As global markets navigate the complexities of geopolitical tensions and economic shifts, European indices have seen a downturn, with the pan-European STOXX Europe 600 Index ending 1.80% lower amid escalating Middle East conflicts. In this environment, investors are increasingly looking towards growth companies with high insider ownership as these stocks can offer unique insights into management confidence and potential resilience in volatile markets.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Biovica International (OM:BIOVIC B) | 18.3% | 78.5% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

| OrganoClick (OM:ORGC) | 23.1% | 109.0% |

Let's dive into some prime choices out of the screener.

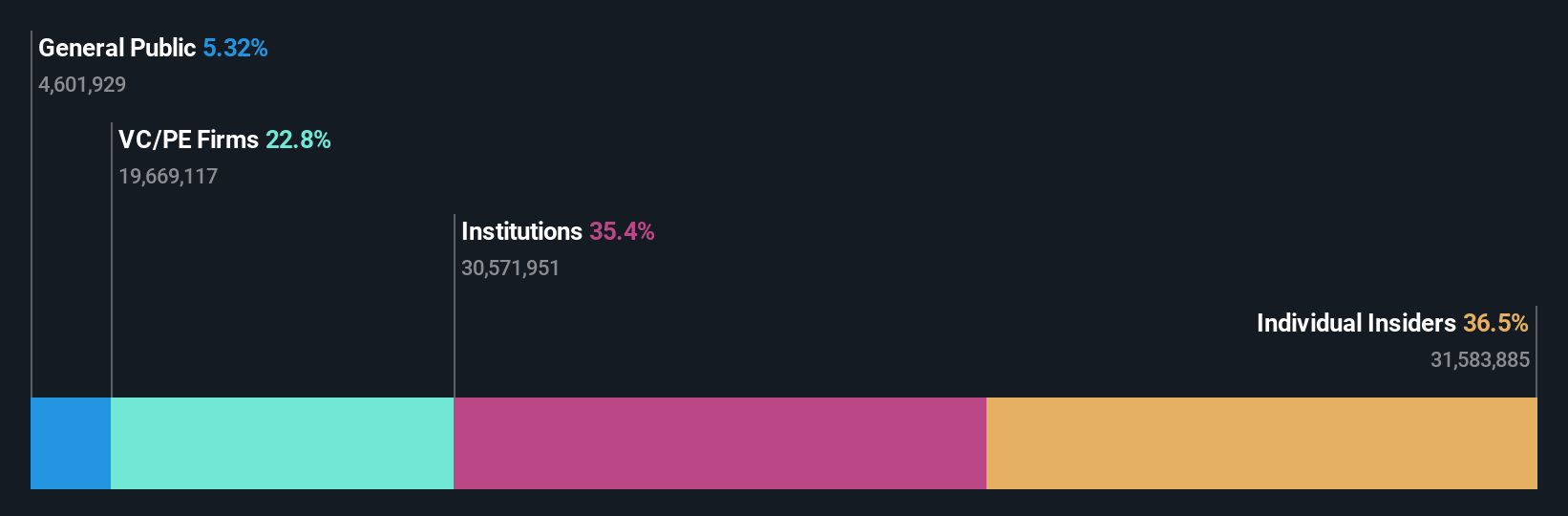

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK12.40 billion.

Operations: Rusta's revenue is primarily derived from its operations in Sweden (SEK6.43 billion), Norway (SEK2.39 billion), and other markets including Finland and Germany (SEK2.41 billion).

Insider Ownership: 10.2%

Earnings Growth Forecast: 21.5% p.a.

Rusta demonstrates strong growth potential with earnings forecast to grow significantly at 21.5% annually, surpassing the Swedish market's average. The company is trading well below its estimated fair value and has no recent insider trading activity. Recent expansions, including new stores in Sweden and Norway, align with its strategic growth focus. Rusta reported Q1 sales of SEK 3.07 billion, reflecting steady revenue growth despite a slower pace than earnings expansion.

- Unlock comprehensive insights into our analysis of Rusta stock in this growth report.

- Upon reviewing our latest valuation report, Rusta's share price might be too optimistic.

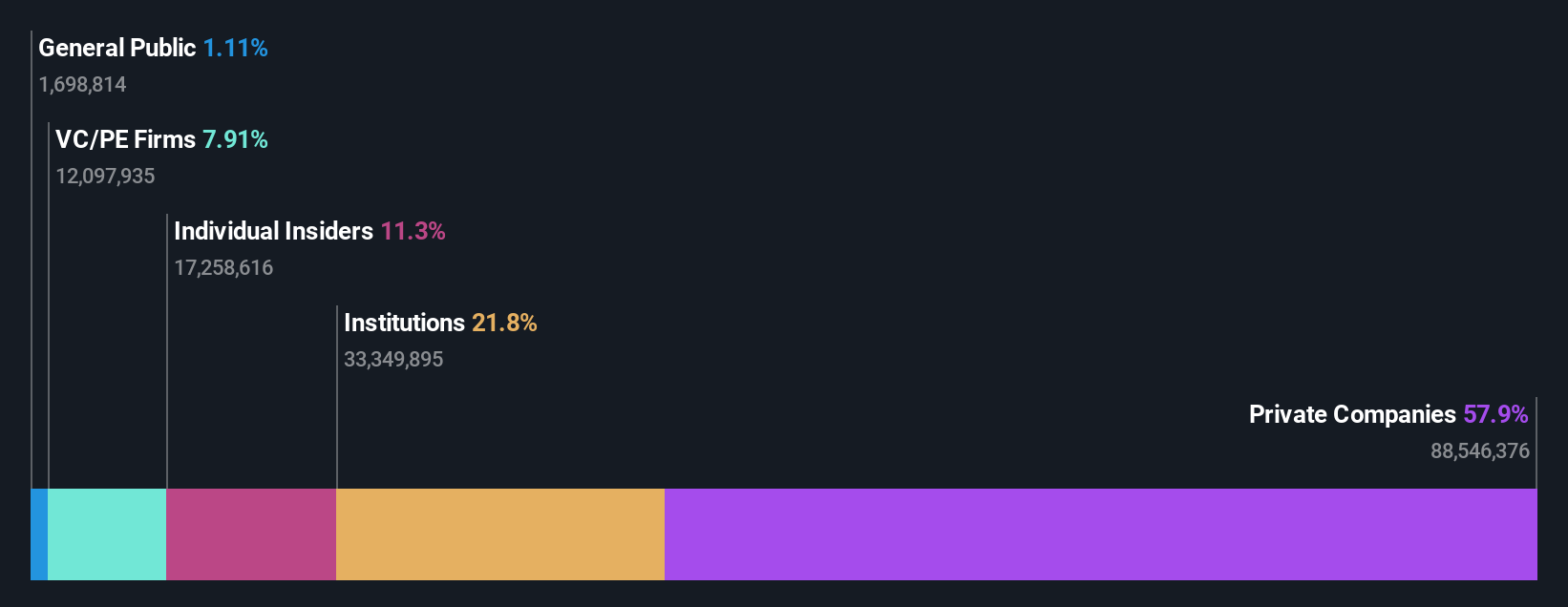

Truecaller (OM:TRUE B)

Simply Wall St Growth Rating: ★★★★★★

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK13.79 billion.

Operations: The company's revenue primarily comes from its Communications Software segment, which generated SEK1.72 billion.

Insider Ownership: 29.6%

Earnings Growth Forecast: 21.6% p.a.

Truecaller is poised for growth with forecasted annual earnings and revenue increases of 21.6% and 20.3%, respectively, outpacing the Swedish market. Despite a decline in recent sales, it trades at a significant discount to its fair value, indicating potential upside. Recent strategic moves include appointing Seema Jindal to enhance regulatory affairs in India and partnering with Halan to improve communication security, boosting Truecaller's business profile globally without substantial insider selling activity recently.

- Dive into the specifics of Truecaller here with our thorough growth forecast report.

- Our valuation report unveils the possibility Truecaller's shares may be trading at a discount.

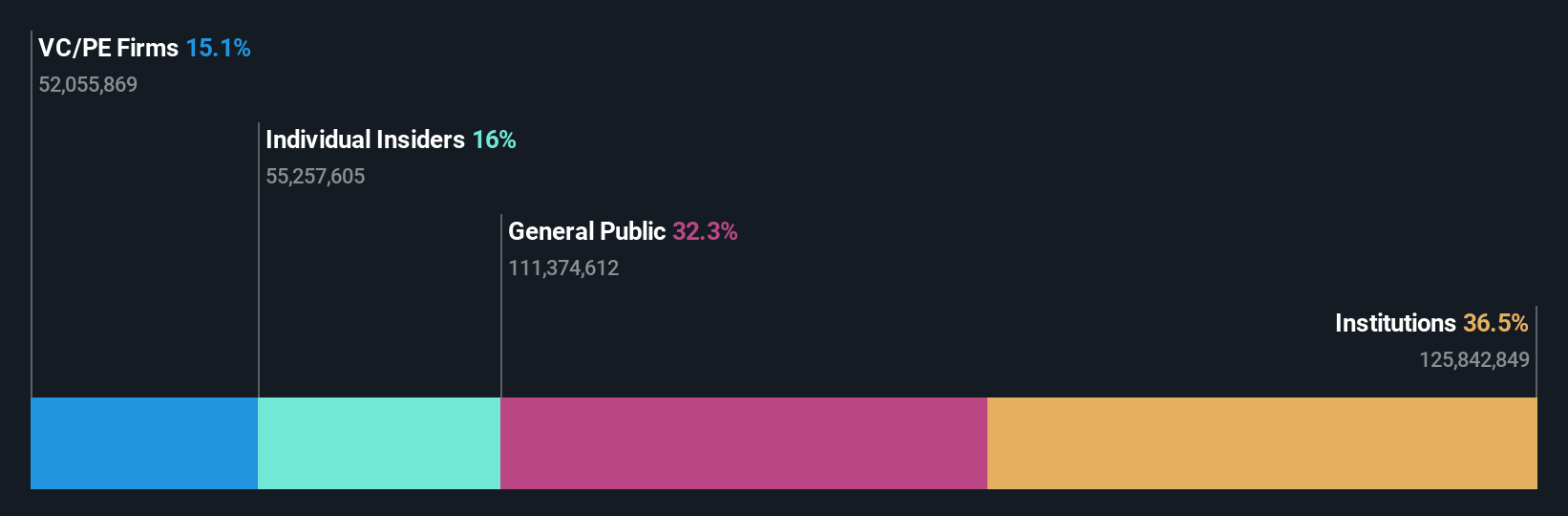

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK23.16 billion.

Operations: The company generates revenue of SEK2.09 billion from its Security Software & Services segment.

Insider Ownership: 37.5%

Earnings Growth Forecast: 42.3% p.a.

Yubico is set for significant growth, with earnings forecasted to rise 42.3% annually, outpacing the Swedish market. Revenue is projected to grow at 20.5% per year, supported by recent partnerships like PKO Bank Polski's adoption of YubiKeys for secure authentication. Despite high volatility and a dip in profit margins from 17.8% to 9.3%, Yubico trades slightly below its estimated fair value and continues expanding its global security solutions footprint without recent insider trading activity noted.

- Get an in-depth perspective on Yubico's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Yubico is trading beyond its estimated value.

Taking Advantage

- Investigate our full lineup of 78 Fast Growing Swedish Companies With High Insider Ownership right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Truecaller might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:TRUE B

Truecaller

Develops and publishes mobile caller ID applications for individuals and business in India, the Middle East, Africa, and internationally.

Very undervalued with exceptional growth potential.