We're Hopeful That Fastout Int (NGM:FOUT) Will Use Its Cash Wisely

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Fastout Int (NGM:FOUT) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business's cash, relative to its cash burn.

See our latest analysis for Fastout Int

How Long Is Fastout Int's Cash Runway?

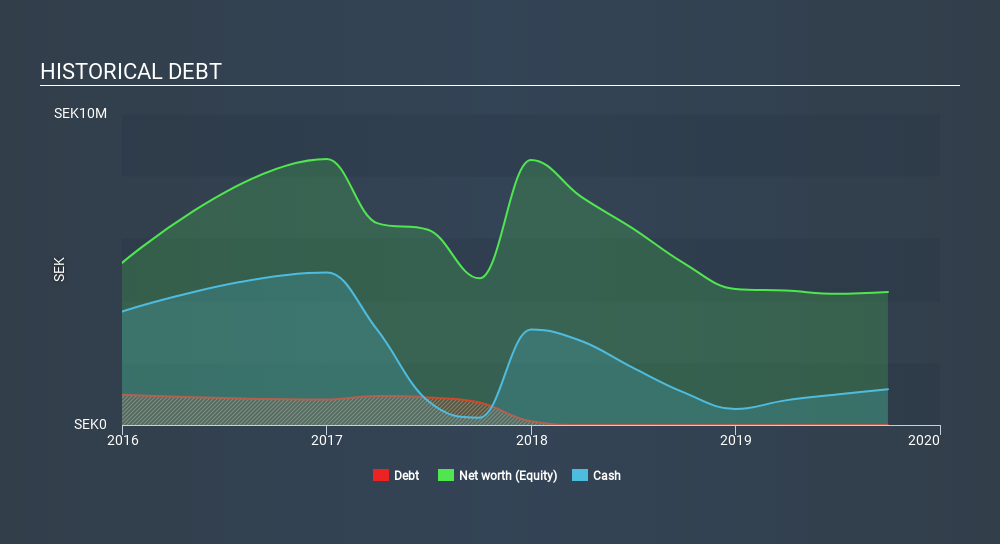

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In September 2019, Fastout Int had kr1.2m in cash, and was debt-free. Importantly, its cash burn was kr887k over the trailing twelve months. So it had a cash runway of approximately 16 months from September 2019. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. You can see how its cash balance has changed over time in the image below.

How Is Fastout Int's Cash Burn Changing Over Time?

In our view, Fastout Int doesn't yet produce significant amounts of operating revenue, since it reported just kr7.0m in the last twelve months. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. The 78% reduction in its cash burn over the last twelve months may be good for protecting the balance sheet but it hardly points to imminent growth. Fastout Int makes us a little nervous due to its lack of substantial operating revenue. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

Can Fastout Int Raise More Cash Easily?

While we're comforted by the recent reduction evident from our analysis of Fastout Int's cash burn, it is still worth considering how easily the company could raise more funds, if it wanted to accelerate spending to drive growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Fastout Int has a market capitalisation of kr22m and burnt through kr887k last year, which is 4.1% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Fastout Int's Cash Burn Situation?

Fastout Int appears to be in pretty good health when it comes to its cash burn situation. One the one hand we have its solid cash burn relative to its market cap, while on the other it can also boast very strong cash burn reduction. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. While we always like to monitor cash burn for early stage companies, qualitative factors such as the CEO pay can also shed light on the situation. Click here to see free what the Fastout Int CEO is paid..

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NGM:HOLDFL

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)