Here's Why We're Watching Eyeonid Group's (NGM:EOID) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Eyeonid Group (NGM:EOID) shareholders is whether they should be concerned by its rate of cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

Check out our latest analysis for Eyeonid Group

When Might Eyeonid Group Run Out Of Money?

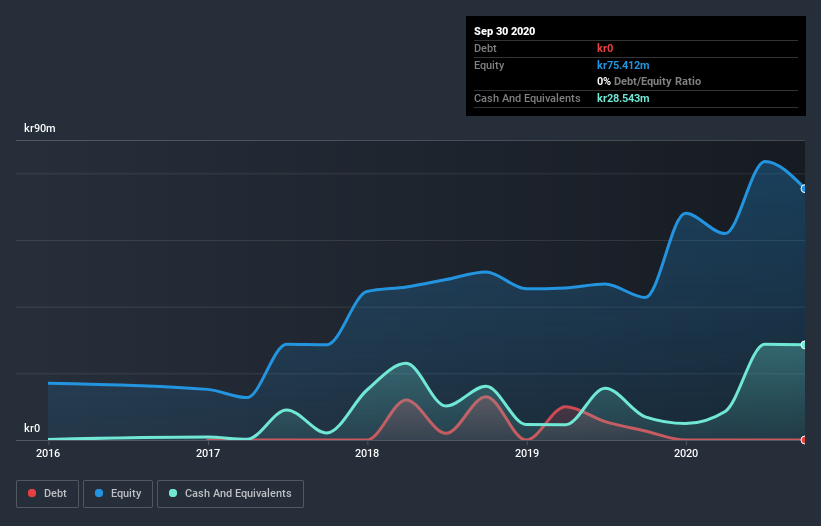

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In September 2020, Eyeonid Group had kr29m in cash, and was debt-free. In the last year, its cash burn was kr35m. So it had a cash runway of approximately 10 months from September 2020. To be frank, this kind of short runway puts us on edge, as it indicates the company must reduce its cash burn significantly, or else raise cash imminently. You can see how its cash balance has changed over time in the image below.

How Well Is Eyeonid Group Growing?

On balance, we think it's mildly positive that Eyeonid Group trimmed its cash burn by 4.8% over the last twelve months. Unfortunately, however, operating revenue declined by 17% during the period. In light of the data above, we're fairly sanguine about the business growth trajectory. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Eyeonid Group has developed its business over time by checking this visualization of its revenue and earnings history.

Can Eyeonid Group Raise More Cash Easily?

Given Eyeonid Group's revenue is receding, there's a considerable chance it will eventually need to raise more money to spend on driving growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Eyeonid Group's cash burn of kr35m is about 21% of its kr171m market capitalisation. That's fairly notable cash burn, so if the company had to sell shares to cover the cost of another year's operations, shareholders would suffer some costly dilution.

Is Eyeonid Group's Cash Burn A Worry?

On this analysis of Eyeonid Group's cash burn, we think its cash burn reduction was reassuring, while its cash runway has us a bit worried. Summing up, we think the Eyeonid Group's cash burn is a risk, based on the factors we mentioned in this article. On another note, Eyeonid Group has 5 warning signs (and 2 which can't be ignored) we think you should know about.

Of course Eyeonid Group may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Eyeonid Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eye World might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:EYEW

Eye World

Develops software-as-a-service platform that offers identity protection solutions in Sweden and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026