- Sweden

- /

- Real Estate

- /

- OM:KFAST B

We Think K-Fast Holding (STO:KFAST B) Is Taking Some Risk With Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, K-Fast Holding AB (publ) (STO:KFAST B) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for K-Fast Holding

What Is K-Fast Holding's Net Debt?

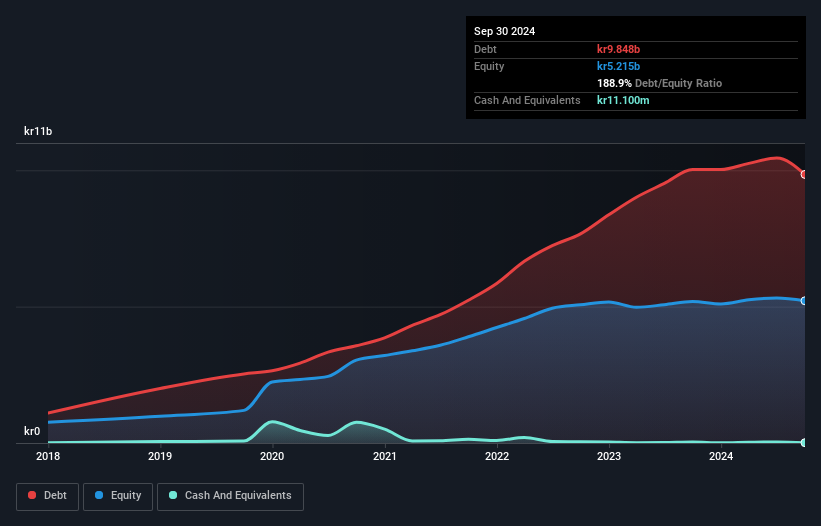

As you can see below, K-Fast Holding had kr9.85b of debt, at September 2024, which is about the same as the year before. You can click the chart for greater detail. And it doesn't have much cash, so its net debt is about the same.

How Strong Is K-Fast Holding's Balance Sheet?

We can see from the most recent balance sheet that K-Fast Holding had liabilities of kr3.42b falling due within a year, and liabilities of kr8.34b due beyond that. On the other hand, it had cash of kr11.1m and kr319.5m worth of receivables due within a year. So its liabilities total kr11.4b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the kr4.33b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, K-Fast Holding would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

K-Fast Holding shareholders face the double whammy of a high net debt to EBITDA ratio (25.1), and fairly weak interest coverage, since EBIT is just 1.3 times the interest expense. The debt burden here is substantial. On a lighter note, we note that K-Fast Holding grew its EBIT by 29% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine K-Fast Holding's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, K-Fast Holding recorded free cash flow of 41% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both K-Fast Holding's net debt to EBITDA and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Overall, it seems to us that K-Fast Holding's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with K-Fast Holding .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if K-Fast Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:KFAST B

K-Fast Holding

Together with its subsidiary, engages in property management and construction businesses in Sweden.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)