- Sweden

- /

- Electronic Equipment and Components

- /

- OM:FING B

This Analyst Just Made An Incredible Upgrade To Their Fingerprint Cards AB (publ) (STO:FING B) Earnings Forecasts

Shareholders in Fingerprint Cards AB (publ) (STO:FING B) may be thrilled to learn that the covering analyst has just delivered a major upgrade to their near-term forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. The market may be pricing in some blue sky too, with the share price gaining 35% to kr36.51 in the last 7 days. We'll be curious to see if these new estimates convince the market to lift the stock price higher still.

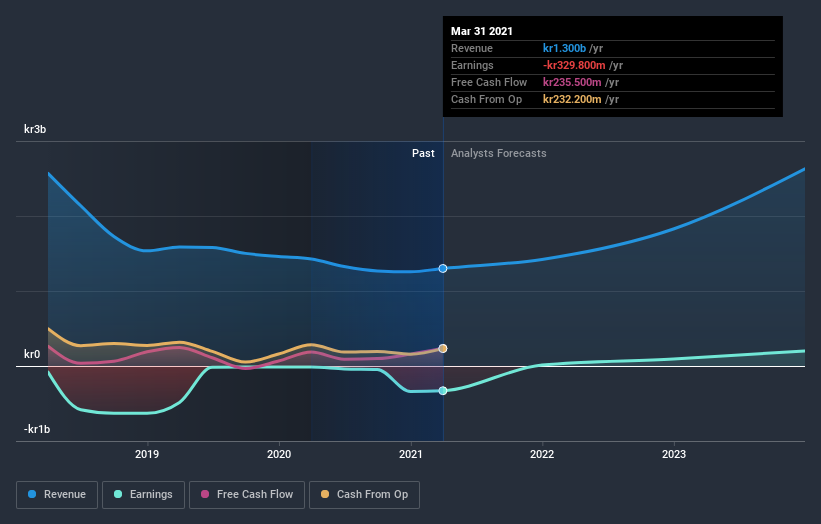

Following the upgrade, the latest consensus from Fingerprint Cards' solo analyst is for revenues of kr1.4b in 2021, which would reflect a notable 9.3% improvement in sales compared to the last 12 months. Losses are expected to turn into profits real soon, with the analyst forecasting kr0.043 in per-share earnings. Previously, the analyst had been modelling revenues of kr1.3b and earnings per share (EPS) of kr0.013 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

See our latest analysis for Fingerprint Cards

With these upgrades, we're not surprised to see that the analyst has lifted their price target 21% to kr40.00 per share.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Fingerprint Cards' past performance and to peers in the same industry. For example, we noticed that Fingerprint Cards' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 13% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 37% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 7.9% per year. So it looks like Fingerprint Cards is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The biggest takeaway for us from these new estimates is that the analyst upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, the analyst also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Fingerprint Cards.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2023, which can be seen for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading Fingerprint Cards or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:FING B

Fingerprint Cards

A high-technology company, engages in the development, production, and marketing of biometric systems and technologies in Sweden, France, Hong Kong, China, the United States, and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives