The Upsales Technology (STO:UPSALE) Share Price Has Gained 132%, So Why Not Pay It Some Attention?

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Upsales Technology AB (publ) (STO:UPSALE). Its share price is already up an impressive 132% in the last twelve months. Also pleasing for shareholders was the 52% gain in the last three months. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Upsales Technology

We don't think that Upsales Technology's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Upsales Technology grew its revenue by 11% last year. That's not a very high growth rate considering it doesn't make profits. In contrast, the share price took off during the year, gaining 132%. The business will need a lot more growth to justify that increase. It's quite likely that the market is considering other factors, not just revenue growth.

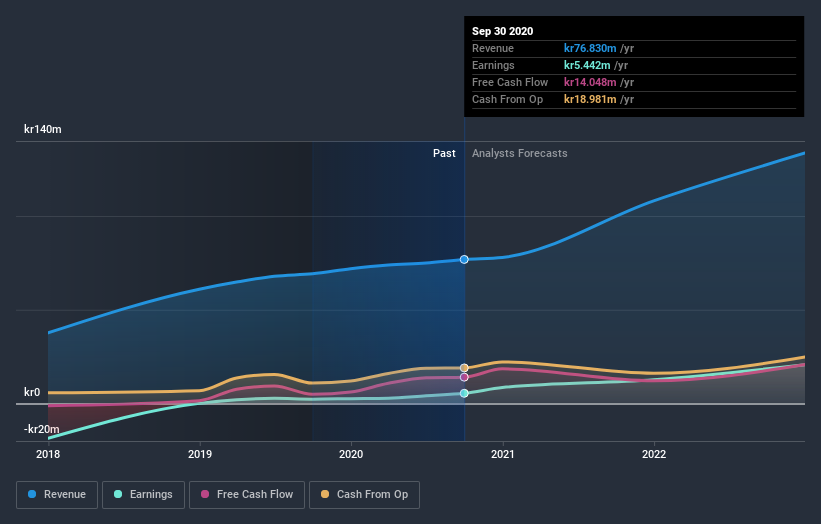

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Upsales Technology has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Upsales Technology stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Upsales Technology shareholders should be happy with the total gain of 132% over the last twelve months. And the share price momentum remains respectable, with a gain of 52% in the last three months. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Upsales Technology better, we need to consider many other factors. Even so, be aware that Upsales Technology is showing 1 warning sign in our investment analysis , you should know about...

We will like Upsales Technology better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you decide to trade Upsales Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Upsales Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:UPSALE

Upsales Technology

Operates as a software-as-a-service company that develops and sells web-based business systems with a focus on sales, marketing, and analysis in Sweden and internationally.

High growth potential with excellent balance sheet.