- Sweden

- /

- Real Estate

- /

- OM:EMIL B

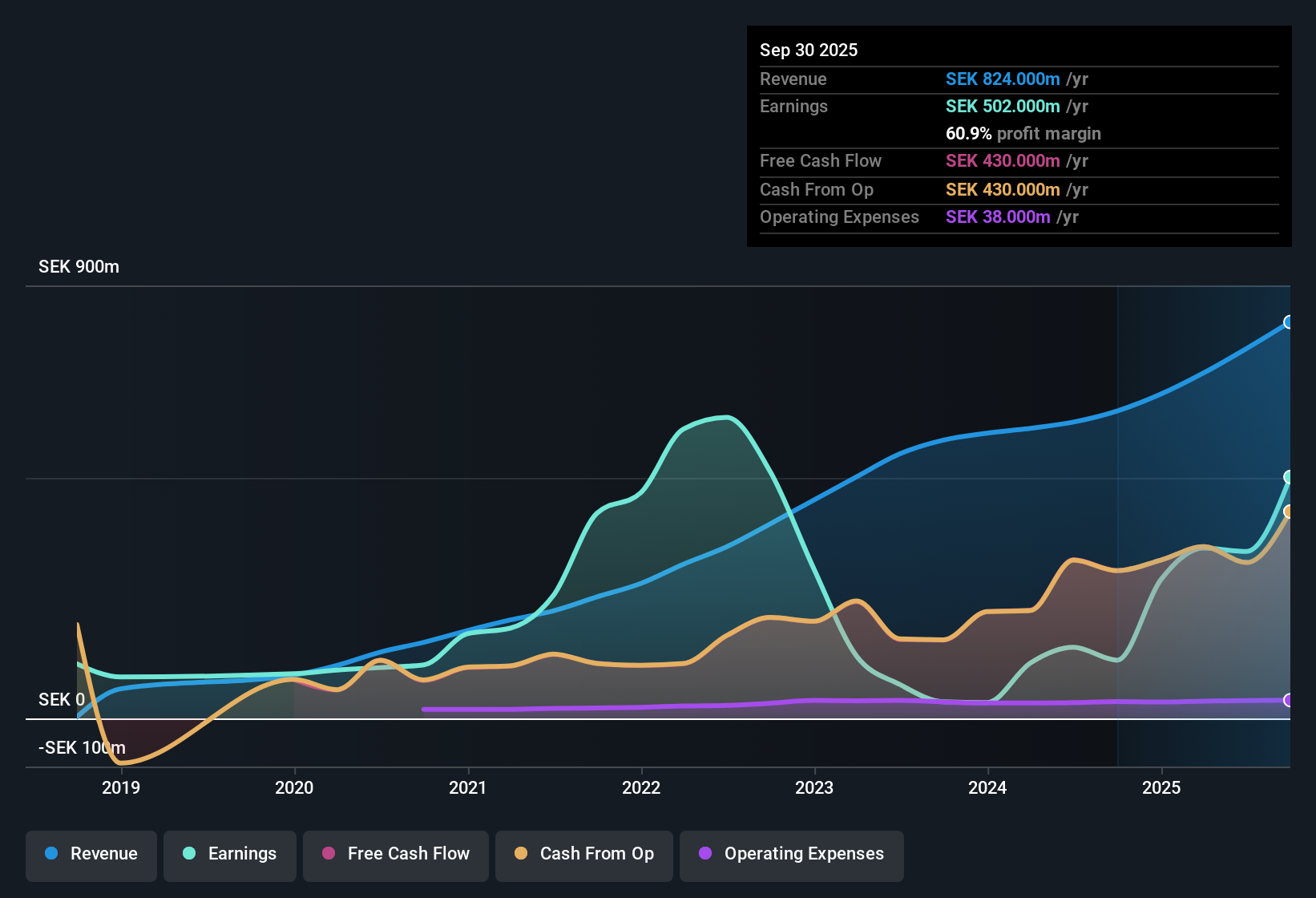

Emilshus (OM:EMIL B) Net Margin Surge Driven by SEK279M One-Off Challenges Earnings Quality Narratives

Reviewed by Simply Wall St

Fastighetsbolaget Emilshus (OM:EMIL B) delivered a net profit margin of 60.9%, well ahead of last year’s 19%, with results boosted by a one-off gain of SEK279.0 million. While EPS is set for slower growth at 2.3% per year, revenue is projected to rise 12.7% annually, handily outpacing the Swedish market average of 4.8%. Investors will be weighing the sizable margin jump and solid revenue outlook against modest EPS growth and the impact of those one-off gains in the bottom line.

See our full analysis for Fastighetsbolaget Emilshus.Now, let's see how the latest earnings figures stack up against the dominant market narratives, highlighting where they align and where the data might challenge investor assumptions.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Drives Profits, but Repeats Unlikely

- The SEK279.0 million one-off gain made a large contribution to the profit this period, highlighting that the 60.9% net profit margin is not all from ongoing business improvements.

- Recent results spotlight how heavily reported profits rely on these non-recurring items.

- Emilshus is not considered to be in a solid financial position, so future growth and profits could look quite different if such one-time boosts do not recur.

- This creates a gap between the perception of strong profit growth and the more modest trend shown by normalized earnings, which echoes caution in the prevailing market view.

Revenue Growth Set to Outpace the Market

- Projected annual revenue growth of 12.7% stands well above the Swedish market average of 4.8%, pointing to firm top-line momentum for Emilshus.

- The prevailing market view sees this as a positive sign, but cautions that while strong revenue growth can support future performance,

- the slower expected earnings growth rate of 2.3% per year may dampen the excitement, suggesting that profitability gains may not fully match the pace of sales increases.

- Investors are still weighing the benefits of growth versus the challenges of translating that growth into sustained bottom-line improvement.

Valuation Screens as Modestly Attractive

- The current price-to-earnings ratio of 17.5x is slightly below both the real estate industry average (17.6x) and peer average (19.9x), offering Emilshus a minor valuation discount in its sector.

- The prevailing market view focuses on this modest discount,

- noting that market pricing appears favorable relative to peers, but future shifts could depend on how recurring earnings trends play out without the help of exceptional gains.

- This opens the door for re-rating if Emilshus can prove consistent long-term growth and financial resilience in upcoming periods.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Fastighetsbolaget Emilshus's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Emilshus’s heavy reliance on one-off gains and a less robust financial position raise concerns about the sustainability of its profit growth.

If you want steadier prospects, use solid balance sheet and fundamentals stocks screener (1983 results) to find companies with resilient finances and reliable earnings growth. This approach may help reduce your exposure to sudden surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EMIL B

Fastighetsbolaget Emilshus

Acquires, develops, and manages commercial real estate properties in Sweden.

Low risk and slightly overvalued.

Market Insights

Community Narratives