- Sweden

- /

- Real Estate

- /

- NGM:AMH2 B

These 4 Measures Indicate That Amhult 2 (NGM:AMH2 B) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Amhult 2 AB (publ) (NGM:AMH2 B) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Amhult 2

What Is Amhult 2's Net Debt?

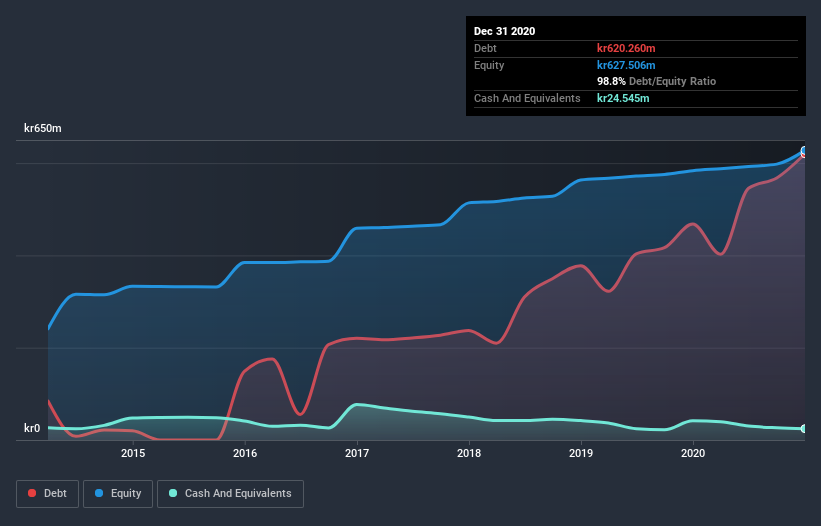

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Amhult 2 had kr620.3m of debt, an increase on kr468.1m, over one year. On the flip side, it has kr24.5m in cash leading to net debt of about kr595.7m.

How Healthy Is Amhult 2's Balance Sheet?

We can see from the most recent balance sheet that Amhult 2 had liabilities of kr141.6m falling due within a year, and liabilities of kr589.4m due beyond that. On the other hand, it had cash of kr24.5m and kr6.38m worth of receivables due within a year. So it has liabilities totalling kr700.1m more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's kr523.2m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Amhult 2 has a rather high debt to EBITDA ratio of 17.5 which suggests a meaningful debt load. But the good news is that it boasts fairly comforting interest cover of 4.2 times, suggesting it can responsibly service its obligations. On a lighter note, we note that Amhult 2 grew its EBIT by 22% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Amhult 2 will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Amhult 2 recorded free cash flow worth 65% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

Both Amhult 2's net debt to EBITDA and its level of total liabilities were discouraging. But on the brighter side of life, its EBIT growth rate leaves us feeling more frolicsome. When we consider all the factors discussed, it seems to us that Amhult 2 is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 4 warning signs with Amhult 2 (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Amhult 2 or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NGM:AMH2 B

Amhult 2

Designs, builds, and manages residential and commercial properties in Sweden.

Acceptable track record low.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success