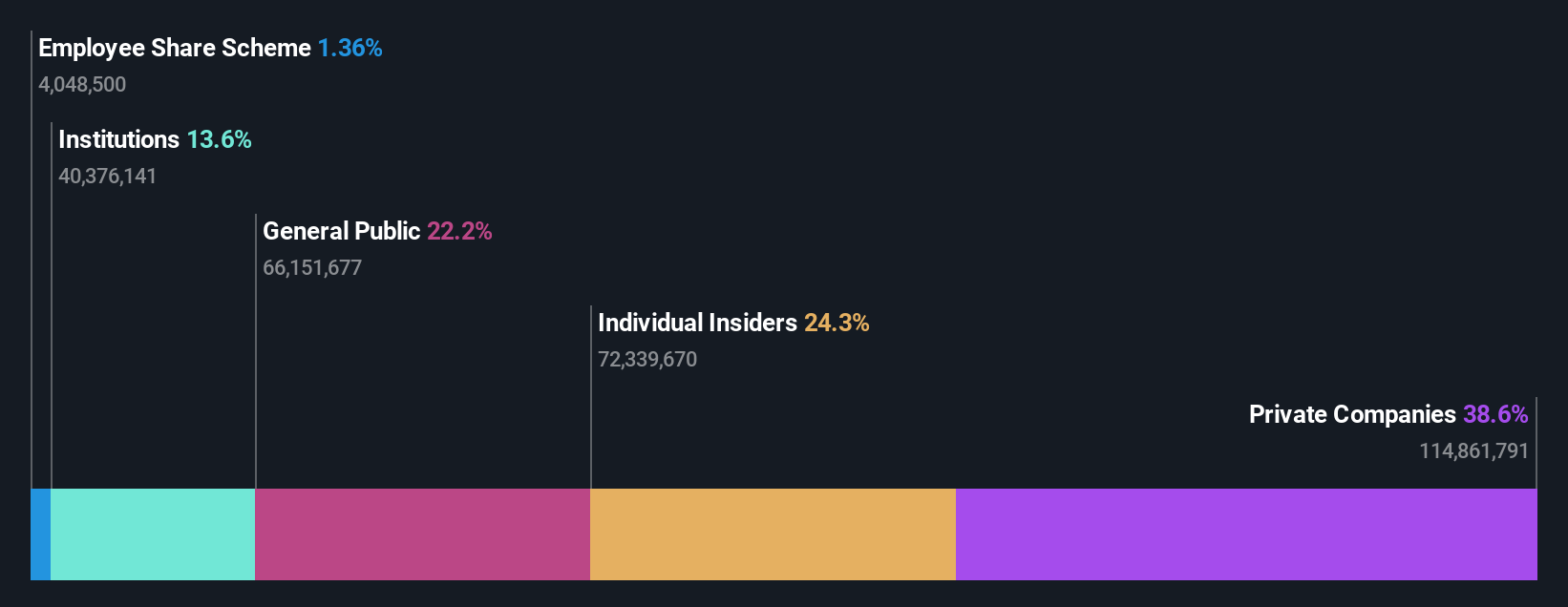

Insider Ownership: 24.3%

Earnings Growth Forecast: 35.1% p.a.

Ningbo Sunrise Elc Technology Ltd shows promising growth prospects, with revenue forecasted to increase by 32.6% annually, outpacing the Chinese market's 13.8% growth rate. Despite a stable earnings per share of CNY 0.64 for nine months ending September 2024, earnings are expected to grow significantly at 35.1% per year over the next three years. The company trades at a favorable price-to-earnings ratio of 20.5x compared to the broader market's higher average, indicating good relative value despite an unstable dividend history.

- Click to explore a detailed breakdown of our findings in Ningbo Sunrise Elc TechnologyLtd's earnings growth report.

- Upon reviewing our latest valuation report, Ningbo Sunrise Elc TechnologyLtd's share price might be too pessimistic.

Taking Advantage

- Explore the 1516 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Storytel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives