- Philippines

- /

- Banks

- /

- PSE:AUB

Undervalued Small Caps With Insider Activity In December 2024

Reviewed by Simply Wall St

As global markets continue to rally, small-cap stocks have joined the momentum, with the Russell 2000 Index reaching new highs amid a backdrop of robust trading activity and shifting geopolitical sentiments. Despite concerns over potential tariffs and a manufacturing slump, consumer strength and recent policy developments have buoyed investor confidence in this segment. In such an environment, identifying promising small-cap stocks often involves looking for those that demonstrate resilience through insider activity and strategic positioning within their industries.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Paradeep Phosphates | 24.1x | 0.8x | 28.74% | ★★★★★☆ |

| Maharashtra Seamless | 10.2x | 1.8x | 34.93% | ★★★★★☆ |

| Marlowe | NA | 0.7x | 49.16% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 38.44% | ★★★★☆☆ |

| Gooch & Housego | 37.6x | 0.9x | 37.25% | ★★★☆☆☆ |

| Semen Indonesia (Persero) | 19.7x | 0.6x | 32.14% | ★★★☆☆☆ |

| L.G. Balakrishnan & Bros | 14.8x | 1.7x | -48.55% | ★★★☆☆☆ |

| Kambi Group | 16.6x | 1.5x | 39.41% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| THG | NA | 0.4x | -1027.30% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

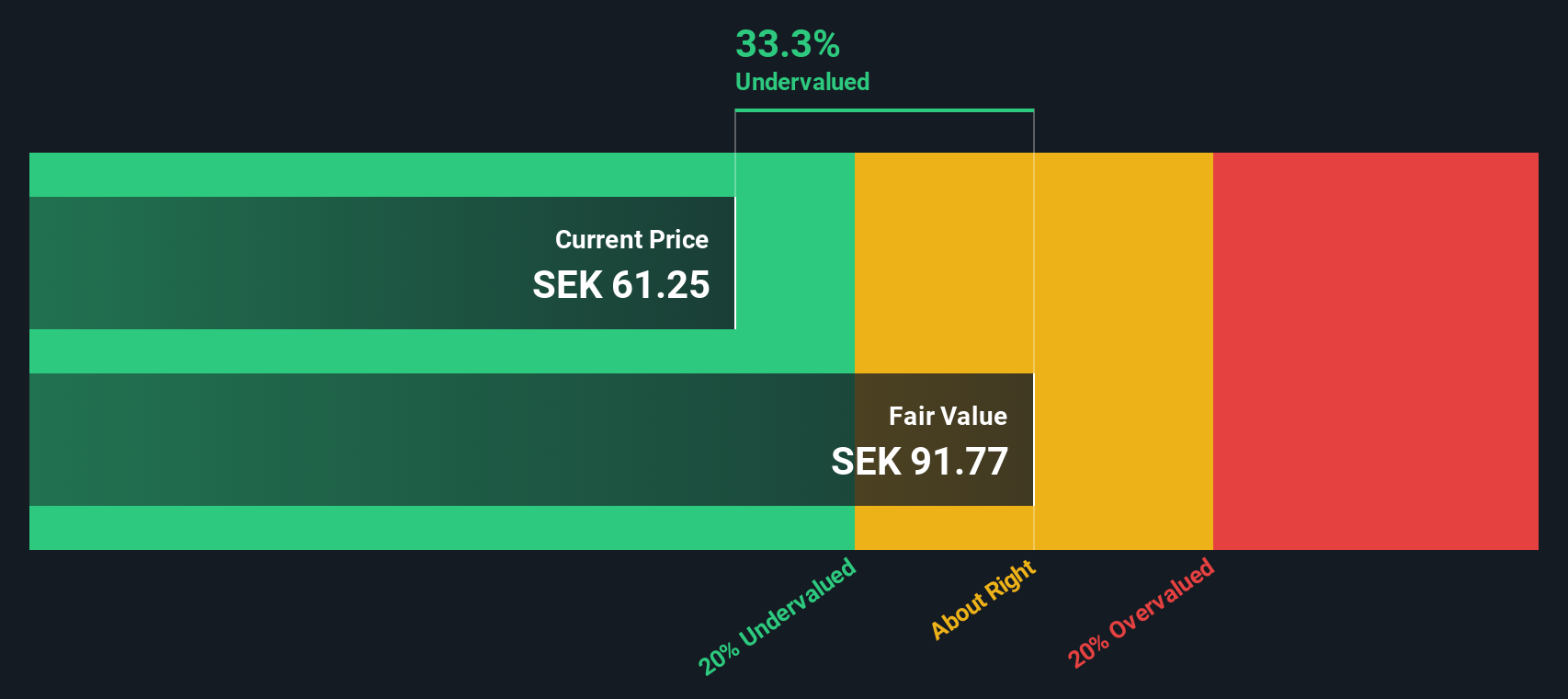

Truecaller (OM:TRUE B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Truecaller is a communications software company specializing in caller identification and spam blocking services, with a market cap of approximately SEK 13.63 billion.

Operations: The company generates revenue primarily from its communications software segment, with a recent gross profit margin of 76.18%. Operating expenses, including general and administrative costs, are significant components of its cost structure.

PE: 36.1x

Truecaller, a smaller company in the tech space, has shown potential for growth with earnings forecasted to rise by 23.58% annually. Despite relying on higher-risk external borrowing for funding, the company's strategic partnerships, like those with Commercial International Bank and King Price Insurance, enhance its reputation in secure communication solutions. Insider confidence is evident as Nami Zarringhalam purchased 22,832 shares worth approximately SEK 986,114 in November 2024. Upcoming leadership changes may further influence Truecaller's trajectory as it continues expanding its business solutions suite globally.

- Unlock comprehensive insights into our analysis of Truecaller stock in this valuation report.

Explore historical data to track Truecaller's performance over time in our Past section.

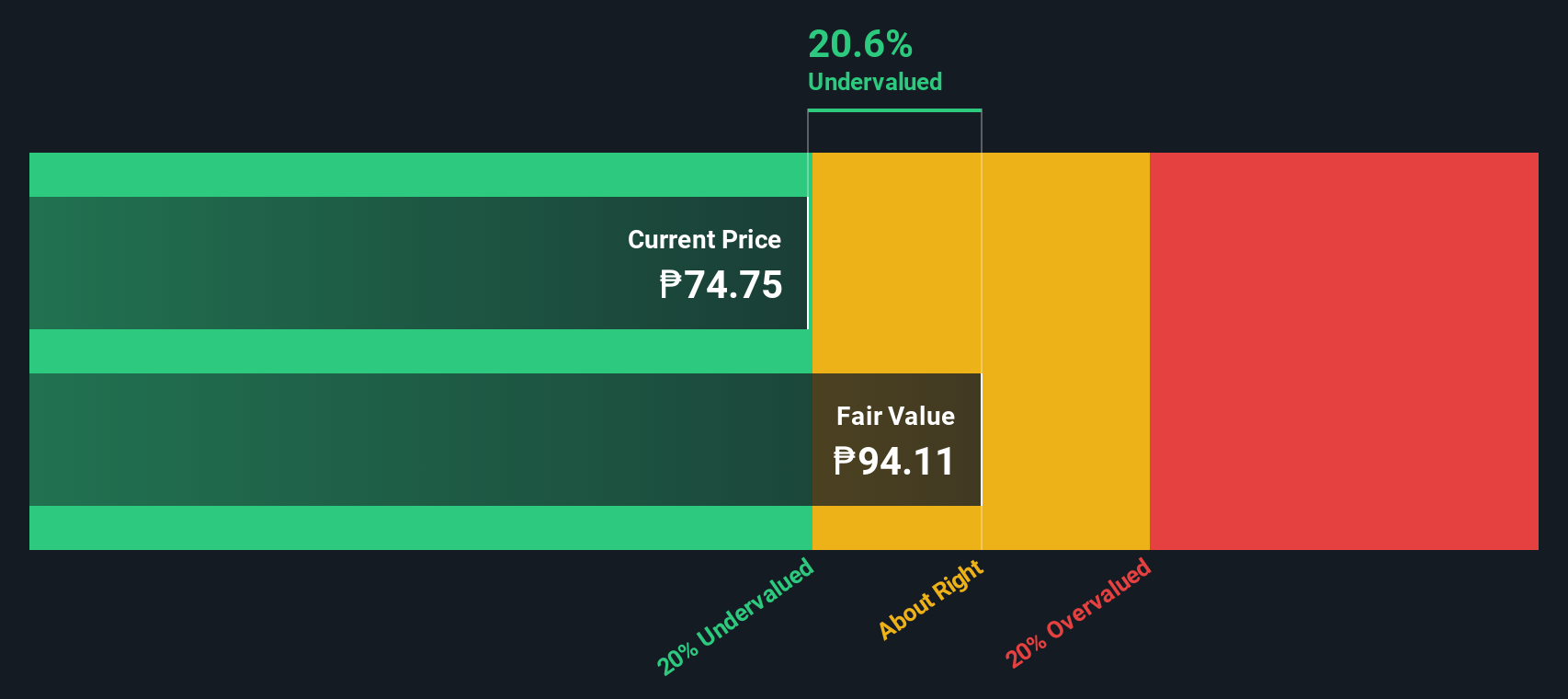

Asia United Bank (PSE:AUB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia United Bank provides a range of financial services including branch, consumer, and commercial banking, as well as treasury operations, with a market capitalization of ₱22.43 billion.

Operations: The company's revenue is primarily driven by branch banking, contributing ₱9.46 billion, followed by commercial banking at ₱4.14 billion and treasury activities at ₱3.35 billion. The net income margin has shown an upward trend, reaching 53.33% in the latest period, indicating efficient cost management relative to its revenue generation capabilities.

PE: 4.2x

Asia United Bank, a smaller player in the banking sector, recently showcased insider confidence with Manuel Gomez acquiring 15,090 shares valued at PHP 890,310 in November 2024. This purchase highlights potential optimism despite the bank's challenging non-performing loans ratio of 2%. The third quarter saw net income rise to PHP 3.35 billion from PHP 1.95 billion year-over-year, indicating strong financial performance. However, basic earnings per share dipped slightly over nine months compared to last year.

- Delve into the full analysis valuation report here for a deeper understanding of Asia United Bank.

Examine Asia United Bank's past performance report to understand how it has performed in the past.

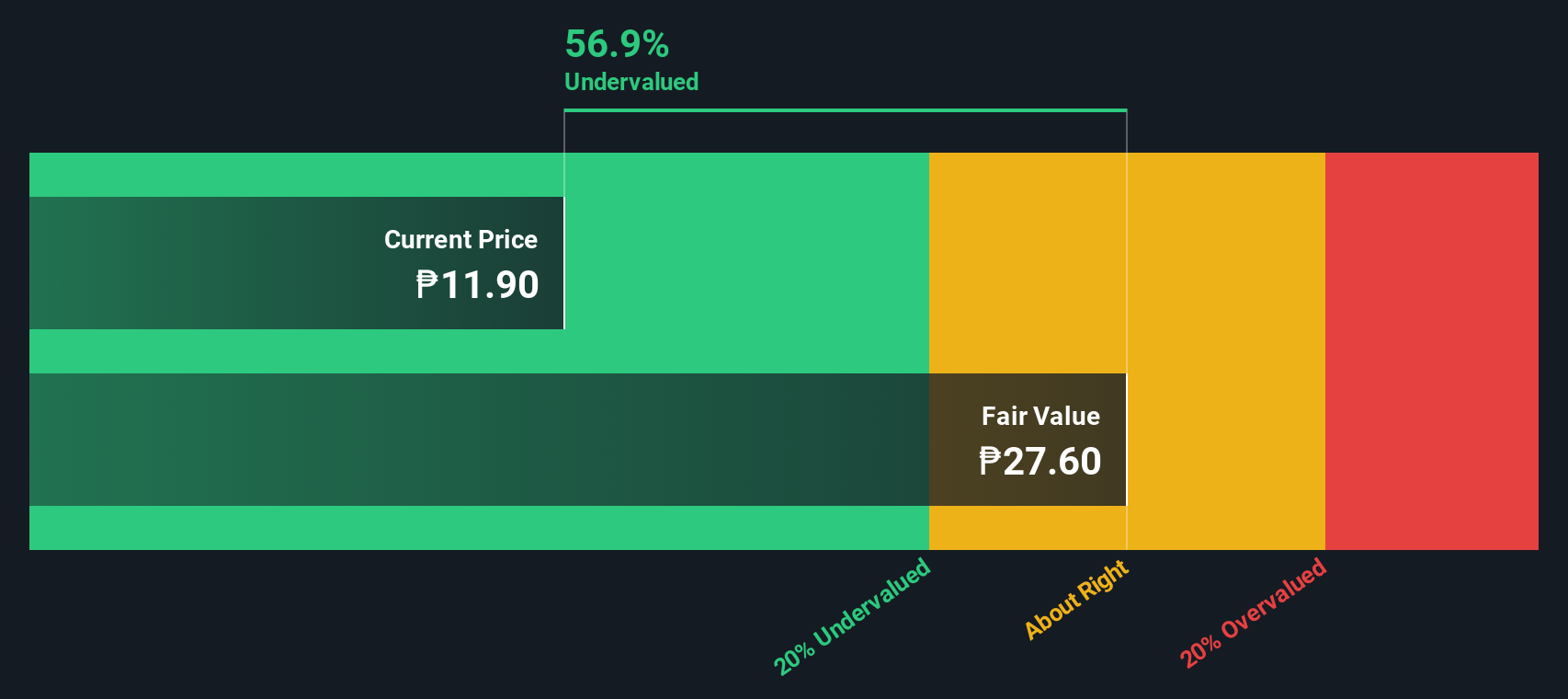

Pryce (PSE:PPC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Pryce operates in the real estate, pharmaceutical products, and liquefied petroleum and industrial gases sectors with a focus on the latter, contributing significantly to its operations.

Operations: Pryce's primary revenue stream is from Liquefied Petroleum and Industrial Gases, generating ₱19.88 billion, followed by Real Estate and Pharmaceutical Products. The company has shown a notable trend in its gross profit margin, reaching 30.18% as of June 2024. Operating expenses include significant allocations for sales and marketing as well as general and administrative purposes.

PE: 7.3x

Pryce has shown impressive growth, with third-quarter sales rising to PHP 5.46 billion from PHP 4.41 billion last year, and net income climbing to PHP 831.73 million from PHP 692.28 million. The company declared a dividend of PHP 0.20 per share, payable in January, reflecting solid earnings performance funded by retained earnings as of December 2023. Insider confidence is evident as President Efren Palma recently purchased shares worth approximately PHP 104,000, signaling potential undervaluation despite reliance on higher-risk external borrowing for funding.

- Navigate through the intricacies of Pryce with our comprehensive valuation report here.

Gain insights into Pryce's past trends and performance with our Past report.

Where To Now?

- Gain an insight into the universe of 187 Undervalued Small Caps With Insider Buying by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:AUB

Asia United Bank

Provides banking and other financial products and services to individual consumers, MSMEs, and corporations in the Philippines.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives