Will Yubico's (OM:YUBICO) New Leadership Team Reshape Its Long-Term Competitive Position?

Reviewed by Sasha Jovanovic

- Yubico recently announced the appointments of Albert Biketi as Chief Product and Technology Officer and Sheryl Chamberlain as Senior Vice President of Business Development, adding two seasoned leaders with deep expertise in cybersecurity, technology, and partnership management.

- This executive team expansion follows the hire of a new CFO, marking a focused effort by Yubico to strengthen its management team to support its global ambitions and drive innovation in secure digital authentication.

- We'll explore how these leadership hires, particularly the addition of executive experience in cybersecurity and partnerships, could influence Yubico's long-term investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Yubico Investment Narrative Recap

Yubico’s investment case centers on its ability to expand recurring subscription revenue and defend its hardware authentication leadership as cybersecurity threats mount and enterprise demand grows. The recent appointments of Albert Biketi and Sheryl Chamberlain bring deep experience in cybersecurity and partnerships but do not immediately alter the most pressing short-term catalyst, accelerating large enterprise adoption of YubiKey-as-a-Service, nor the primary risk, which is declining hardware sales during the subscription transition. The recent launch of YubiKey-as-a-Service across all EU countries stands out for its potential to broaden addressable markets and reinforce the company’s move towards more stable recurring revenues, directly relating to the most important catalyst for near-term performance. While leadership changes are important, investors paying close attention to sales mix shifts and gross margin trends should… However, investors should also be aware of Yubico’s reliance on physical authentication hardware in the face of mounting software-first and passkey competition…

Read the full narrative on Yubico (it's free!)

Yubico's outlook anticipates SEK3.5 billion in revenue and SEK581.1 million in earnings by 2028. This is based on a projected annual revenue growth rate of 14.6% and an earnings increase of SEK326.6 million from current earnings of SEK254.5 million.

Uncover how Yubico's forecasts yield a SEK155.75 fair value, a 19% upside to its current price.

Exploring Other Perspectives

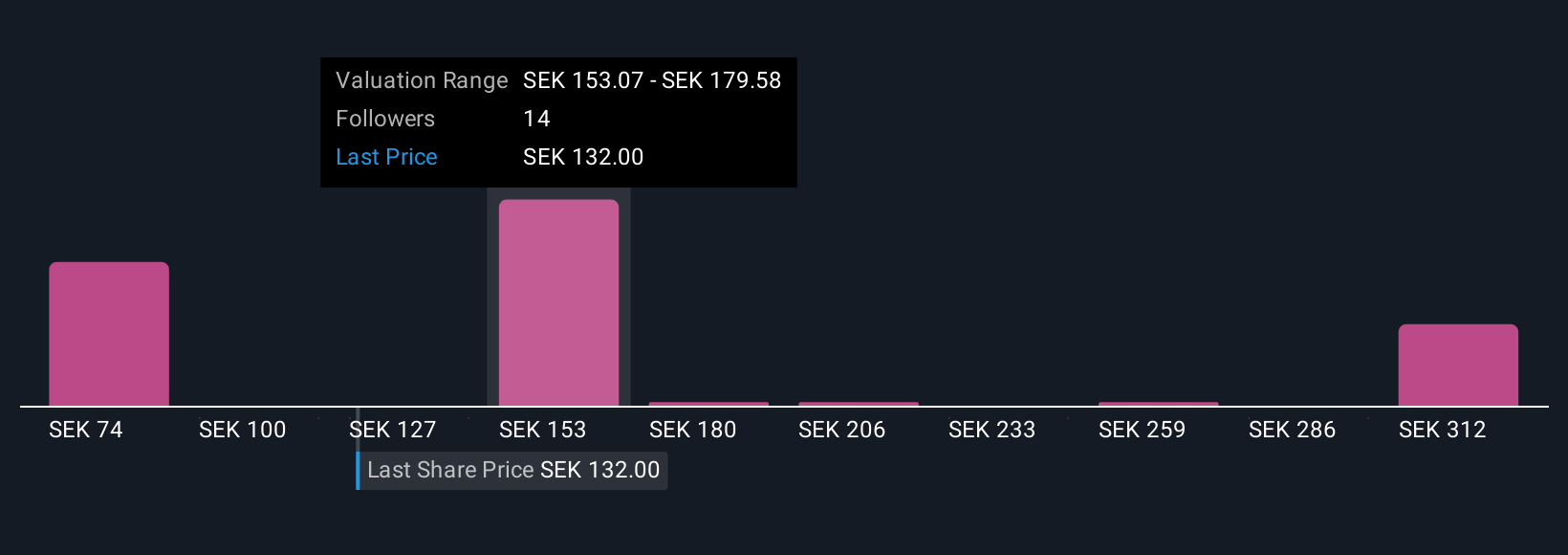

Simply Wall St Community members offered 9 fair value estimates for Yubico that range from SEK73.96 up to SEK338.62 per share. Despite this wide range of opinions, pressure from evolving authentication software and passkeys remains an ongoing concern for long-term returns, so it’s worth exploring these different viewpoints.

Explore 9 other fair value estimates on Yubico - why the stock might be worth over 2x more than the current price!

Build Your Own Yubico Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yubico research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Yubico research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yubico's overall financial health at a glance.

No Opportunity In Yubico?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives