- Sweden

- /

- Communications

- /

- OM:ERIC B

Investing in Telefonaktiebolaget LM Ericsson (STO:ERIC B) a year ago would have delivered you a 83% gain

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Telefonaktiebolaget LM Ericsson (publ) (STO:ERIC B) share price is 76% higher than it was a year ago, much better than the market return of around 23% (not including dividends) in the same period. That's a solid performance by our standards! In contrast, the longer term returns are negative, since the share price is 7.3% lower than it was three years ago.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Telefonaktiebolaget LM Ericsson

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Telefonaktiebolaget LM Ericsson grew its earnings per share (EPS) by 94%. Though we do note extraordinary items affected the bottom line. It's fair to say that the share price gain of 76% did not keep pace with the EPS growth. So it seems like the market has cooled on Telefonaktiebolaget LM Ericsson, despite the growth. Interesting.

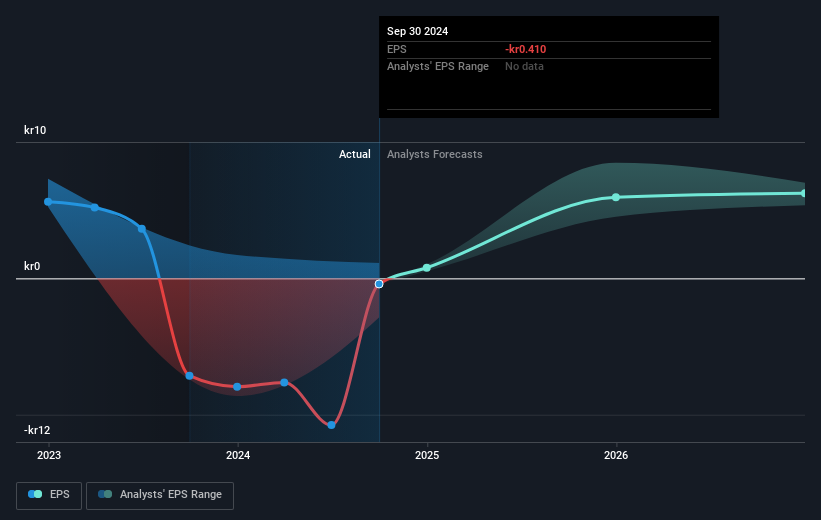

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Telefonaktiebolaget LM Ericsson's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Telefonaktiebolaget LM Ericsson's TSR for the last 1 year was 83%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Telefonaktiebolaget LM Ericsson has rewarded shareholders with a total shareholder return of 83% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 3% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Telefonaktiebolaget LM Ericsson , and understanding them should be part of your investment process.

Telefonaktiebolaget LM Ericsson is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Telefonaktiebolaget LM Ericsson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ERIC B

Telefonaktiebolaget LM Ericsson

Provides mobile connectivity solutions for telcom operators and enterprise customers in various sectors in North America, Europe, Latin America, the Middle East, Africa, North East Asia, South East Asia, Oceania, and India.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives