Could Executive Hires at Yubico (OM:YUBICO) Reveal a New Approach to Innovation and Growth?

Reviewed by Sasha Jovanovic

- In late September 2025, Yubico announced the appointments of Snejana Koleva as CFO, Albert Biketi as Chief Product and Technology Officer, and Sheryl Chamberlain as Senior Vice President of Business Development, bringing significant experience in cybersecurity, business transformation, and technology alliances to the executive team.

- The addition of leadership with expertise from leading global tech companies and cybersecurity innovators highlights Yubico’s focus on strengthening its capabilities in finance, product, and business development as it pursues growth opportunities.

- We'll now consider how these high-profile executive appointments may shape Yubico's investment narrative, particularly regarding future leadership and execution.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Yubico Investment Narrative Recap

Yubico’s investment story centers on its ability to lead the hardware authentication market while adapting to fast-moving cybersecurity trends and evolving enterprise needs. The addition of high-profile executives with backgrounds in finance, cybersecurity, and global technology brings deep operational experience, but the immediate impact on Yubico’s critical transition to a subscription model and top-line volatility is limited, short-term margin and sales challenges remain foremost for investors.

Of recent company developments, the European expansion of YubiKey as a Service stands out as highly relevant; as Yubico scales its recurring subscription business, any operational, financial, or partnership expertise brought by new leadership could help ease near-term profitability and sales volatility during the business model transition.

Yet, in contrast to Yubico's credentialed new hires, the short-term risk of declining hardware sales and margin pressure persists as a critical factor investors should be aware of, especially if...

Read the full narrative on Yubico (it's free!)

Yubico's outlook anticipates SEK3.5 billion in revenue and SEK581.1 million in earnings by 2028. This projection requires a 14.6% annual revenue growth rate and an increase in earnings of SEK326.6 million from the current SEK254.5 million.

Uncover how Yubico's forecasts yield a SEK155.75 fair value, a 26% upside to its current price.

Exploring Other Perspectives

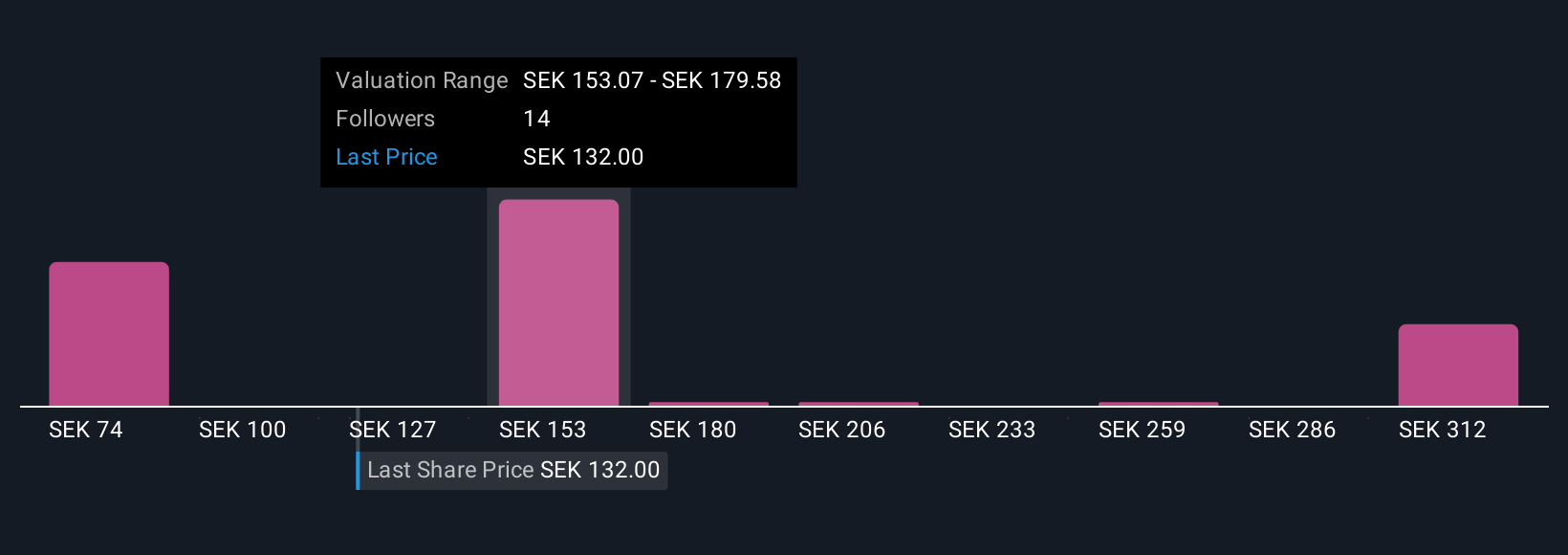

Nine members of the Simply Wall St Community estimate Yubico’s fair value anywhere from SEK74 to SEK338 per share. As Yubico continues its move toward higher-margin subscriptions, opinions differ on its ability to balance growth and profitability, explore how these perspectives may reshape your own view.

Explore 9 other fair value estimates on Yubico - why the stock might be worth 40% less than the current price!

Build Your Own Yubico Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yubico research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Yubico research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yubico's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:YUBICO

Yubico

Provides authentication solutions for use in computers, networks, and online services.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives