- Sweden

- /

- Real Estate

- /

- OM:DIOS

Exploring 3 Undervalued Small Caps In The European Market With Insider Action

Reviewed by Simply Wall St

As the European market navigates a complex landscape marked by mixed performances across major indices and a slight uptick in eurozone inflation, small-cap stocks present intriguing opportunities for investors seeking growth potential amid economic fluctuations. In this environment, identifying promising small caps often involves looking at companies with solid fundamentals that can weather economic shifts and leverage insider actions as indicators of confidence.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Norcros | 13.5x | 0.7x | 42.05% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 39.18% | ★★★★★☆ |

| Eastnine | 11.6x | 7.3x | 49.57% | ★★★★★☆ |

| Senior | 24.5x | 0.8x | 28.02% | ★★★★★☆ |

| Eurocell | 16.7x | 0.3x | 39.05% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.6x | 39.69% | ★★★★☆☆ |

| Norbit | 30.9x | 5.2x | 9.23% | ★★★☆☆☆ |

| Gooch & Housego | 45.1x | 1.1x | 24.41% | ★★★☆☆☆ |

| Kendrion | 29.3x | 0.7x | 41.68% | ★★★☆☆☆ |

| CVS Group | 46.0x | 1.3x | 26.32% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Secure Trust Bank (LSE:STB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Secure Trust Bank is a UK-based financial institution that provides a range of banking services, including retail and vehicle finance, commercial finance, and real estate finance, with a market capitalization of £0.15 billion.

Operations: Secure Trust Bank generates revenue primarily from Retail Finance (£77.90 million), Vehicle Finance (£17.80 million), Commercial Finance (£19.60 million), and Real Estate Finance (£27.30 million). The company's gross profit margin consistently stands at 100%, indicating no reported cost of goods sold, while the net income margin fluctuates, reaching as high as 27.09% in recent periods before declining to 15.77%. Operating expenses are a significant component of costs, impacting overall profitability across different reporting periods.

PE: 8.3x

Secure Trust Bank, a European financial institution, shows potential as an undervalued investment opportunity. With insider confidence demonstrated by James Raymond Brown's purchase of 25,000 shares for £228,987 in September 2025 and earnings projected to grow by over 41% annually, the bank presents a compelling case. However, challenges include a high bad loans ratio of 4.5% and significant one-off items affecting earnings quality. Recent board changes signal strategic shifts that may influence future performance positively.

- Delve into the full analysis valuation report here for a deeper understanding of Secure Trust Bank.

Assess Secure Trust Bank's past performance with our detailed historical performance reports.

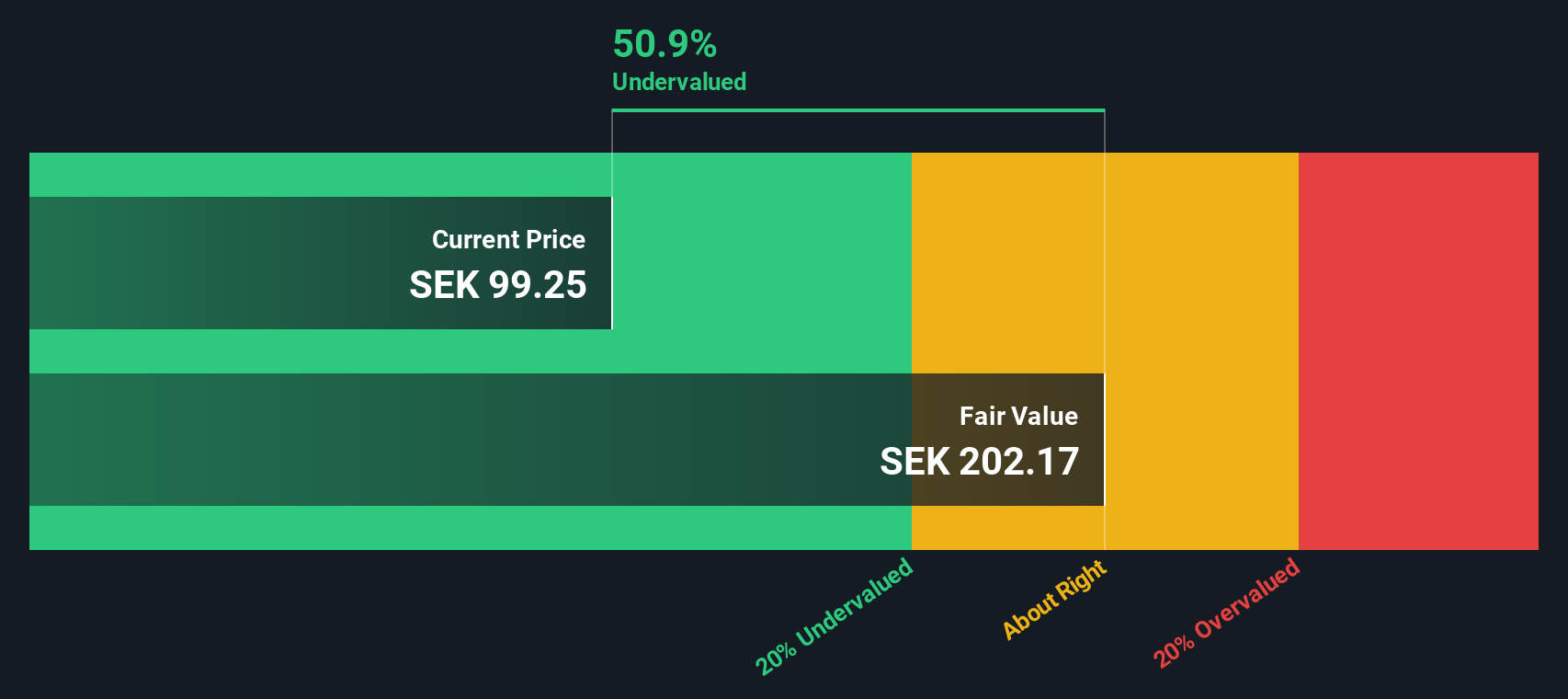

Diös Fastigheter (OM:DIOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Diös Fastigheter is a Swedish real estate company focused on owning and managing commercial properties in various regions, with a market capitalization of approximately SEK 6.97 billion.

Operations: The company generates revenue primarily from its regional operations, with significant contributions from areas such as Dalarna and Luleå. Over time, the gross profit margin has shown an upward trend, reaching 69.07% by September 2024. Operating expenses have remained relatively stable compared to revenue growth, while non-operating expenses have fluctuated significantly impacting net income margins.

PE: 11.2x

Diös Fastigheter, a property company in Europe, is attracting attention for its potential value. Recent insider confidence was demonstrated by an individual purchasing 15,000 shares worth approximately SEK 987,450. Their earnings have improved significantly from a net loss to SEK 303 million for Q3 2025 compared to the previous year. The company has also signed multiple green lease agreements with notable firms like Bonnier News and WSP, reflecting a strategic focus on sustainable development and tenant diversification.

- Click here to discover the nuances of Diös Fastigheter with our detailed analytical valuation report.

Examine Diös Fastigheter's past performance report to understand how it has performed in the past.

Dynavox Group (OM:DYVOX)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dynavox Group is a company involved in the computer hardware sector, with operations generating SEK 2.38 billion in revenue.

Operations: Dynavox Group primarily generates revenue from its computer hardware segment, with recent figures reaching SEK 2.38 billion. The company's cost structure includes significant expenses in sales and marketing, research and development, and general administrative areas. Notably, the gross profit margin has shown an upward trend, reaching 68.72% by the end of September 2025.

PE: 75.4x

Dynavox Group, a European company with smaller market capitalization, shows potential for investors seeking overlooked opportunities. Despite having SEK 1.8 billion in sales for the first nine months of 2025, earnings slightly dipped to SEK 90 million from SEK 92 million the previous year. They rely entirely on external borrowing, which adds risk but also signals growth ambition. Notably, insider confidence is evident with share purchases throughout September and October 2025, hinting at optimism about future performance amidst forecasted earnings growth of over 38% annually.

- Take a closer look at Dynavox Group's potential here in our valuation report.

Gain insights into Dynavox Group's historical performance by reviewing our past performance report.

Key Takeaways

- Navigate through the entire inventory of 73 Undervalued European Small Caps With Insider Buying here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DIOS

Diös Fastigheter

Develops, owns, and rents commercial and residential properties in Sweden.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)