Vitec Software Group (OM:VIT B) Margin Decline Tests Growth Optimism Despite Strong Track Record

Reviewed by Simply Wall St

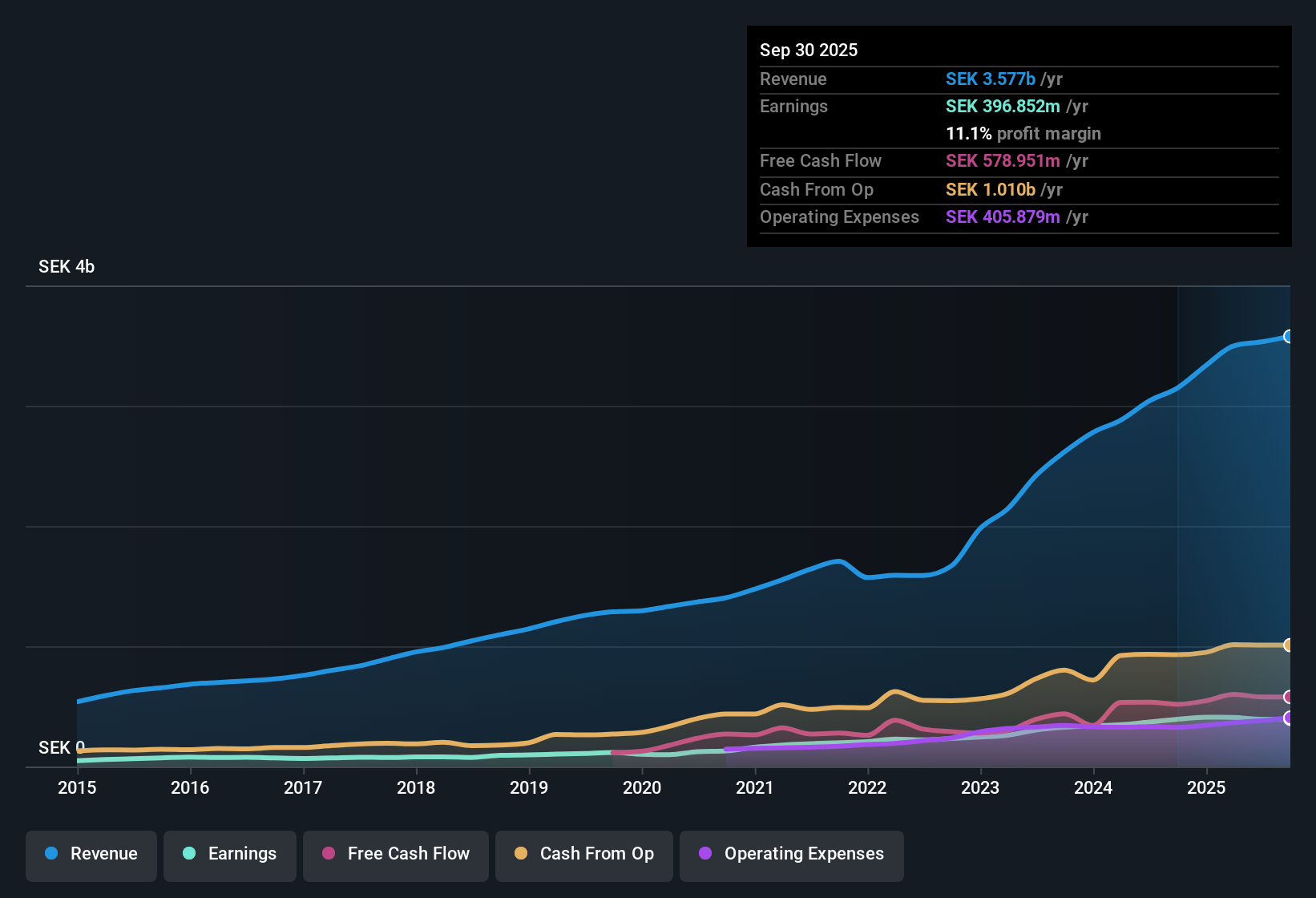

Vitec Software Group (OM:VIT B) posted a solid 6.2% EPS growth for its most recent period, falling short of its five-year annual average of 21.7%. Net profit margins declined to 11.1% from 12.2%. Looking ahead, analysts expect the company to accelerate earnings at 18.1% annually, with revenue forecast to climb 13.9% per year. This signals that market optimism about continued growth may be well-placed.

See our full analysis for Vitec Software Group.Now, let’s see how these latest results compare with the popular narratives around Vitec Software Group. Areas of consensus could get reinforced, but some expectations may get put to the test.

See what the community is saying about Vitec Software Group

Margins Set to Rebound by 2028

- Analysts project profit margins will increase from 11.1% today to 15.0% within three years, marking a meaningful recovery above current levels.

- According to the analysts' consensus view, this potential margin improvement hinges on two main factors:

- Strategic acquisitions and organic upselling are expected to drive higher revenues. This could help offset pressure from rising costs per employee.

- The company’s decentralized approach and focus on customer-tailored solutions are seen as crucial to boosting efficiency. These factors enable productivity gains that support improved net margins.

See how analysts’ projections for Vitec’s operational turnaround compare to market expectations in the detailed consensus view. 📊 Read the full Vitec Software Group Consensus Narrative.

Price-to-Earnings: Premium or Opportunity?

- Vitec trades at a price-to-earnings ratio of 37.2x, which is above the Swedish industry average of 31.2x but far below the peer group’s 72.5x multiple.

- Analysts' consensus view highlights a surprising tension:

- The company’s above-average valuation signals investor confidence in revenue and margin improvement. However, there is ongoing debate over whether the premium is justified by near-term profit growth.

- The share price (SEK366.8) remains below the SEK530.17 analyst price target and the DCF fair value estimate of SEK384.07. This suggests market participants have not yet fully priced in expected earnings expansion.

Growth Bets on Acquisitions and Upselling

- Looking forward, revenue is forecast to climb 13.9% per year, propelled by further M&A and efforts to grow recurring revenue from existing customers.

- Consensus narrative emphasizes the pivotal role of Vitec’s acquisition strategy:

- The company’s growth plan depends on successfully integrating new acquisitions while sustaining productivity. This is critical for achieving the 18.1% annual earnings growth analysts anticipate.

- Delays in project rollouts or shifts in revenue mix, such as a heavier reliance on lower-margin transaction-based revenue, could undermine these ambitions and keep profit margins below projected targets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Vitec Software Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

View the figures from another angle? Share your interpretation and shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Vitec Software Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite optimistic forecasts, Vitec’s high valuation and reliance on margin recovery mean investors face uncertainty if earnings growth stalls or expectations fall short.

If you’re looking for attractive options where strong cash flows support reasonable prices, focus on companies like these 877 undervalued stocks based on cash flows that are better positioned for value and upside potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIT B

Vitec Software Group

Develops and delivers vertical market software solutions in Sweden, Denmark, Finland, Norway, the Netherlands, the United States, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion