- Sweden

- /

- Real Estate

- /

- OM:FABG

Evaluating Fabege (OM:FABG)’s Valuation After Renewed Nasdaq Green Equity Recognition

Reviewed by Simply Wall St

Fabege (OM:FABG) has retained its Nasdaq Green Equity label for a third year, backed by an S&P Global Ratings review. This serves as a fresh reminder that most of its business and investments are genuinely tied to green activities.

See our latest analysis for Fabege.

The recognition comes as Fabege’s share price sits at SEK 80.45, with a modest 90 day share price return of 1.20 percent but a five year total shareholder return of negative 28.79 percent. This suggests momentum is only slowly rebuilding as the market reassesses long term sustainability driven value.

If this kind of sustainability angle interests you, it could be a good moment to explore other real asset plays via fast growing stocks with high insider ownership and see what else stands out.

Yet with the share still below analysts’ targets after years of lacklustre returns, investors face a key question: is Fabege’s green transition undervalued, or is the market already pricing in every bit of future growth?

Most Popular Narrative: 6.4% Undervalued

With Fabege last closing at SEK 80.45 against a narrative fair value of SEK 85.98, followers see modest upside driven by long term fundamentals.

The analysts have a consensus price target of SEK84.125 for Fabege based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK120.0, and the most bearish reporting a price target of just SEK61.0.

Want to know what kind of revenue path and profit margins could justify those diverging targets? The valuation hinges on a dramatic earnings step up and a far leaner future multiple. Curious how those pieces fit together?

Result: Fair Value of $85.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent Stockholm office weakness and ongoing property value declines could easily derail the earnings ramp and compress that assumed future multiple.

Find out about the key risks to this Fabege narrative.

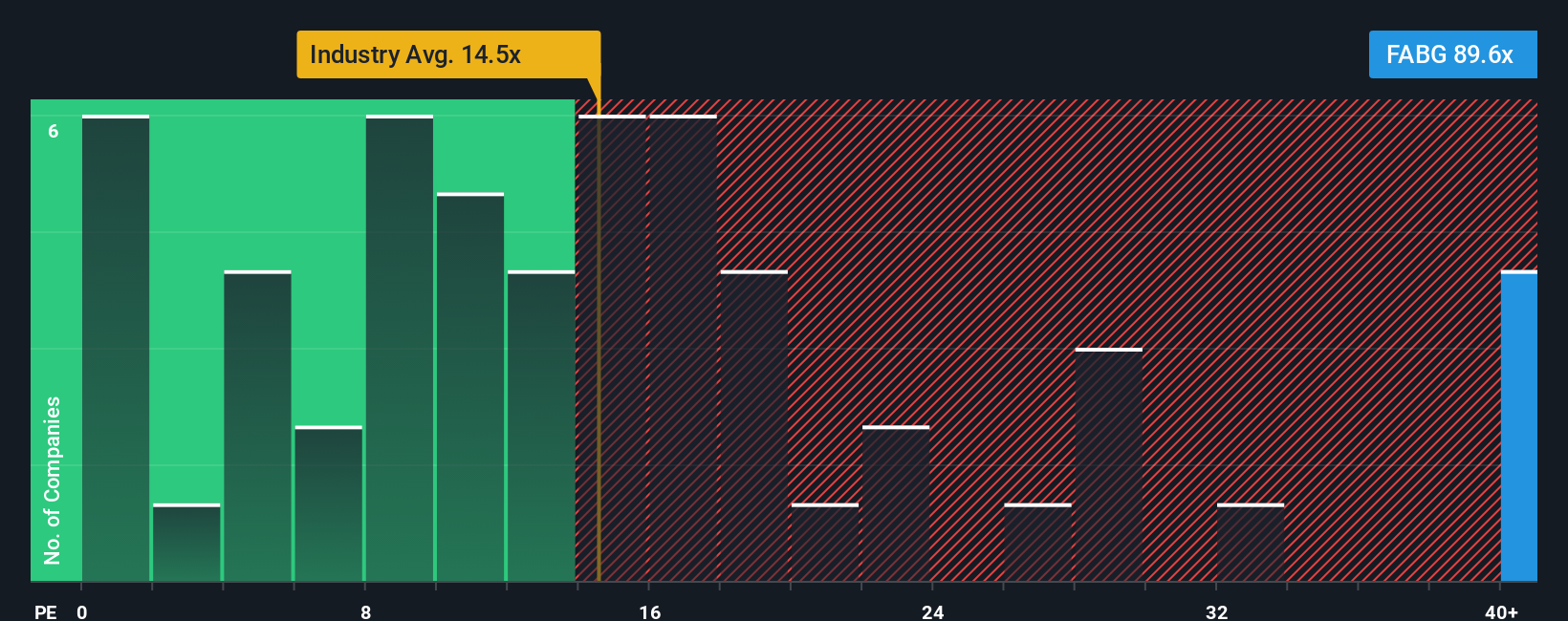

Another Lens on Value: Earnings Multiple Looks Stretched

While the narrative fair value points to roughly 6 percent upside, the current share price implies a price to earnings ratio of about 88 times, versus 17 times for peers and a fair ratio closer to 67 times. That leaves little margin for error if the earnings ramp stalls.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fabege Narrative

If this perspective does not quite align with your own, you can dive into the numbers, shape your own view in minutes, and Do it your way.

A great starting point for your Fabege research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before you move on, consider using the Simply Wall Street Screener to identify fresh, high conviction ideas that fit your strategy.

- Look for potential turnaround value by targeting these 908 undervalued stocks based on cash flows that have solid cash flow support behind their current prices.

- Explore transformative technology themes through these 26 AI penny stocks participating in the next wave of AI driven growth.

- Search for these 12 dividend stocks with yields > 3% that balance yield with sustainable payout prospects to help support your income objectives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FABG

Fabege

A property company, primarily engages in the development, investment, and management of commercial premises in Sweden.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026