- Sweden

- /

- Capital Markets

- /

- OM:EQT

Top Swedish Growth Companies With High Insider Ownership September 2024

Reviewed by Simply Wall St

As the European market experiences a lift from the ECB's recent interest rate cut, Sweden's economy remains a focal point for investors seeking growth opportunities. In this favorable environment, high insider ownership in growth companies can be an indicator of strong confidence and potential stability. In this article, we will explore three top Swedish growth companies with significant insider ownership that stand out in September 2024.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| Biovica International (OM:BIOVIC B) | 17.5% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

We'll examine a selection from our screener results.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of approximately SEK416.42 billion.

Operations: The company's revenue segments include €37.20 million from Central, €878.70 million from Real Assets, and €1.28 billion from Private Capital.

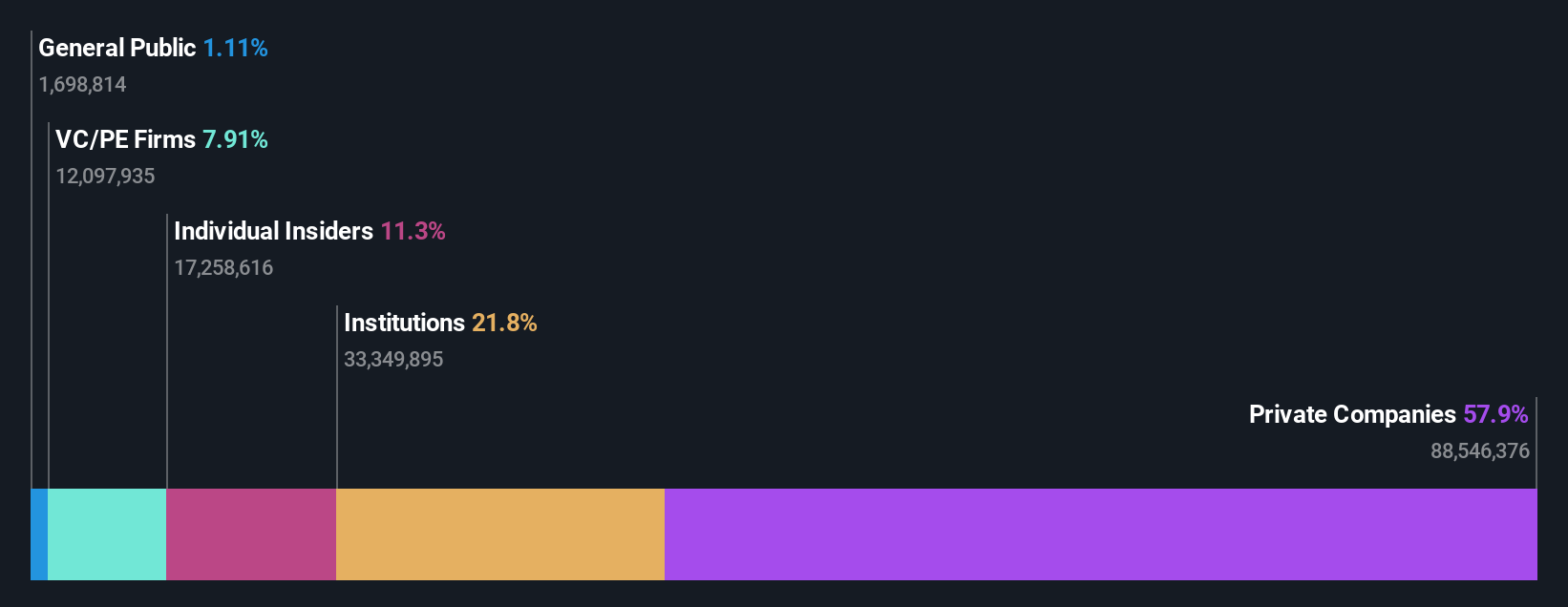

Insider Ownership: 30.9%

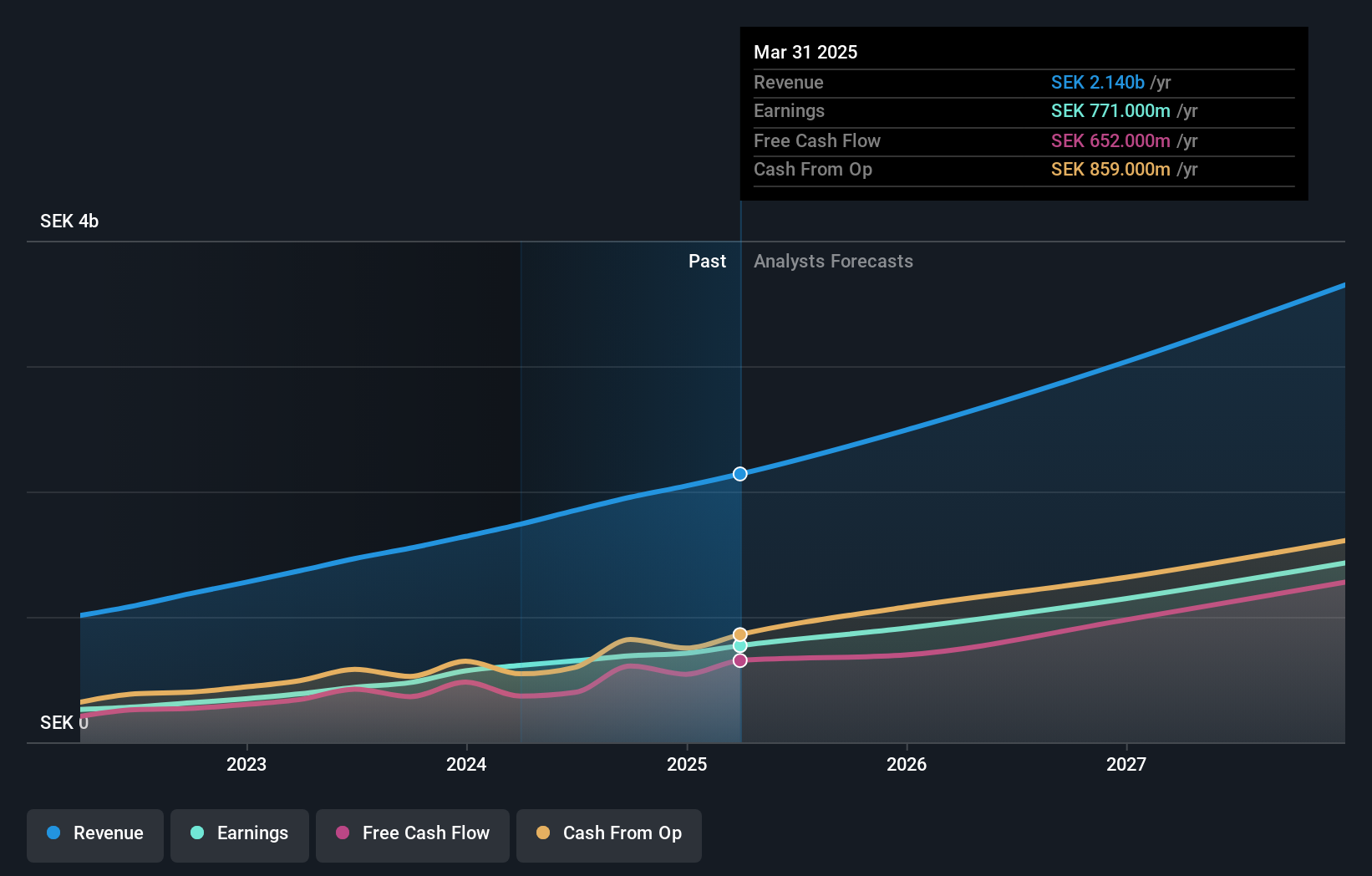

EQT AB (publ) demonstrates strong growth potential with forecasted revenue and earnings growth rates of 15.5% and 35.2% per year, respectively, outpacing the Swedish market averages. The company has seen significant insider buying in recent months, indicating confidence from those within the firm. Recent M&A activities include exploring a sale of its majority stake in Banking Circle for over $2 billion and bidding for Singapore Post Limited's $1 billion Australian business.

- Take a closer look at EQT's potential here in our earnings growth report.

- The valuation report we've compiled suggests that EQT's current price could be inflated.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Fortnox AB (publ) offers financial and administrative software solutions for small and medium-sized businesses, accounting firms, and organizations, with a market cap of SEK38.60 billion.

Operations: Revenue segments for Fortnox AB (publ) include Businesses (SEK378 million), Marketplaces (SEK160 million), Core Products (SEK734 million), Accounting Firms (SEK352 million), and Financial Services (SEK249 million).

Insider Ownership: 21.1%

Fortnox AB is experiencing robust growth with forecasted annual revenue and earnings increases of 20.2% and 22.6%, respectively, outpacing the Swedish market. Insider activity has been positive, with substantial buying over the past three months and no significant selling. The stock trades at 19.1% below its estimated fair value, suggesting potential upside. Recent earnings reports show strong performance, with Q2 sales of SEK 515 million and net income of SEK 164 million, both up from last year.

- Navigate through the intricacies of Fortnox with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Fortnox's shares may be trading at a discount.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany with a market cap of SEK11.24 billion.

Operations: Rusta AB generates revenue from its operations in Sweden (SEK6.43 billion), Norway (SEK2.39 billion), and other markets (SEK2.41 billion).

Insider Ownership: 10.2%

Rusta AB has demonstrated solid growth, with Q1 2024 earnings showing a net income increase to SEK 231 million from SEK 189 million last year. The company continues its expansion, recently opening its 50th store in Norway and planning further openings. Insider activity has been positive with more shares bought than sold over the past three months. Rusta's revenue and earnings are forecasted to grow faster than the Swedish market, with annual profit growth expected at 21.5%.

- Dive into the specifics of Rusta here with our thorough growth forecast report.

- Our expertly prepared valuation report Rusta implies its share price may be too high.

Where To Now?

- Embark on your investment journey to our 91 Fast Growing Swedish Companies With High Insider Ownership selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity firm specializing in private capital and real asset segments.

Excellent balance sheet with reasonable growth potential.