Exploring 3 High Growth Tech Stocks with Potential for Future Expansion

Reviewed by Simply Wall St

As global markets navigate a period of heightened volatility, with small-cap stocks underperforming and inflation concerns persisting, investors are keenly observing the tech sector for opportunities that might offer resilience and growth potential. In such an environment, identifying high-growth tech stocks with robust fundamentals and innovative capabilities can be key to capitalizing on future expansion prospects.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1202 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

74Software (ENXTPA:74SW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: 74Software is an infrastructure software publisher with operations across France, the rest of Europe, the Americas, and the Asia Pacific, and it has a market cap of approximately €785.31 million.

Operations: The company generates revenue through four primary streams: License (€8.46 million), Maintenance (€77.04 million), Subscription (€201.19 million), and Services (Excl. Subscription) (€35.49 million). The subscription segment is the largest contributor to its revenue model, indicating a focus on recurring income sources.

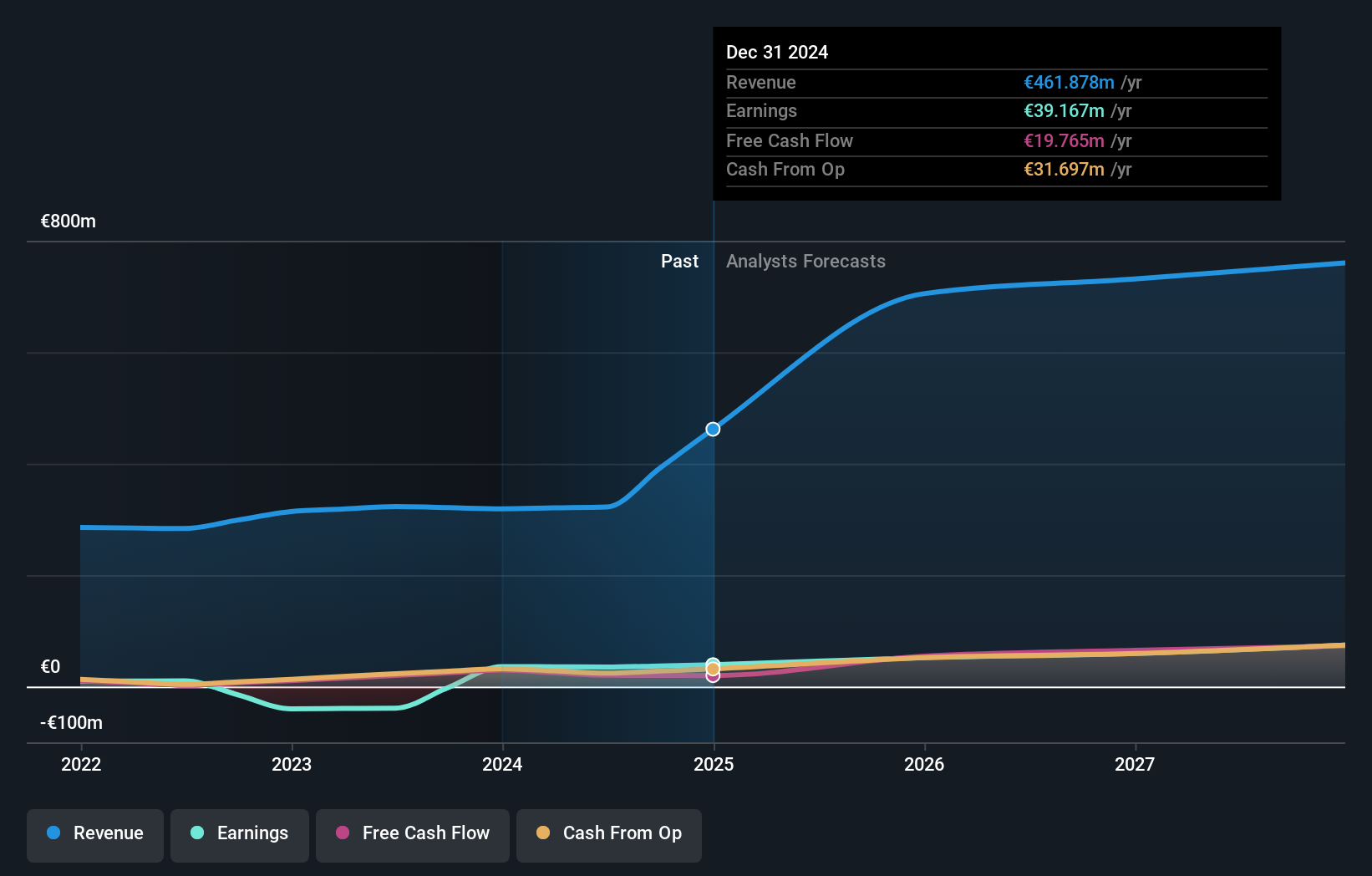

74Software, previously known as Axway Software, is navigating a transformative phase with a recent name and ticker change to 74SW on Euronext Paris. This shift coincides with an impressive third-quarter revenue report showing a 62.1% increase year-over-year, totaling €112.4 million, driven by organic growth of 14.9%. The company's robust performance is further underscored by its transition into profitability this year and an anticipated earnings growth of 20.9% annually, outpacing the French market's average. Despite these gains, its forecasted revenue growth at 13.4% annually remains modest compared to industry giants but exceeds the broader French market's growth rate of 5.4%. These dynamics illustrate 74Software's potential in leveraging both operational efficiency and strategic rebranding to enhance its market position amidst competitive pressures.

- Click here to discover the nuances of 74Software with our detailed analytical health report.

Explore historical data to track 74Software's performance over time in our Past section.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★★☆

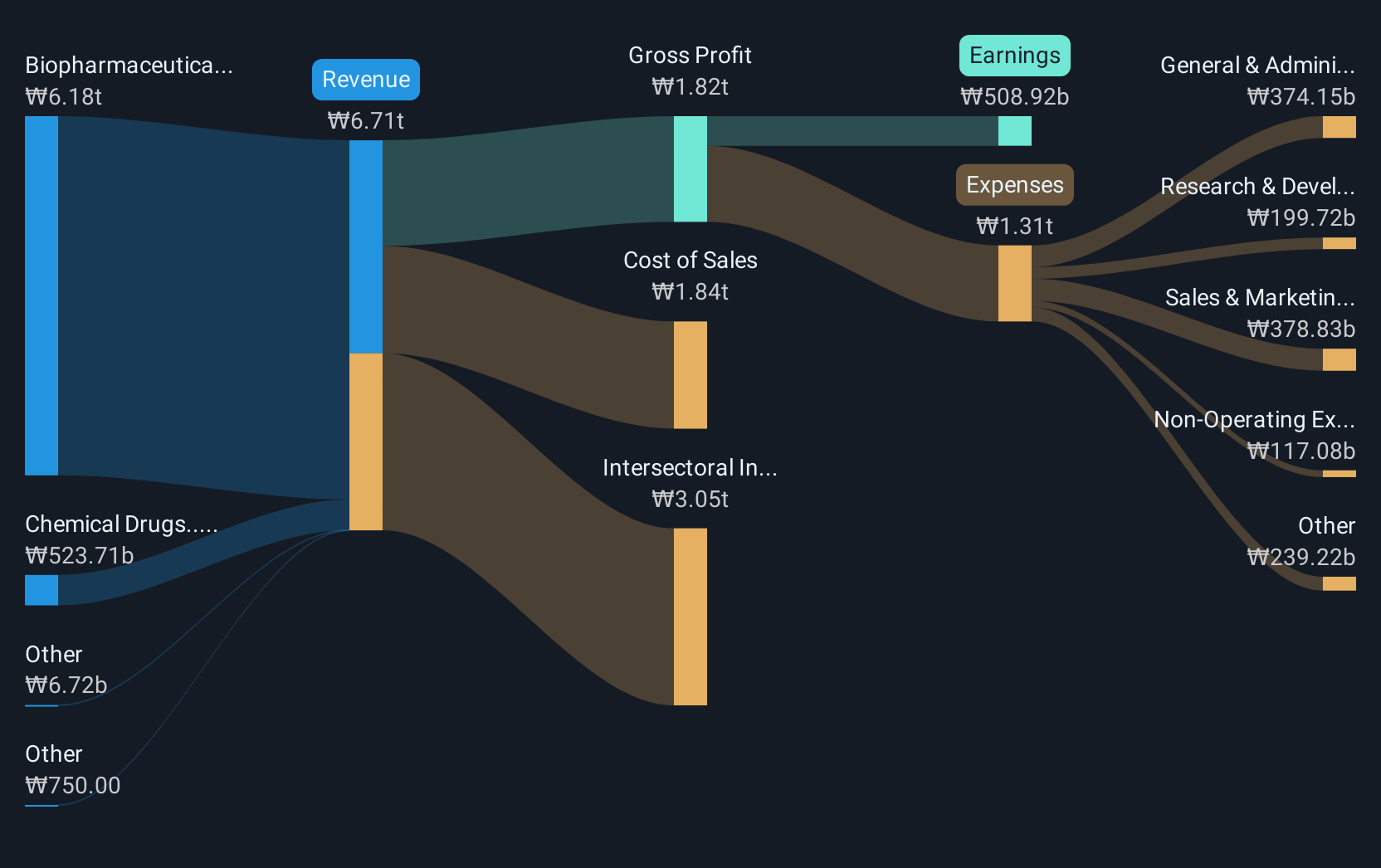

Overview: Celltrion, Inc., along with its subsidiaries, focuses on developing and producing protein-based drugs for oncology treatment in South Korea, with a market capitalization of ₩39.57 trillion.

Operations: Celltrion generates revenue primarily from its Bio Medical Supply segment, which contributes ₩4.58 trillion, and Chemical Drugs, adding ₩511.97 billion. The company's focus on protein-based oncology treatments is central to its business operations in South Korea.

Celltrion, a trailblazer in the biotechnology sector, is making significant strides with its robust R&D focus and recent FDA approvals. The company's annual revenue growth is projected at 26%, outpacing the South Korean market's 9.1% growth rate. Notably, Celltrion has committed KRW 106.74 billion to repurchase shares, underscoring confidence in its financial health and commitment to shareholder value. This strategic move coincides with their latest FDA nod for STEQEYMA®, a biosimilar that promises to fortify their market position in biologics for chronic diseases, reflecting a deep understanding of both scientific innovation and market dynamics.

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

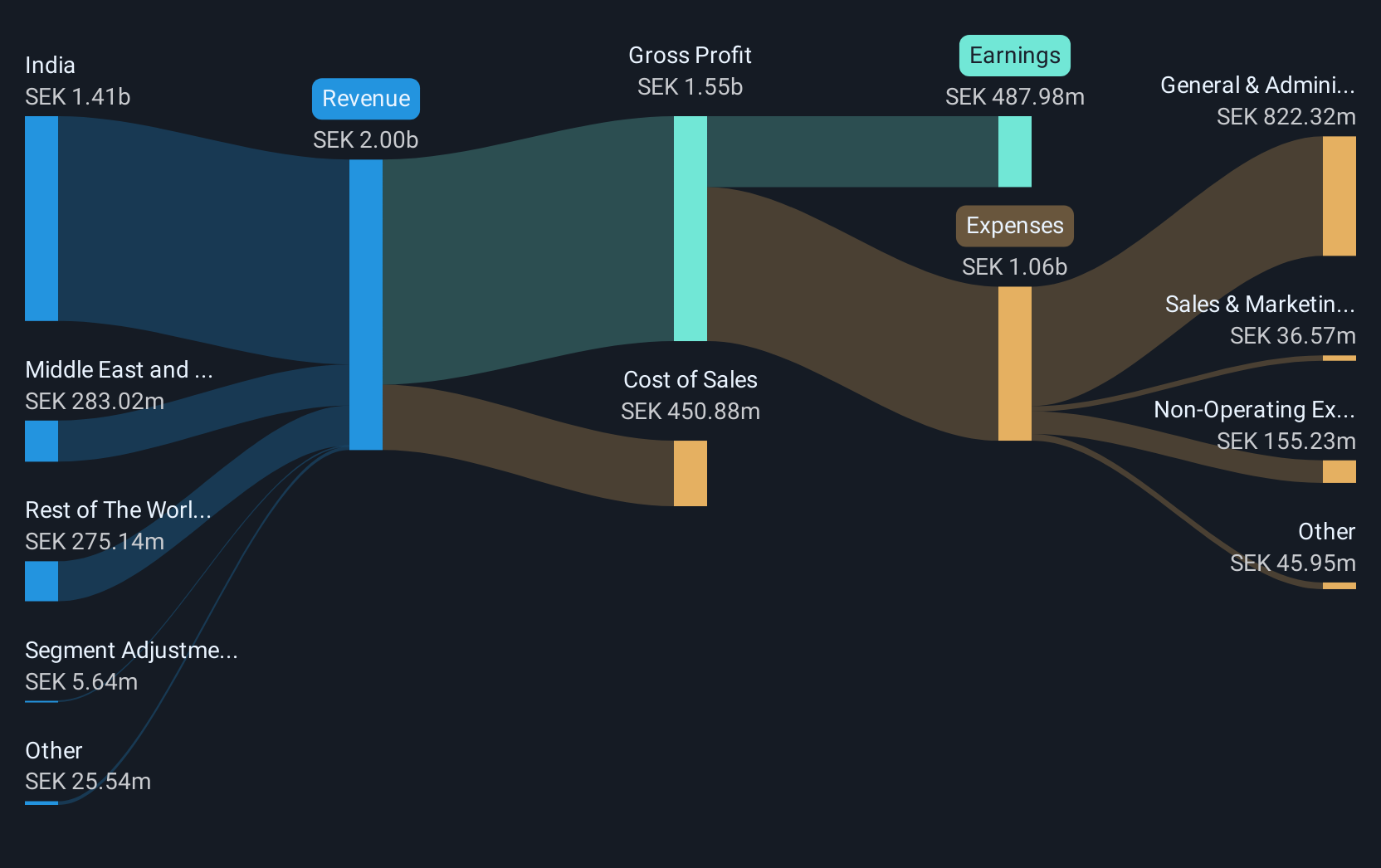

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of SEK17.75 billion.

Operations: The company generates revenue primarily from its communications software segment, amounting to SEK1.78 billion.

Truecaller, a leader in communication verification and fraud prevention, is making significant strides with a robust 21.3% annual revenue growth, outpacing the Swedish market's 1.1%. This growth is complemented by an impressive forecast of 25.3% in annual earnings growth over the next three years, highlighting its strong market position and operational efficiency. Recent strategic partnerships with Nawy and Commercial International Bank underscore Truecaller's pivotal role in enhancing customer communication safety within real estate and banking sectors, leveraging its Customer Experience Solution to foster trust and streamline interactions. These collaborations not only expand Truecaller's business footprint but also reinforce its commitment to delivering innovative solutions that address critical industry needs for security and transparency in communications.

- Navigate through the intricacies of Truecaller with our comprehensive health report here.

Understand Truecaller's track record by examining our Past report.

Taking Advantage

- Click through to start exploring the rest of the 1199 High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Exceptional growth potential with flawless balance sheet.