Ratos And 2 Other Undiscovered Gems In Sweden Backed By Strong Fundamentals

Reviewed by Simply Wall St

In the midst of global economic uncertainties, including a notable drop in major indices and renewed fears about economic growth, investors are increasingly looking towards markets with strong fundamentals. Sweden's market offers promising opportunities, particularly within its small-cap segment. Identifying stocks with robust financial health and growth potential is crucial in such volatile times. This article highlights Ratos and two other undiscovered gems in Sweden that stand out due to their solid fundamentals and resilience amidst broader market turbulence.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Ratos (OM:RATO B)

Simply Wall St Value Rating: ★★★★☆☆

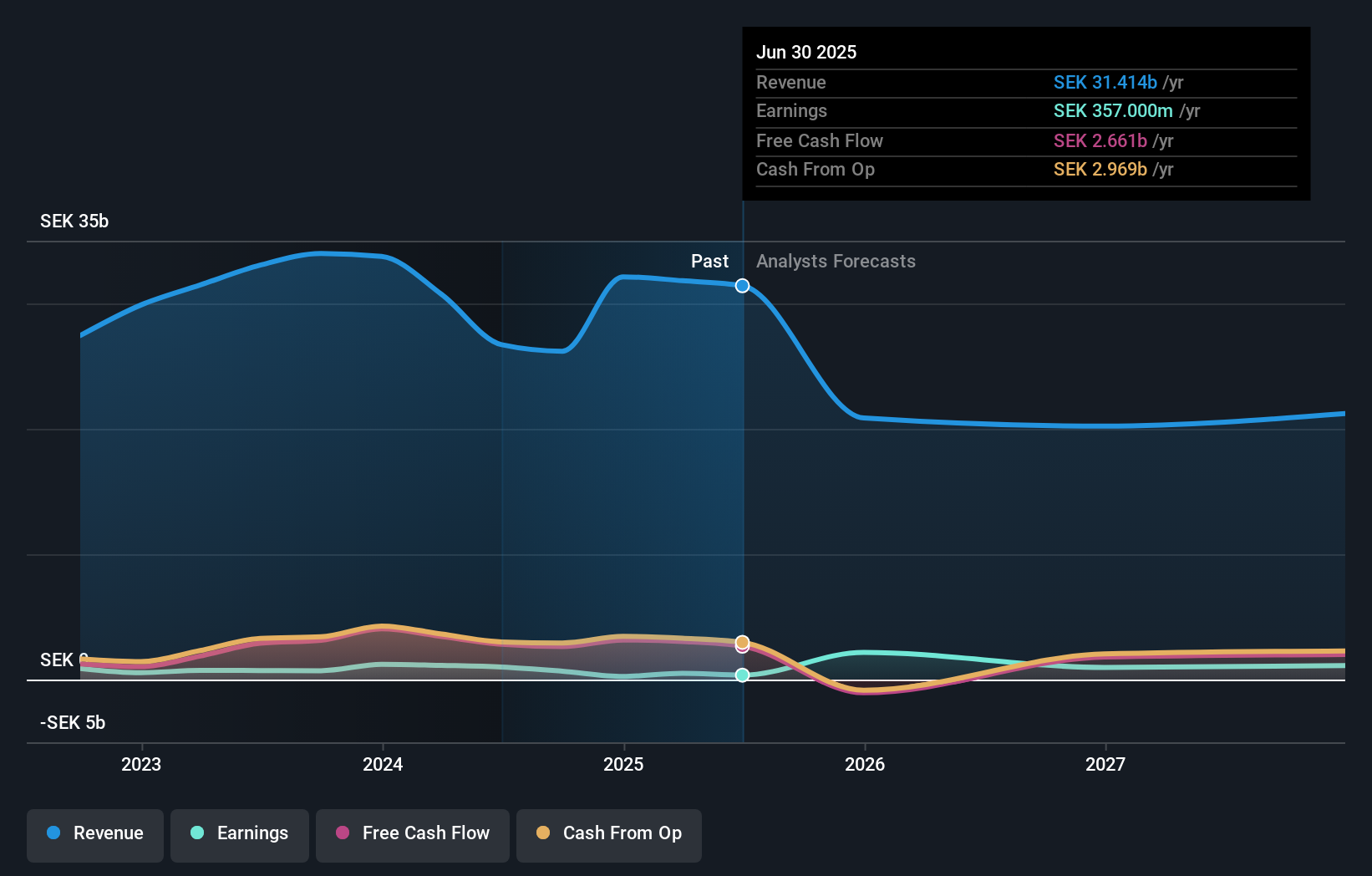

Overview: Ratos AB (publ) is a private equity firm specializing in buyouts, turnarounds, add-on acquisitions, and middle market transactions with a market cap of approximately SEK11.22 billion.

Operations: Ratos generates revenue primarily from its Consumer (SEK5.65 billion), Industry (SEK10.47 billion), and Construction & Services (SEK16.77 billion) segments, with a minor adjustment of SEK-20 million.

Ratos, a small cap Swedish investment company, has shown robust earnings growth of 34% annually over the past five years. Recently, Ratos reported net income of SEK 628 million for H1 2024 compared to SEK 558 million a year ago. The company's debt to equity ratio has been reduced from 56.6% to 33% over five years. Notably, SSEA Group secured four new contracts worth SEK 1.1 billion in Stockholm and Gothenburg regions, enhancing future prospects significantly.

- Click to explore a detailed breakdown of our findings in Ratos' health report.

Examine Ratos' past performance report to understand how it has performed in the past.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

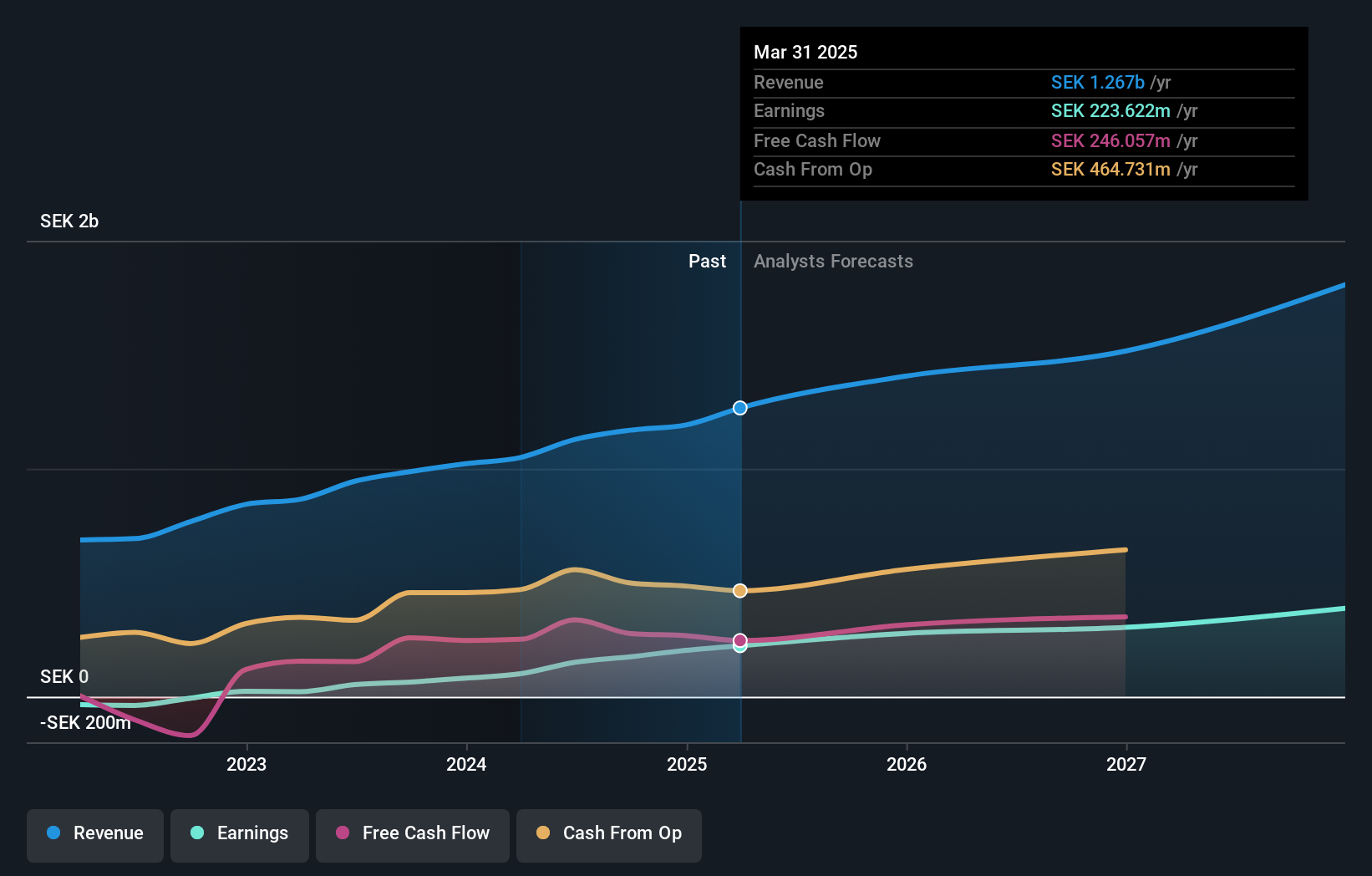

Overview: RaySearch Laboratories AB (publ) is a medical technology company that provides software solutions for cancer care across various global regions, with a market cap of SEK5.64 billion.

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, which brought in SEK1.13 billion. The company's financial performance is influenced by its cost structure and market presence across multiple global regions.

RaySearch Laboratories has demonstrated impressive growth, with earnings increasing by 187% over the past year, significantly outpacing the Healthcare Services industry. The company is debt-free, which is a notable improvement from five years ago when its debt to equity ratio was 1.8%. Recent achievements include a successful patient treatment using RayCare and TrueBeam at Iridium Network and securing an order for RayCare from Connecticut Proton Therapy Center. Additionally, Q2 2024 sales reached SEK 318.87 million, up from SEK 239.47 million last year.

- Unlock comprehensive insights into our analysis of RaySearch Laboratories stock in this health report.

Evaluate RaySearch Laboratories' historical performance by accessing our past performance report.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

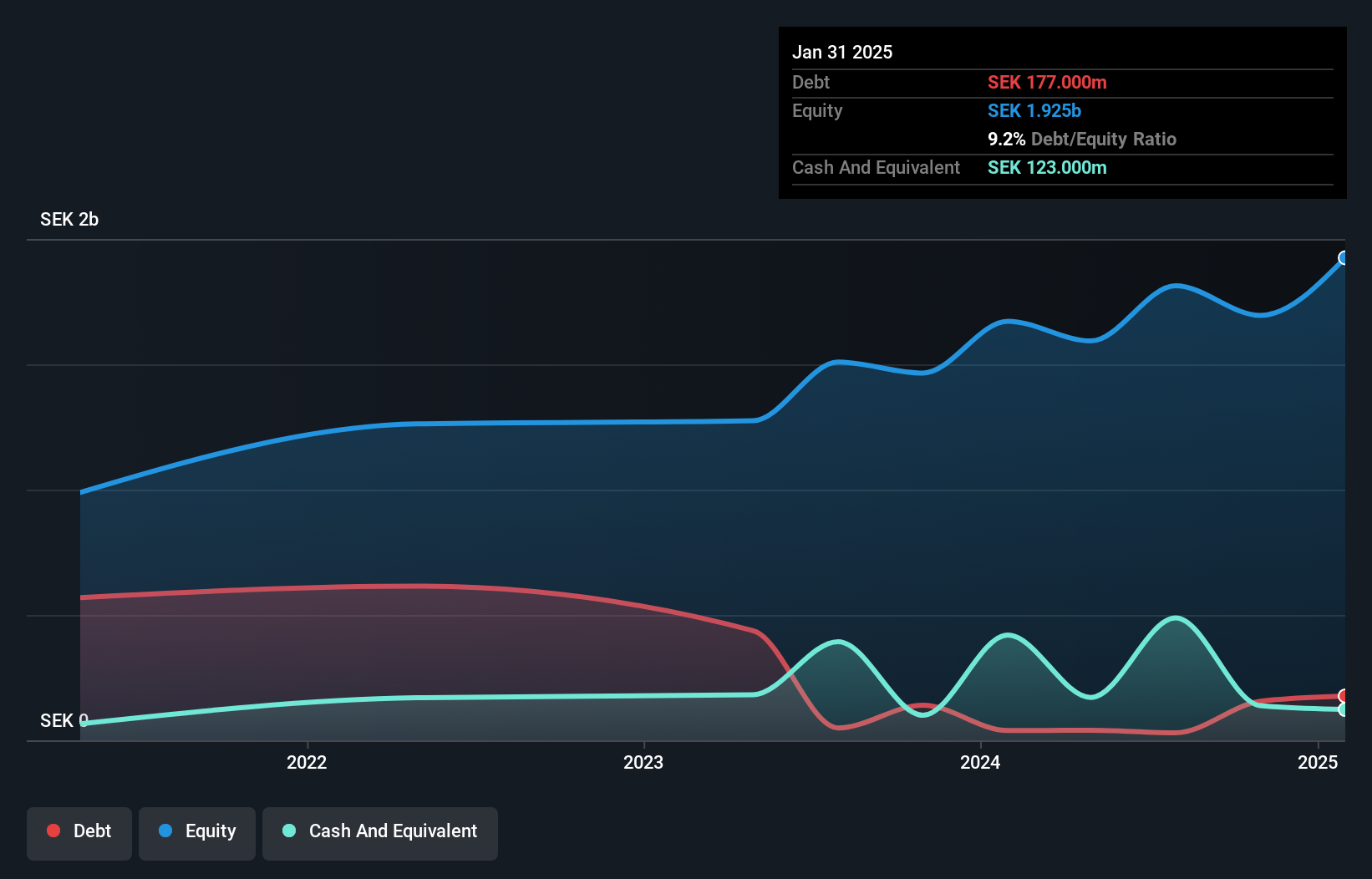

Overview: Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany with a market cap of SEK11.29 billion.

Operations: Rusta AB (publ) generates revenue primarily from Sweden (SEK 6.38 billion), Norway (SEK 2.35 billion), and other markets including Finland and Germany (SEK 2.39 billion).

Rusta has shown impressive earnings growth of 56.3% over the past year, significantly outperforming the Multiline Retail industry, which saw a -5% change. The company’s interest payments are well covered by EBIT at 3.3x, indicating strong financial health. Recently, Rusta reported Q1 sales of SEK 3.07 billion compared to SEK 2.96 billion last year and net income increased to SEK 231 million from SEK 189 million a year ago.

Taking Advantage

- Navigate through the entire inventory of 54 Swedish Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany.

High growth potential with solid track record.