As global markets continue to navigate a landscape marked by rising inflation and volatile interest rates, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In such an environment, companies that exhibit high insider ownership often attract investor attention due to the potential alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Findi (ASX:FND) | 35.8% | 118.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

SungEel HiTech (KOSDAQ:A365340)

Simply Wall St Growth Rating: ★★★★★☆

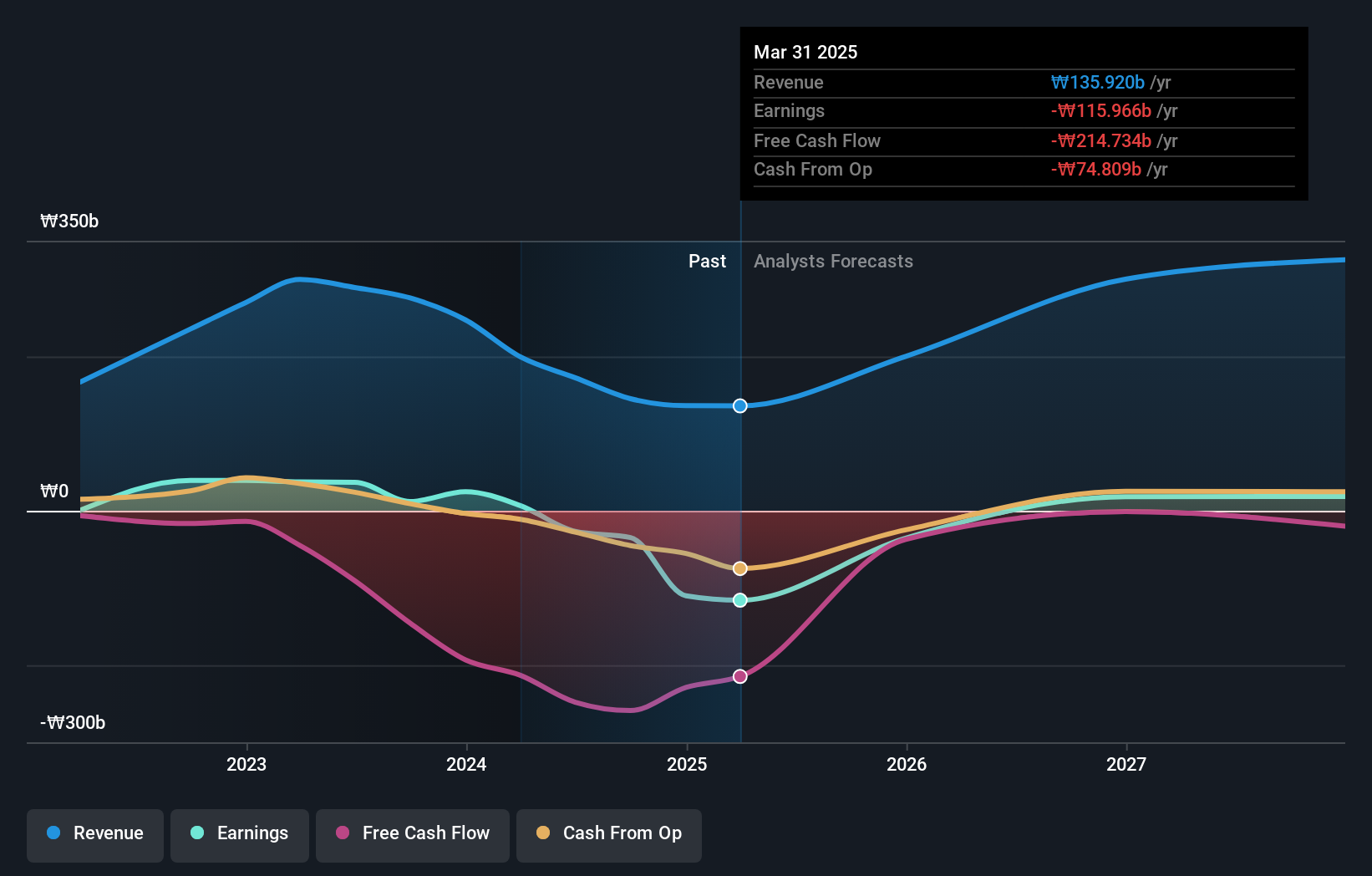

Overview: SungEel HiTech Co., Ltd. is a South Korean company specializing in secondary battery recycling, with a market cap of approximately ₩474.99 billion.

Operations: The company's revenue primarily comes from its secondary battery raw material manufacturing segment, which generated ₩166.79 billion.

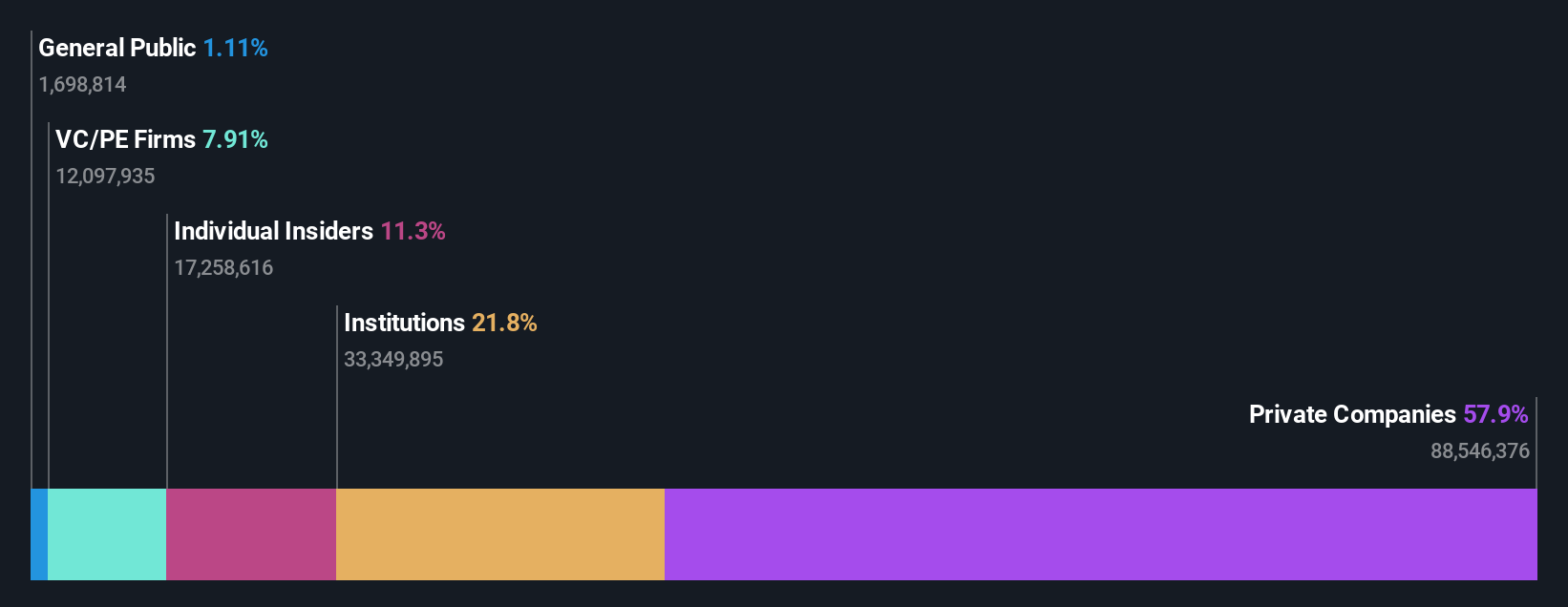

Insider Ownership: 37.9%

Earnings Growth Forecast: 104.1% p.a.

SungEel HiTech is set to experience significant growth, with revenue projected to increase by 45.3% annually, outpacing the Korean market's average. The company is expected to become profitable within three years, indicating robust potential despite its current low return on equity forecast of 4.3%. However, its debt levels are concerning as they aren't well-covered by operating cash flow. Currently trading slightly below fair value, SungEel HiTech presents both opportunities and risks for investors.

- Click here and access our complete growth analysis report to understand the dynamics of SungEel HiTech.

- Our expertly prepared valuation report SungEel HiTech implies its share price may be too high.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market cap of SEK12.50 billion.

Operations: Rusta AB (publ) generates revenue from its operations in Sweden (SEK6.49 billion), Norway (SEK2.43 billion), and other markets including Finland and Germany (SEK2.39 billion).

Insider Ownership: 11.3%

Earnings Growth Forecast: 22.1% p.a.

Rusta's earnings are forecast to grow significantly at 22.1% annually, surpassing the Swedish market average of 10.6%. Despite revenue growth being slower than 20%, it still exceeds the market rate. Recent board changes may influence strategic direction. Trading at a substantial discount to estimated fair value, Rusta has seen more insider buying than selling recently, suggesting confidence in its future prospects despite some earnings fluctuations and a modest return on equity forecast in three years.

- Get an in-depth perspective on Rusta's performance by reading our analyst estimates report here.

- Our valuation report here indicates Rusta may be undervalued.

Petchsrivichai Enterprise (SET:PCE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Petchsrivichai Enterprise Public Company Limited manufactures and sells crude palm kernel oil both in Thailand and internationally, with a market cap of THB8.69 billion.

Operations: The company's revenue segments include Logistics and Services (THB870.89 million), Distribution of Electricity (THB50.79 million), and Manufacture and Distribution of Palm Products (THB27.41 billion).

Insider Ownership: 10.5%

Earnings Growth Forecast: 28.5% p.a.

Petchsrivichai Enterprise's earnings are forecast to grow significantly at 28.5% annually, outpacing the Thai market average of 14.7%. Revenue growth is also expected to exceed the market rate, though not surpassing 20%. Despite a lack of recent insider trading activity, strong profit growth over the past year indicates potential for future expansion. The recent board meeting suggests ongoing strategic evaluations, although insufficient data limits assessment of long-term return on equity projections.

- Click to explore a detailed breakdown of our findings in Petchsrivichai Enterprise's earnings growth report.

- Our valuation report unveils the possibility Petchsrivichai Enterprise's shares may be trading at a premium.

Summing It All Up

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1466 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany.

Outstanding track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives