- Sweden

- /

- Specialty Stores

- /

- OM:BILI A

Bilia AB (publ) (STO:BILI A) Soars 27% But It's A Story Of Risk Vs Reward

Bilia AB (publ) (STO:BILI A) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 27%.

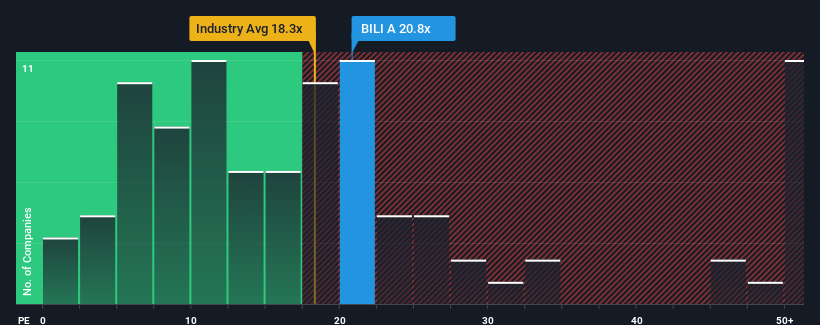

Although its price has surged higher, Bilia's price-to-earnings (or "P/E") ratio of 20.8x might still make it look like a buy right now compared to the market in Sweden, where around half of the companies have P/E ratios above 24x and even P/E's above 44x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Bilia could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Bilia

Is There Any Growth For Bilia?

In order to justify its P/E ratio, Bilia would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 52% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 24% each year over the next three years. With the market only predicted to deliver 21% per annum, the company is positioned for a stronger earnings result.

With this information, we find it odd that Bilia is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Bilia's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Bilia's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Bilia (including 1 which is significant).

If these risks are making you reconsider your opinion on Bilia, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bilia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:BILI A

Bilia

Operates as a full-service supplier for car ownership in Sweden, Norway, Luxemburg, and Belgium.

Undervalued average dividend payer.

Market Insights

Community Narratives