- Sweden

- /

- Real Estate

- /

- OM:PRISMA

Prisma Properties AB (publ) (STO:PRISMA) Just Reported Third-Quarter Earnings: Have Analysts Changed Their Mind On The Stock?

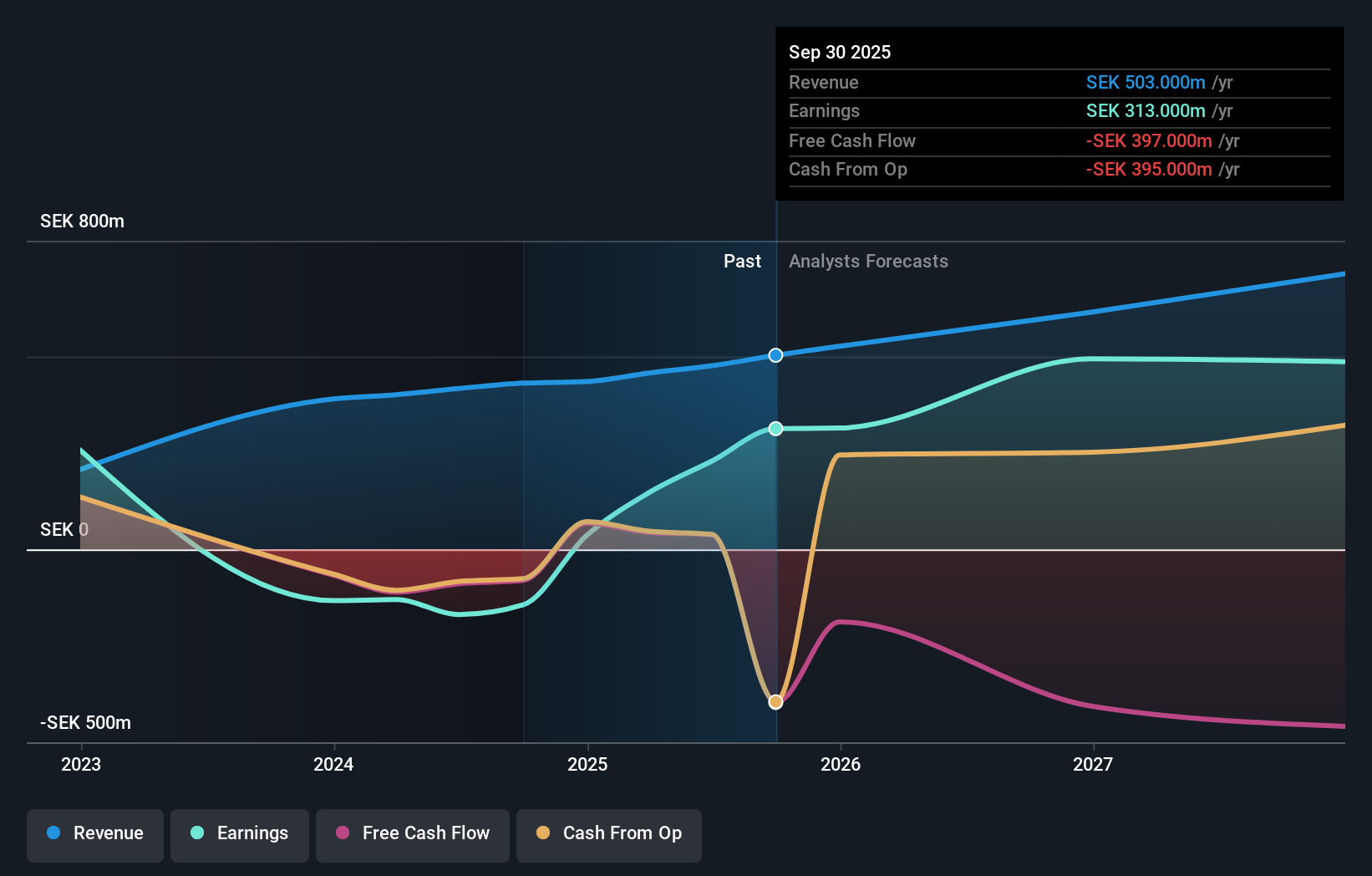

It's been a good week for Prisma Properties AB (publ) (STO:PRISMA) shareholders, because the company has just released its latest third-quarter results, and the shares gained 2.7% to kr25.00. Revenues came in 3.4% below expectations, at kr135m. Statutory earnings per share were relatively better off, with a per-share profit of kr0.25 being roughly in line with analyst estimates. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Taking into account the latest results, the most recent consensus for Prisma Properties from two analysts is for revenues of kr615.1m in 2026. If met, it would imply a substantial 22% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to bounce 54% to kr2.94. Before this earnings report, the analysts had been forecasting revenues of kr636.7m and earnings per share (EPS) of kr3.04 in 2026. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a minor downgrade to earnings per share estimates.

Check out our latest analysis for Prisma Properties

The analysts made no major changes to their price target of kr31.00, suggesting the downgrades are not expected to have a long-term impact on Prisma Properties' valuation.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Prisma Properties' revenue growth is expected to slow, with the forecast 17% annualised growth rate until the end of 2026 being well below the historical 23% p.a. growth over the last three years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 4.9% per year. Even after the forecast slowdown in growth, it seems obvious that Prisma Properties is also expected to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Prisma Properties. They also downgraded Prisma Properties' revenue estimates, but industry data suggests that it is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Prisma Properties. Long-term earnings power is much more important than next year's profits. At least one analyst has provided forecasts out to 2027, which can be seen for free on our platform here.

However, before you get too enthused, we've discovered 2 warning signs for Prisma Properties (1 is significant!) that you should be aware of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PRISMA

Prisma Properties

Owns, develops, and leases properties in Sweden, Denmark, and Norway.

Moderate growth potential and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)