- Sweden

- /

- Electrical

- /

- OM:FAG

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, marked by inflation concerns and political uncertainties, investors are closely watching the Federal Reserve's rate decisions and their impact on equities. Amidst this backdrop of volatility, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those seeking to balance risk in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.31% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.64% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

Click here to see the full list of 2017 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

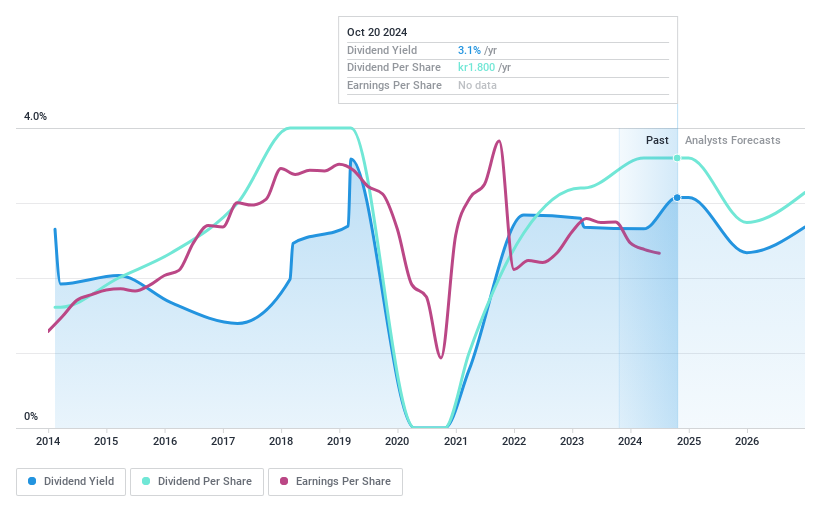

Fagerhult Group (OM:FAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fagerhult Group AB, along with its subsidiaries, manufactures and sells professional lighting solutions globally, with a market cap of SEK9.70 billion.

Operations: Fagerhult Group's revenue is derived from its segments: Premium (SEK2.87 billion), Collection (SEK3.91 billion), Professional (SEK1.03 billion), and Infrastructure (SEK843.90 million).

Dividend Yield: 3.3%

Fagerhult Group's dividend payments have been volatile over the past decade, with an annual drop of over 20% at times. Despite this, dividends are covered by earnings (77.7% payout ratio) and cash flows (43% cash payout ratio). The dividend yield of 3.27% is below the top tier in Sweden. Recent earnings show a decline, with Q3 net income falling to SEK 54 million from SEK 158.8 million year-over-year amidst ongoing strategic initiatives and M&A pursuits.

- Dive into the specifics of Fagerhult Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Fagerhult Group is priced lower than what may be justified by its financials.

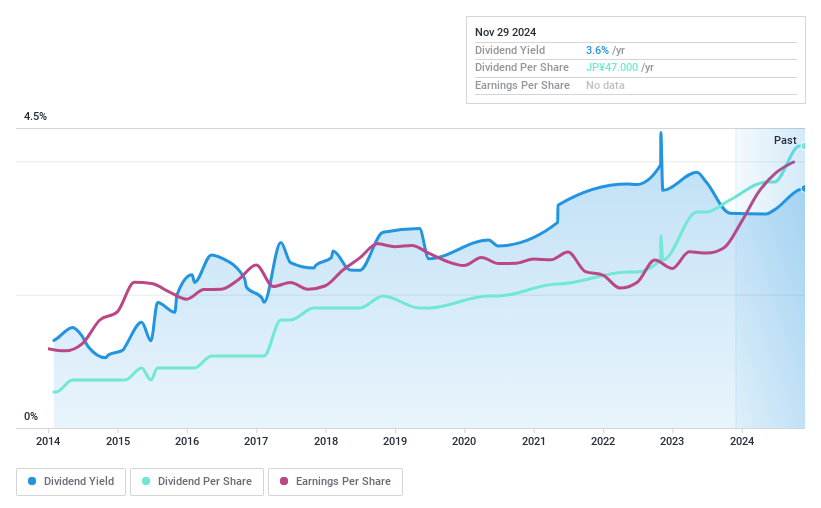

MEISEI INDUSTRIALLtd (TSE:1976)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MEISEI INDUSTRIAL Co., Ltd. is a construction works company operating both in Japan and internationally, with a market cap of ¥68.41 billion.

Operations: MEISEI INDUSTRIAL Co., Ltd. generates revenue primarily from its Construction Work segment, amounting to ¥58.38 billion, and its Boiler Business segment, contributing ¥7.35 billion.

Dividend Yield: 3.4%

MEISEI INDUSTRIAL's recent dividend increase to ¥21.00 per share highlights its commitment to shareholder returns, with dividends reliably growing over the past decade despite being underpinned by earnings rather than free cash flow. The company’s buyback program aims to enhance capital efficiency and shareholder value. While its 3.36% dividend yield is below Japan's top tier, a low payout ratio of 38.8% suggests dividends are well-covered by earnings, supported by a strong earnings growth of 45.2%.

- Navigate through the intricacies of MEISEI INDUSTRIALLtd with our comprehensive dividend report here.

- Our valuation report unveils the possibility MEISEI INDUSTRIALLtd's shares may be trading at a premium.

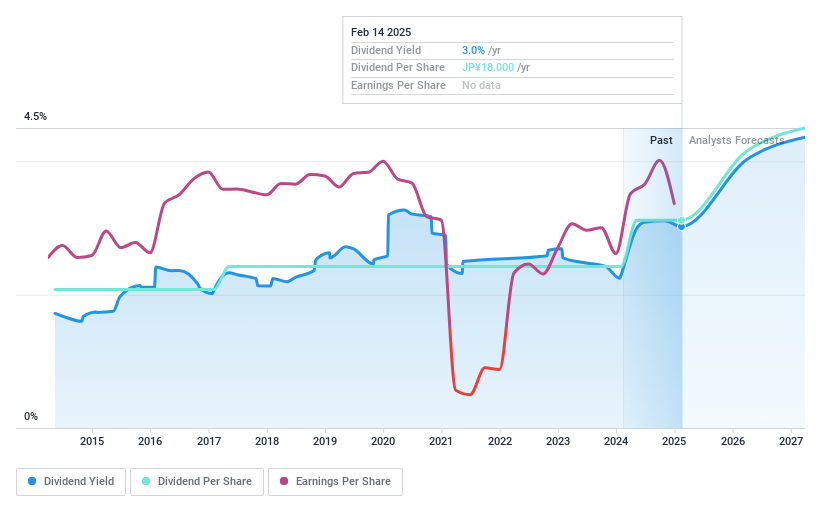

Airport Facilities (TSE:8864)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Airport Facilities Co., Ltd. operates in Japan, providing real estate services, area heating and cooling, and water supply and drainage services, with a market cap of ¥28.97 billion.

Operations: Airport Facilities Co., Ltd.'s revenue is primarily derived from its operations in real estate, area heating and cooling, and water supply and drainage services within Japan.

Dividend Yield: 3.1%

Airport Facilities offers a stable dividend profile, with dividends consistently paid and growing over the past decade. The payout ratio of 51.7% indicates dividends are well-covered by earnings, while a cash payout ratio of 40.9% ensures coverage by cash flows. Although its 3.13% yield is below the top tier in Japan, it remains attractive due to reliable and stable payments. Currently trading at 50.9% below estimated fair value, it may present a good opportunity for value-focused investors.

- Click here to discover the nuances of Airport Facilities with our detailed analytical dividend report.

- The analysis detailed in our Airport Facilities valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Delve into our full catalog of 2017 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FAG

Fagerhult Group

Engages in the manufacture and sale of professional lighting solutions worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives