- Sweden

- /

- Electronic Equipment and Components

- /

- NGM:OURLIV

Trade Alert: The Chairman of the Board Of Compare-IT Nordic AB (publ) (NGM:COMPIT), Leif Liljebrunn, Has Just Spent kr79k Buying 4.6% More Shares

Whilst it may not be a huge deal, we thought it was good to see that the Compare-IT Nordic AB (publ) (NGM:COMPIT) Chairman of the Board, Leif Liljebrunn, recently bought kr79k worth of stock, for kr1.62 per share. However, it only increased their shares held by 4.6%, and it wasn't a huge purchase by absolute value, either.

View our latest analysis for Compare-IT Nordic

Compare-IT Nordic Insider Transactions Over The Last Year

While there weren't any large insider transactions in the last twelve months, it's still worth looking at the trading.

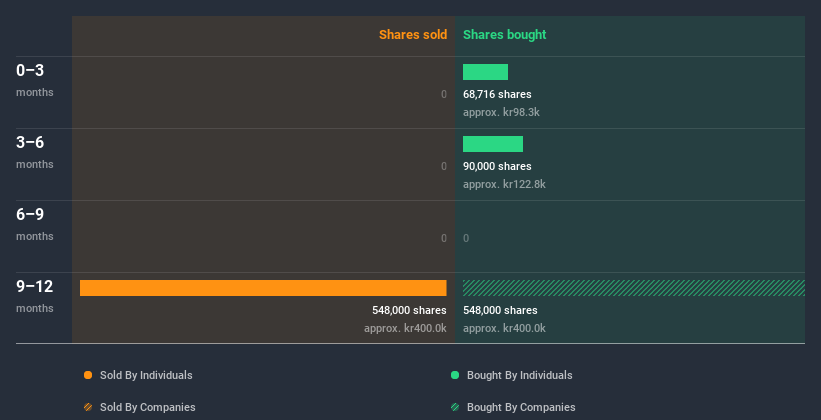

Happily, we note that in the last year insiders paid kr229k for 158.72k shares. On the other hand they divested 548.00k shares, for kr400k. In total, Compare-IT Nordic insiders sold more than they bought over the last year. They sold for an average price of about kr0.73. We don't gain confidence from insider selling below the recent share price, which is kr2.06. Since insiders sell for many reasons, we wouldn't put too much weight on it. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

I will like Compare-IT Nordic better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Insider Ownership of Compare-IT Nordic

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. Insiders own 16% of Compare-IT Nordic shares, worth about kr5.9m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Compare-IT Nordic Insiders?

It's certainly positive to see the recent insider purchases. On the other hand the transaction history, over the last year, isn't so positive. While recent transactions indicate confidence in Compare-IT Nordic, insiders don't own enough of the company to overcome our cautiousness about the longer term transactions. Overall they seem reasonably aligned. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. Every company has risks, and we've spotted 5 warning signs for Compare-IT Nordic (of which 4 are a bit concerning!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Compare-IT Nordic, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NGM:OURLIV

OurLiving

Operates as a software company, provides turnkey SaaS services for the digitization of construction, management, and housing in Sweden.

Medium-low and overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026