- Sweden

- /

- Metals and Mining

- /

- OM:GRNG

Undiscovered European Stock Gems To Explore In April 2025

Reviewed by Simply Wall St

Amid escalating trade tensions and heightened market volatility, European equities have experienced a turbulent period, with the STOXX Europe 600 Index recently closing 1.92% lower. Despite these challenges, opportunities may exist in lesser-known stocks that demonstrate resilience and potential for growth even in uncertain economic climates.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Gränges (OM:GRNG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gränges AB (publ) is involved in the development, production, and distribution of rolled aluminum products for various applications across Asia Pacific, Europe, and the Americas, with a market cap of approximately SEK11.87 billion.

Operations: Gränges AB generates revenue primarily from its Gränges Eurasia and Gränges Americas segments, contributing SEK13.08 billion and SEK11.41 billion, respectively.

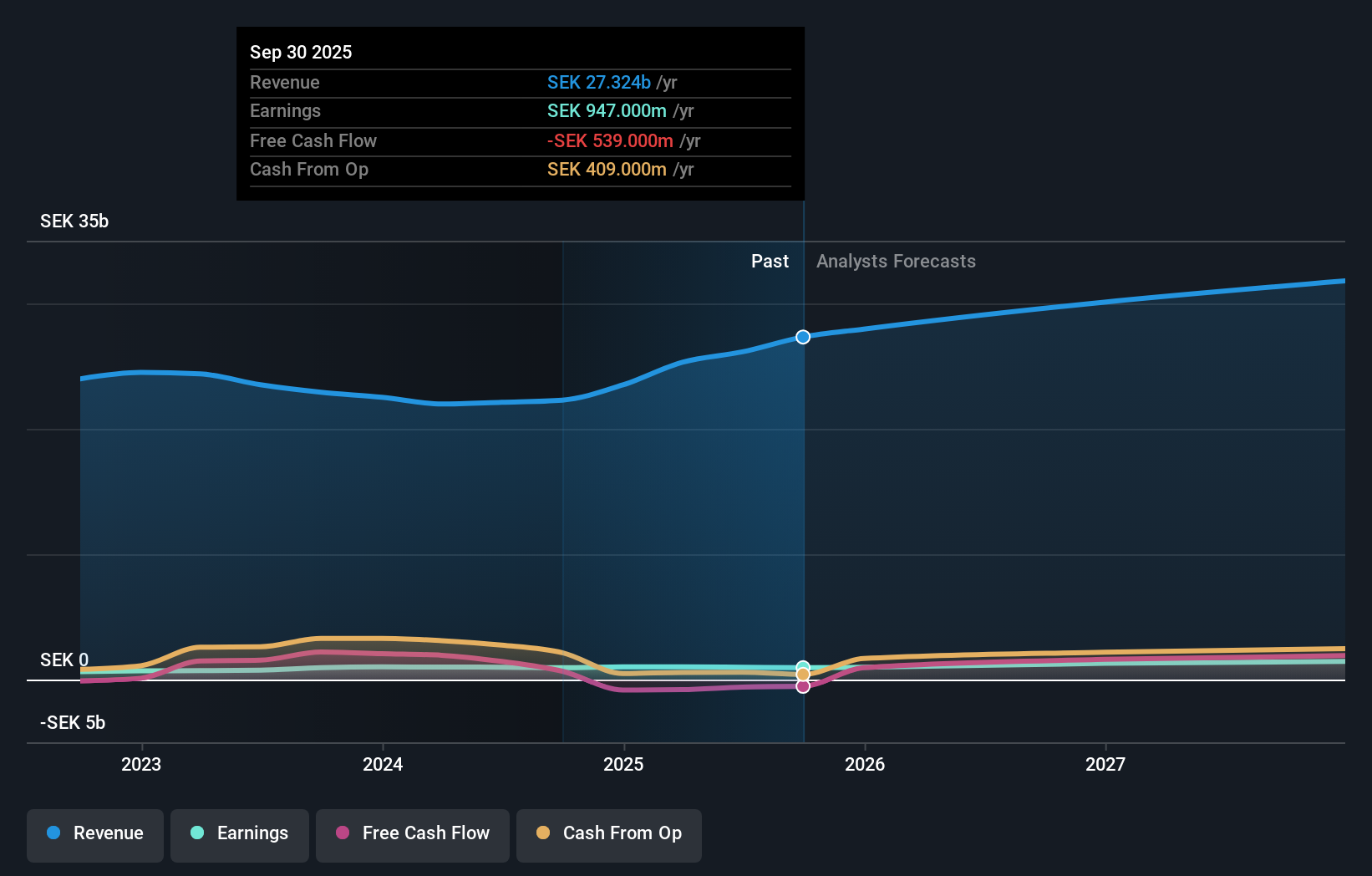

Gränges, a notable player in Europe's metals and mining sector, is making waves with its strategic moves. The recent acquisition of a factory in Shandong, China is expected to boost profitability and EPS by streamlining production. In the past year, earnings grew by 0.3%, outpacing the industry average of -4%. The company's debt to equity ratio improved significantly from 83.3% to 47.6% over five years, reflecting prudent financial management. Despite trading at 72% below estimated fair value and having high-quality earnings with EBIT covering interest payments 6.8 times over, free cash flow remains negative due to increased working capital demands from expansion efforts.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK 10.80 billion.

Operations: The company's revenue primarily comes from its operations in Sweden, contributing SEK 6.68 billion, followed by Norway with SEK 2.47 billion and other markets adding SEK 2.39 billion.

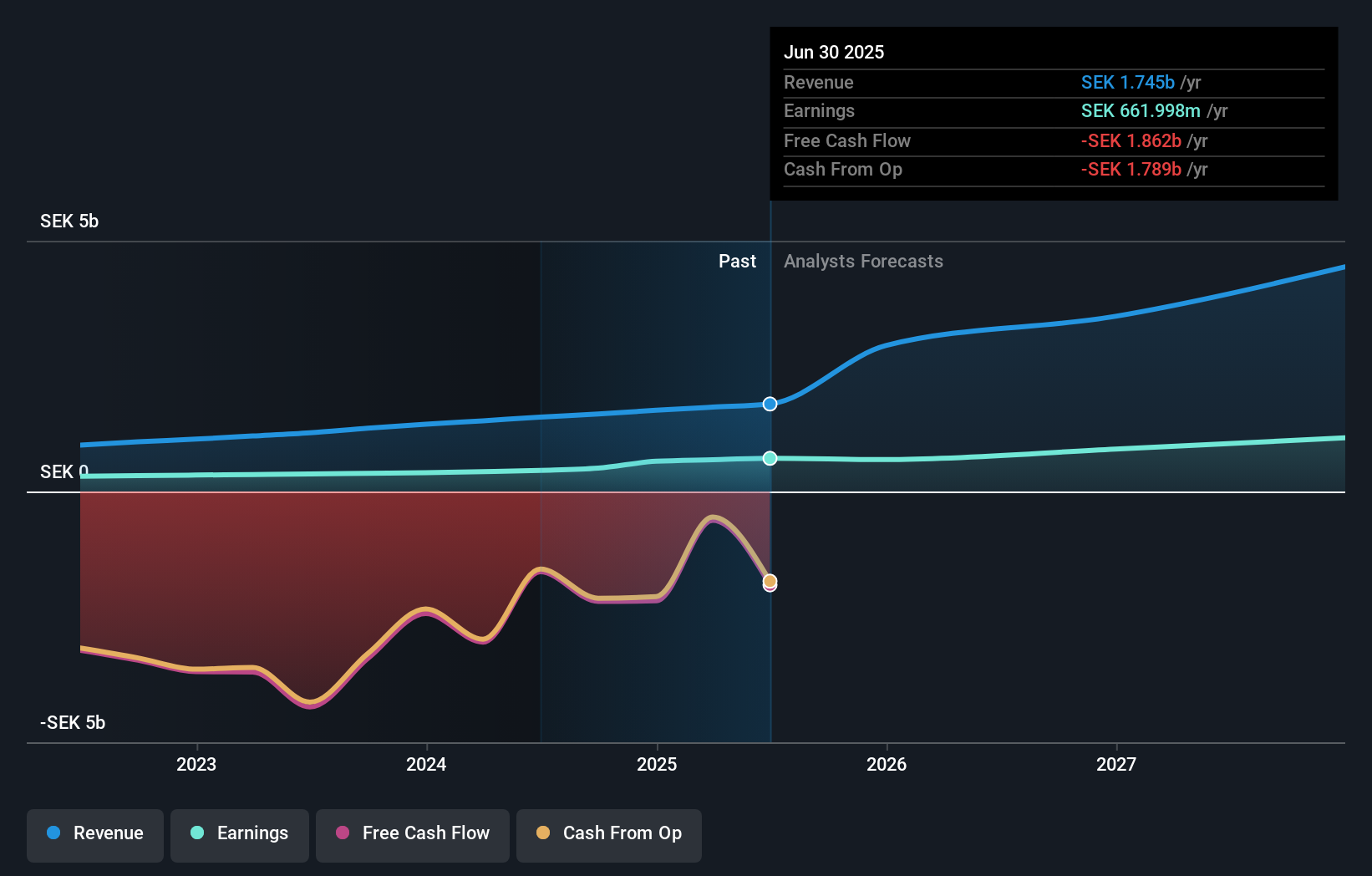

Rusta, an emerging player in the retail sector, is making strategic moves with plans to open 50 to 80 new stores, particularly targeting the German market. This expansion aligns with its recent earnings report showing a net income of SEK 257 million for Q3 2025, up from SEK 243 million last year. The company’s earnings per share also rose to SEK 1.7 from SEK 1.6 over the same period. Rusta's EBIT covers interest payments by a factor of 3.4x, indicating solid financial health and a satisfactory net debt-to-equity ratio of just under 3%. These factors position Rusta as a promising investment opportunity amid competitive pressures and potential market shifts.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★★★

Overview: TF Bank AB (publ) is a digital bank that offers consumer banking services and e-commerce solutions via its proprietary IT platform in Sweden, with a market cap of SEK 7.41 billion.

Operations: TF Bank generates revenue primarily from consumer banking services and e-commerce solutions. The company's financial performance is marked by a net profit margin of 26.5%, reflecting its operational efficiency in the digital banking sector.

With total assets of SEK25.1 billion and equity of SEK2.9 billion, TF Bank is a noteworthy player in the financial sector. The bank's deposits stand at SEK21 billion against loans of SEK20.3 billion, reflecting a robust balance sheet with 94% low-risk funding sources like customer deposits. It boasts an appropriate bad loan ratio of 1.3% and maintains a sufficient allowance for bad loans at 282%. Earnings surged by 59%, outpacing the industry average, while trading at nearly half its estimated fair value suggests potential undervaluation. Recent leadership changes and special dividends further highlight strategic positioning for growth.

- Click to explore a detailed breakdown of our findings in TF Bank's health report.

Evaluate TF Bank's historical performance by accessing our past performance report.

Next Steps

- Delve into our full catalog of 352 European Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Gränges, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:GRNG

Gränges

Engages in the development, production, and distribution of rolled aluminum products for thermal management systems, specialty packaging, and niche applications in Asia Pacific, Europe, and North and South Americas.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives