As global markets grapple with geopolitical tensions and economic shifts, the European market has seen cautious investor sentiment, particularly influenced by conflicts in the Middle East. Despite these challenges, Sweden continues to offer promising investment opportunities, especially in growth companies with strong insider ownership—a factor often associated with aligned interests and long-term potential.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Yubico (OM:YUBICO) | 37.5% | 42.2% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

We're going to check out a few of the best picks from our screener tool.

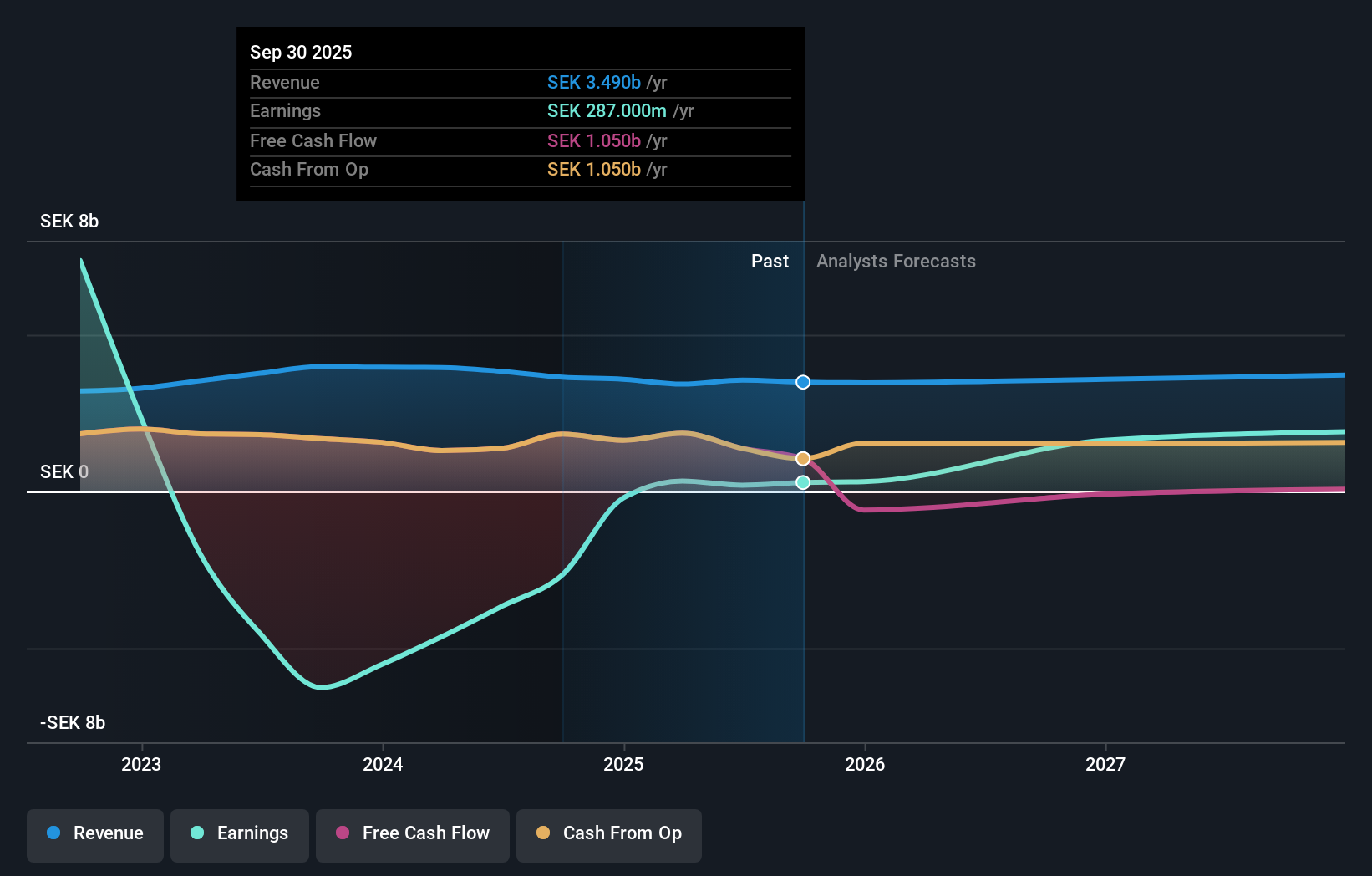

Fabege (OM:FABG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fabege AB (publ) is a property company that specializes in the development, investment, and management of commercial premises in Sweden, with a market cap of SEK30.22 billion.

Operations: The company's revenue segments include SEK3.13 billion from Management, SEK420 million from Birgers Residence, SEK244 million from Refinement, and SEK36 million from Project activities.

Insider Ownership: 26%

Fabege shows a mixed outlook as a growth company with high insider ownership. Insiders have been net buyers over the past three months, though the volumes aren't substantial. The company's earnings are forecast to grow significantly at 96.39% per year, becoming profitable in three years—ahead of average market growth. However, revenue growth is modest at 1.5% annually and interest payments are not well covered by earnings, posing potential financial challenges.

- Get an in-depth perspective on Fabege's performance by reading our analyst estimates report here.

- Our valuation report here indicates Fabege may be overvalued.

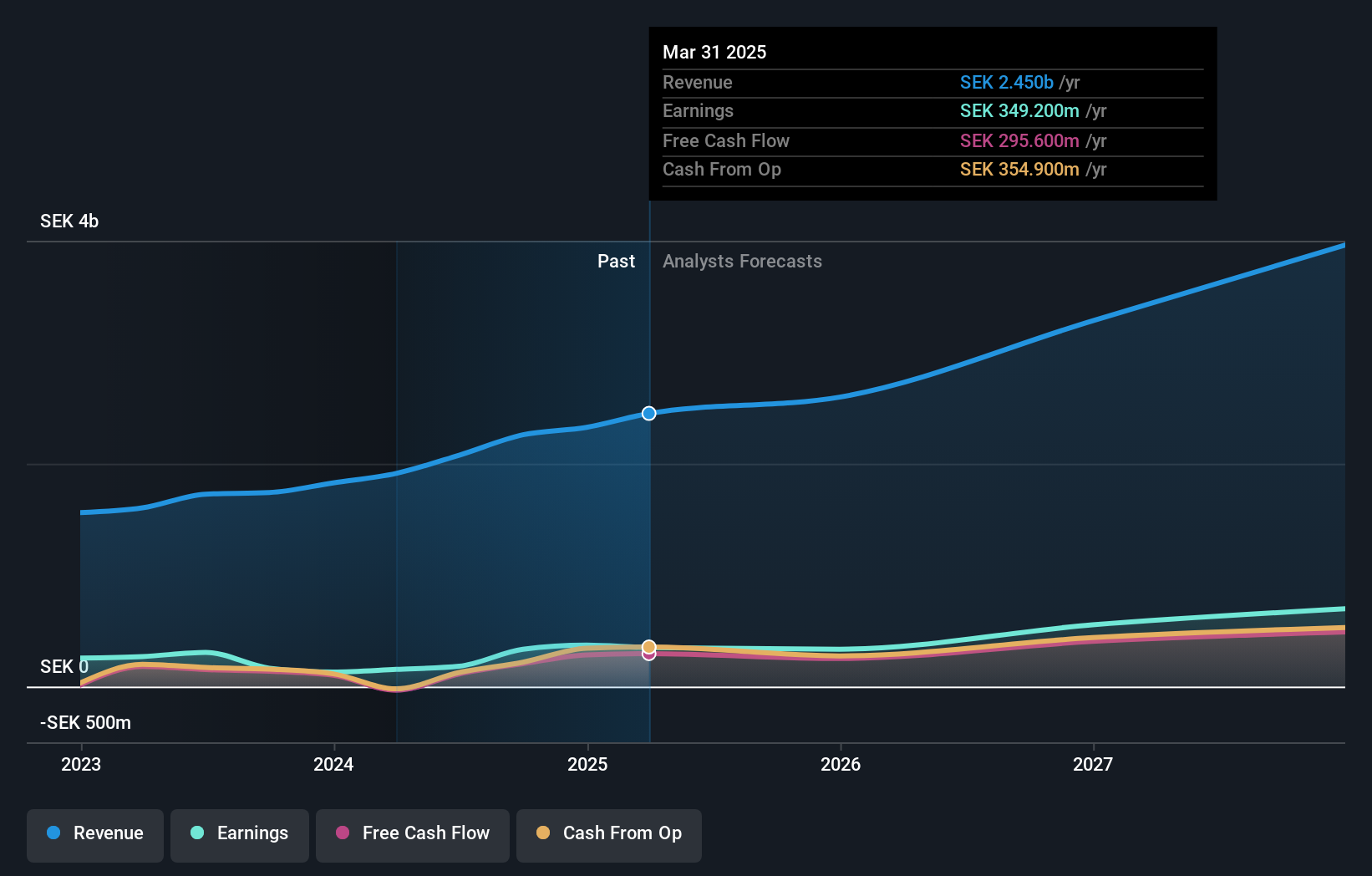

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK12.67 billion.

Operations: The company's revenue segments consist of SEK2.39 billion from Norway, SEK6.43 billion from Sweden, and SEK2.41 billion from other markets.

Insider Ownership: 10.2%

Rusta's growth trajectory is underscored by its aggressive expansion strategy, recently opening new stores in Sweden and Norway. The company's earnings are forecast to grow significantly at 21.5% annually, outpacing the Swedish market average. Revenue is also expected to rise faster than the market at 9% per year. Rusta trades considerably below its estimated fair value, offering potential upside for investors. Insider ownership remains stable without recent substantial trading activity.

- Click here to discover the nuances of Rusta with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Rusta is priced higher than what may be justified by its financials.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK23.04 billion.

Operations: The company's revenue segment is comprised of Security Software & Services, generating SEK2.09 billion.

Insider Ownership: 37.5%

Yubico's growth prospects are robust, with earnings expected to grow significantly at 42.2% annually, outpacing the Swedish market. Revenue is forecasted to rise by 20.5% per year, surpassing market averages. Despite recent volatility in share price and a decline in profit margins from 17.8% to 9.3%, Yubico remains a key player in cybersecurity with its YubiKey technology gaining traction globally, highlighted by partnerships like PKO Bank Polski for secure authentication solutions.

- Dive into the specifics of Yubico here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Yubico is trading beyond its estimated value.

Key Takeaways

- Discover the full array of 78 Fast Growing Swedish Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany.

High growth potential with solid track record.