Amid hopes for new trade deals and a slight uptick in major stock indexes, the European market has shown resilience despite recent tariff announcements. As investors navigate these fluctuating conditions, dividend stocks can offer a stable income stream and potential growth opportunities, making them an attractive consideration for those looking to enhance their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.49% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.24% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.76% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.91% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.59% | ★★★★★★ |

| ERG (BIT:ERG) | 5.43% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 3.95% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.62% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 225 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

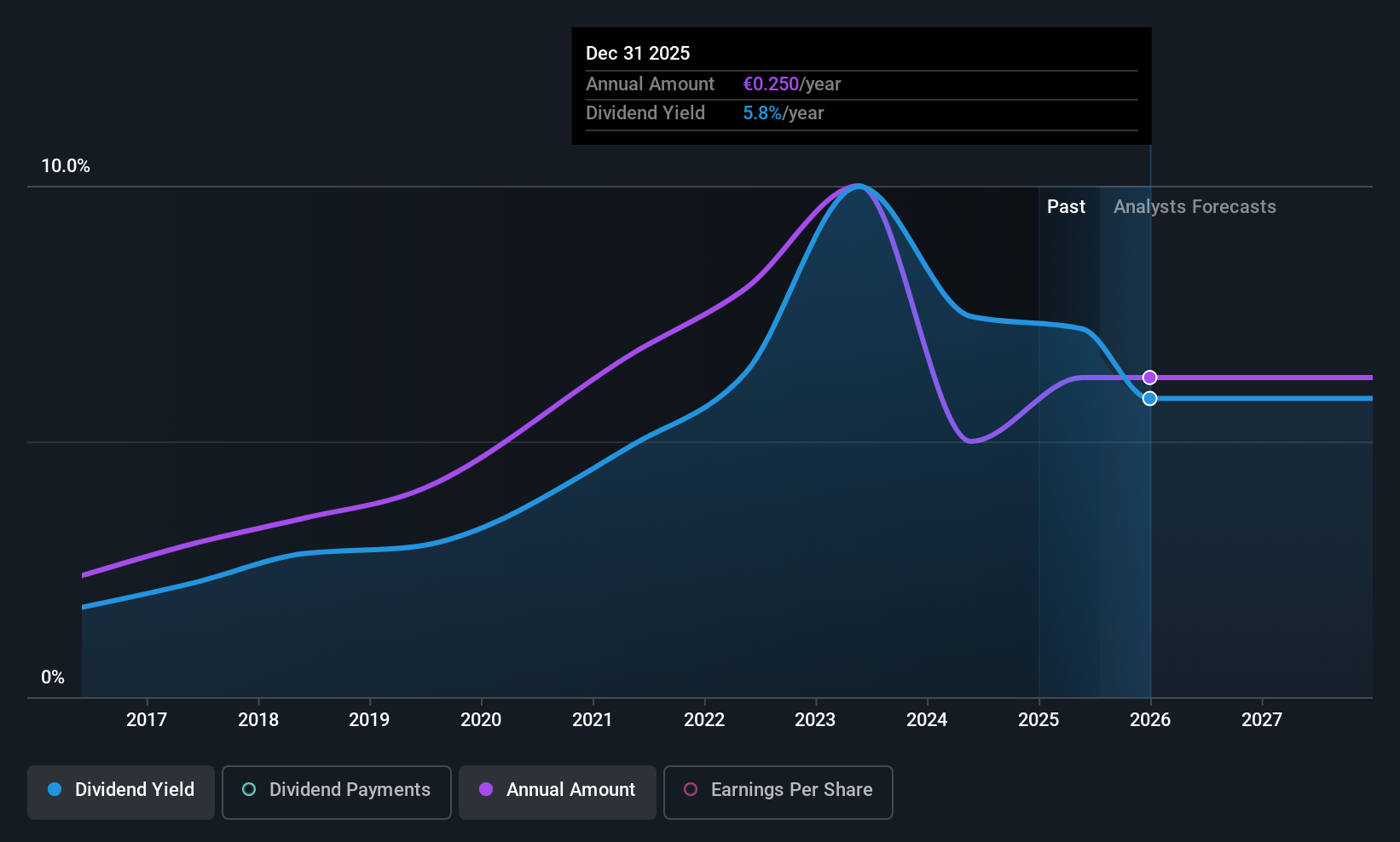

High (ENXTPA:HCO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: High Co. SA offers consumer engagement chain solutions in France, Belgium, and Spain with a market cap of €86.27 million.

Operations: High Co. SA generates revenue from its advertising segment, amounting to €146.38 million.

Dividend Yield: 5.7%

HCO's dividend yield is among the top 25% in France, reflecting its appeal to income-focused investors. Despite a volatile dividend history with occasional sharp drops, recent payments are well-covered by both earnings and cash flows, boasting a payout ratio of 63.5% and a cash payout ratio of 20.4%. However, with earnings expected to decline significantly in the coming years, sustainability concerns could arise if economic conditions worsen or financial performance deteriorates further.

- Click here to discover the nuances of High with our detailed analytical dividend report.

- Our valuation report here indicates High may be undervalued.

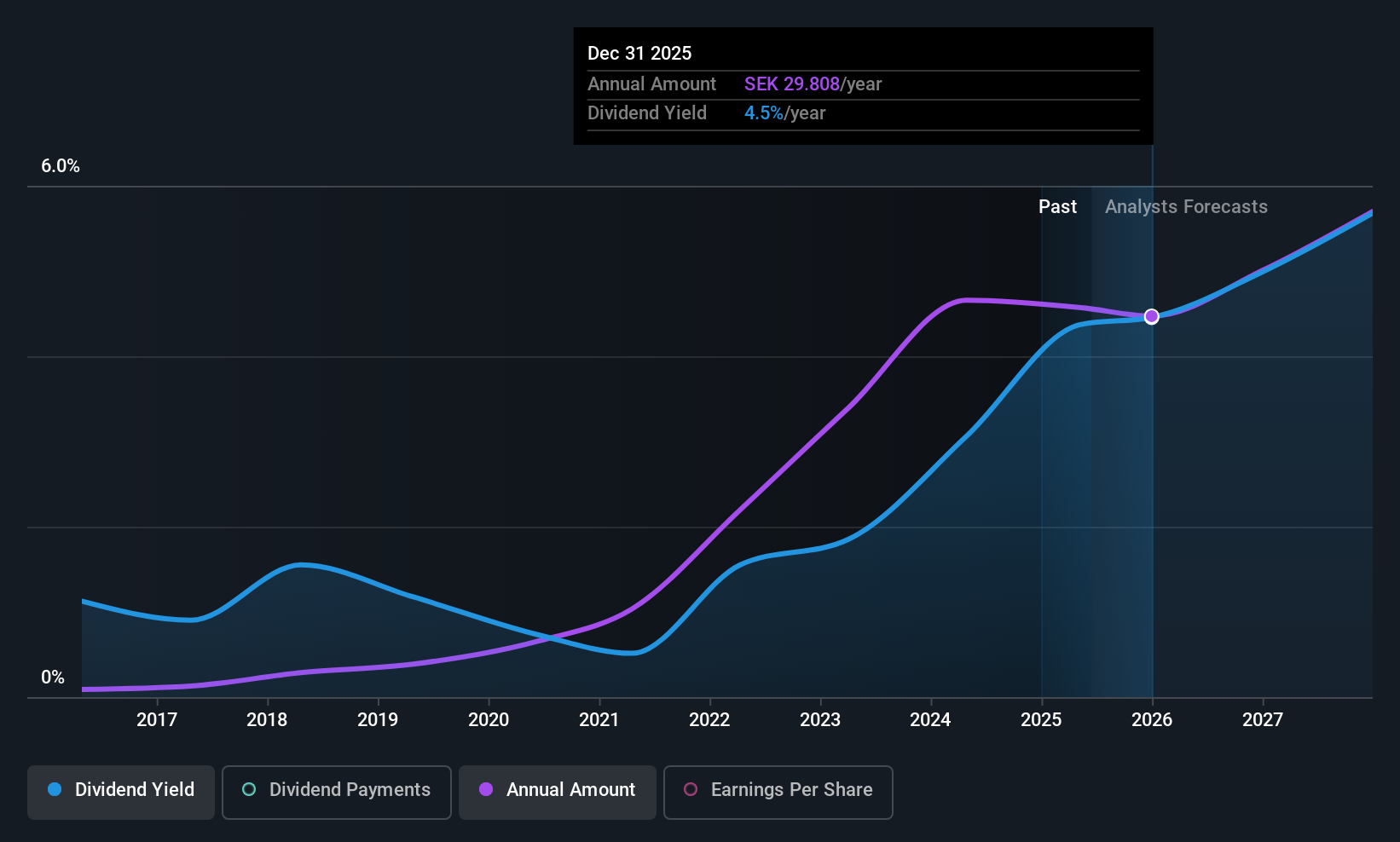

Evolution (OM:EVO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evolution AB (publ) develops, produces, markets, and licenses online casino systems to gaming operators globally and has a market cap of approximately SEK168.76 billion.

Operations: Evolution AB (publ) generates revenue primarily through the development, production, marketing, and licensing of online casino systems to gaming operators across various regions including Europe, Asia, North America, and Latin America.

Dividend Yield: 3.8%

Evolution's dividend yield ranks in the top 25% of Swedish payers, with a payout ratio of 47.4% and cash payout ratio of 46.3%, indicating strong coverage by earnings and cash flows. Although dividends have been stable and growing, Evolution has only paid them for nine years. Recent earnings reports show modest revenue growth but a slight decline in net income, which could impact future dividend sustainability if not addressed through strategic initiatives like their recent partnerships and share buyback program.

- Take a closer look at Evolution's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Evolution is trading behind its estimated value.

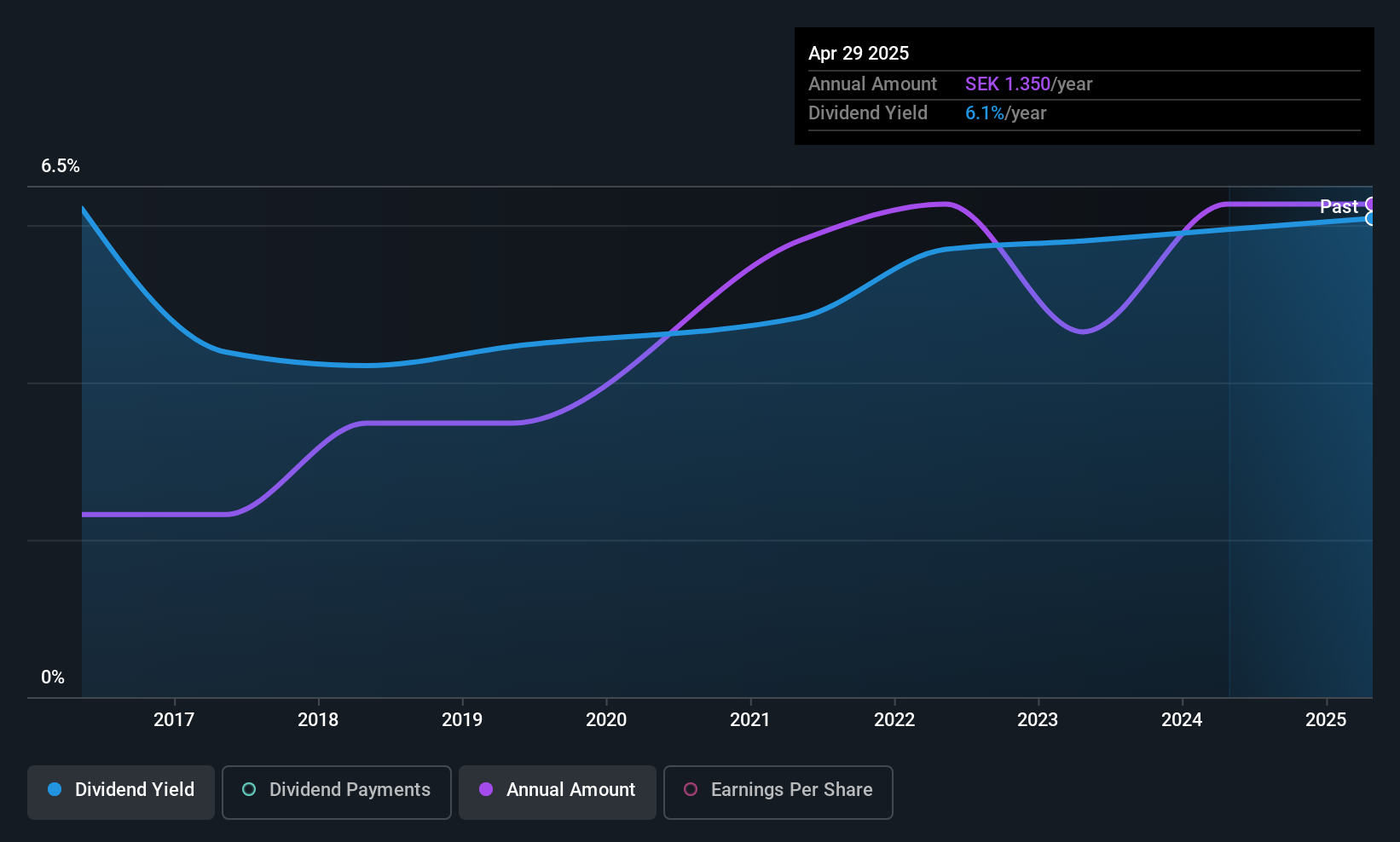

Softronic (OM:SOF B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Softronic AB (publ) offers IT and management services in Sweden with a market capitalization of approximately SEK1.27 billion.

Operations: Softronic AB (publ) generates revenue of SEK847.54 million from its computer services segment in Sweden.

Dividend Yield: 5.6%

Softronic's dividend yield is among the top 25% in Sweden, with a payout ratio of 88.6% and cash payout ratio of 58.2%, suggesting coverage by earnings and cash flows despite past volatility. Dividends have increased over the last decade, yet their stability remains questionable due to historical unreliability. Recent earnings show slight sales growth to SEK 235.2 million but a decline in net income, potentially affecting future dividend consistency if not managed effectively.

- Navigate through the intricacies of Softronic with our comprehensive dividend report here.

- Our expertly prepared valuation report Softronic implies its share price may be lower than expected.

Make It Happen

- Embark on your investment journey to our 225 Top European Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if High might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HCO

High

Provides consumer engagement chain solutions in France, Belgium, and Spain.

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)