Analyst Estimates: Here's What Brokers Think Of Fortnox AB (publ) (STO:FNOX) After Its Yearly Report

Last week, you might have seen that Fortnox AB (publ) (STO:FNOX) released its full-year result to the market. The early response was not positive, with shares down 3.8% to kr75.20 in the past week. The result was positive overall - although revenues of kr2.0b were in line with what the analysts predicted, Fortnox surprised by delivering a statutory profit of kr1.16 per share, modestly greater than expected. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for Fortnox

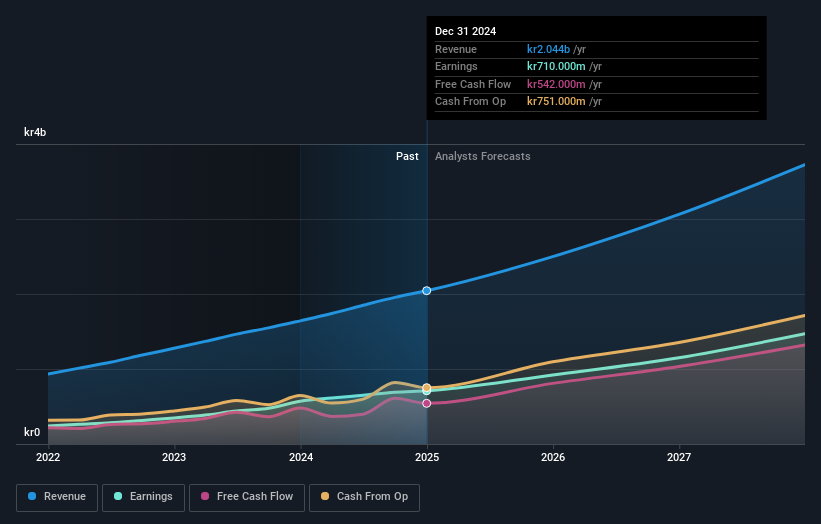

Taking into account the latest results, the consensus forecast from Fortnox's seven analysts is for revenues of kr2.50b in 2025. This reflects a major 22% improvement in revenue compared to the last 12 months. Per-share earnings are expected to soar 30% to kr1.51. Before this earnings report, the analysts had been forecasting revenues of kr2.49b and earnings per share (EPS) of kr1.48 in 2025. The analysts seems to have become more bullish on the business, judging by their new earnings per share estimates.

The consensus price target was unchanged at kr77.11, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Fortnox analyst has a price target of kr95.00 per share, while the most pessimistic values it at kr40.00. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The period to the end of 2025 brings more of the same, according to the analysts, with revenue forecast to display 22% growth on an annualised basis. That is in line with its 27% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 15% per year. So although Fortnox is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Fortnox's earnings potential next year. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Fortnox analysts - going out to 2027, and you can see them free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:FNOX

Fortnox

Provides smart technical products, packages, services, and integrations for financial and administration applications in small and medium sized businesses, accounting firms, and organizations in Sweden.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.