- Sweden

- /

- Capital Markets

- /

- OM:AJA B

We Ran A Stock Scan For Earnings Growth And Byggmästare Anders J Ahlström Holding (STO:AJA B) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Byggmästare Anders J Ahlström Holding (STO:AJA B). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Byggmästare Anders J Ahlström Holding with the means to add long-term value to shareholders.

See our latest analysis for Byggmästare Anders J Ahlström Holding

Byggmästare Anders J Ahlström Holding's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for Byggmästare Anders J Ahlström Holding to have grown EPS from kr22.34 to kr102 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of Byggmästare Anders J Ahlström Holding's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Byggmästare Anders J Ahlström Holding is growing revenues, and EBIT margins improved by 27.3 percentage points to 29%, over the last year. That's great to see, on both counts.

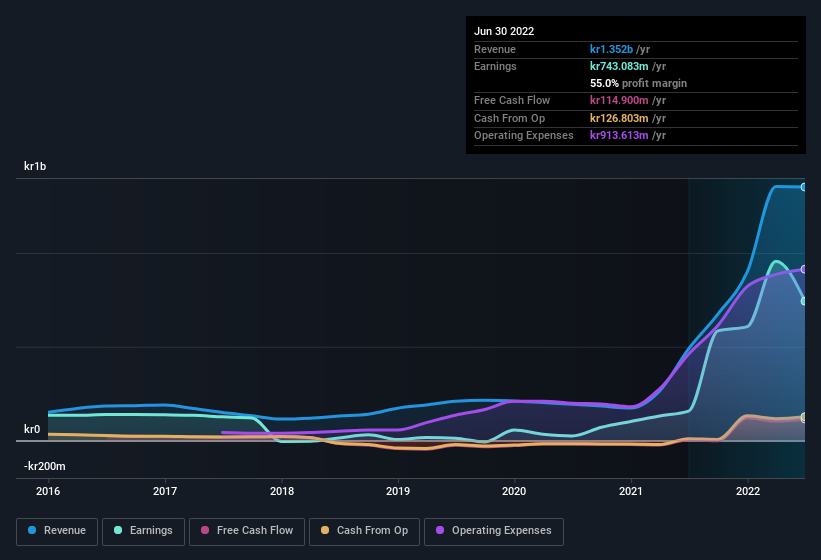

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Byggmästare Anders J Ahlström Holding is no giant, with a market capitalisation of kr1.9b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Byggmästare Anders J Ahlström Holding Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Byggmästare Anders J Ahlström Holding shares, in the last year. So it's definitely nice that Chief Executive Officer Tomas Bergstrom bought kr383k worth of shares at an average price of around kr257. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Along with the insider buying, another encouraging sign for Byggmästare Anders J Ahlström Holding is that insiders, as a group, have a considerable shareholding. As a matter of fact, their holding is valued at kr307m. That's a lot of money, and no small incentive to work hard. As a percentage, this totals to 16% of the shares on issue for the business, an appreciable amount considering the market cap.

Does Byggmästare Anders J Ahlström Holding Deserve A Spot On Your Watchlist?

Byggmästare Anders J Ahlström Holding's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Byggmästare Anders J Ahlström Holding belongs near the top of your watchlist. Even so, be aware that Byggmästare Anders J Ahlström Holding is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

Keen growth investors love to see insider buying. Thankfully, Byggmästare Anders J Ahlström Holding isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Byggmästare Anders J Ahlström Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AJA B

Byggmästare Anders J Ahlström Holding

Invests in, owns, and develops listed and unlisted small and medium-sized companies in Sweden and rest of the Nordic region.

Excellent balance sheet with low risk.

Market Insights

Community Narratives