- Sweden

- /

- Specialty Stores

- /

- OM:HM B

Is H&M (OM:HM B) Overvalued After Its Recent Share Price Rebound? A Closer Look at the Valuation

Reviewed by Simply Wall St

H & M Hennes & Mauritz (OM:HM B) has been quietly rewarding patient shareholders, with the stock gaining about 22% over the past 3 months and roughly 20% year to date.

See our latest analysis for H & M Hennes & Mauritz.

At around SEK 178.65 per share, the 90 day share price return of about 22% and a three year total shareholder return above 80% suggest momentum is clearly building again as investors warm to H & M Hennes & Mauritz’s recovery story.

If H & M’s rebound has you rethinking retail, it could be a good moment to explore auto makers facing their own shifts in demand through auto manufacturers.

Yet with shares trading above analyst targets but still showing a sizable estimated intrinsic discount, the real question is whether H & M remains mispriced value or if the market is already banking on stronger growth ahead.

Most Popular Narrative: 18.5% Overvalued

Compared with the narrative fair value estimate of about SEK 150.74, H & M Hennes & Mauritz’s last close near SEK 178.65 implies investors are already paying up for future margin gains and operational improvements.

Efforts to mitigate external cost pressures, such as negative currency impacts and shipping costs, along with strategic supplier collaborations, are expected to positively affect gross margins and operating profit in the latter half of the year.

Curious how modest revenue growth, rising margins and a disciplined earnings multiple combine to justify that value gap? Want to see the exact roadmap behind it?

Result: Fair Value of $150.74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and weaker sales in key regions could quickly compress margins and challenge the optimism embedded in current expectations.

Find out about the key risks to this H & M Hennes & Mauritz narrative.

Another Angle on Value

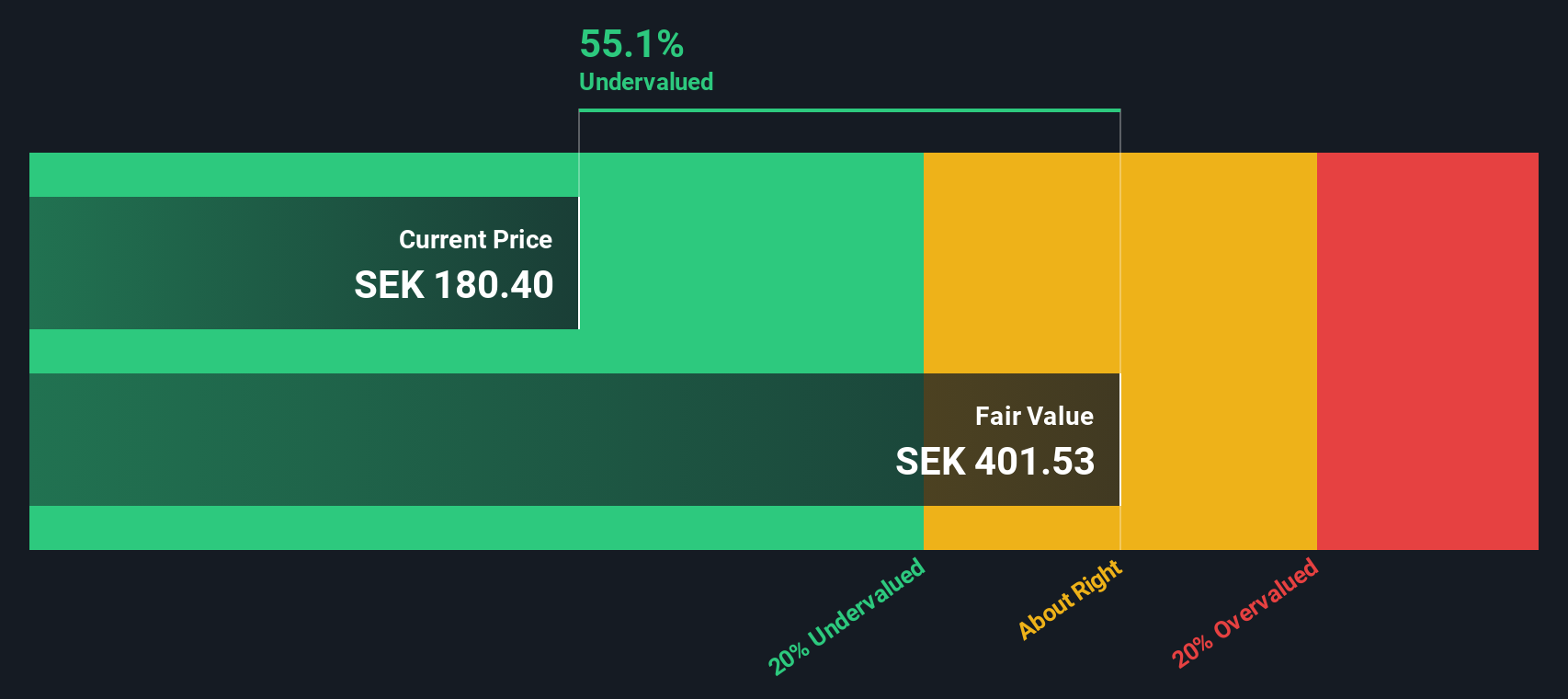

Analysts see H & M Hennes & Mauritz as roughly 18.5% overvalued versus a narrative fair value of about SEK 150.74, yet our SWS DCF model points the other way and suggests the shares trade around 53.6% below intrinsic value. Which story do you think the market ultimately prices in?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out H & M Hennes & Mauritz for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own H & M Hennes & Mauritz Narrative

If you would rather dig into the numbers yourself and shape your own view, you can build a full narrative in just minutes: Do it your way.

A great starting point for your H & M Hennes & Mauritz research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before the market shifts again, use the Simply Wall Street Screener to uncover fresh opportunities that match your strategy and keep you a step ahead.

- Capture high-potential rebounds by scanning these 3605 penny stocks with strong financials that pair tiny share prices with solid underlying fundamentals.

- Ride structural growth trends by targeting these 30 healthcare AI stocks transforming how medicine is diagnosed, delivered and personalized.

- Lock in reliable income streams by focusing on these 12 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if H & M Hennes & Mauritz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HM B

H & M Hennes & Mauritz

Provides clothing, accessories, footwear, cosmetics, home textiles, and homeware for women, men, and children worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026