- Sweden

- /

- Real Estate

- /

- OM:BALD B

Does Balder's (OM:BALD B) Gothenburg Project Signal a Deeper Commitment to Sustainable Urban Development?

Reviewed by Simply Wall St

- Fastighets AB Balder has begun construction on the Granit rental housing project along Langstromsallen in Gothenburg, adding nearly 100 new rental apartments and commercial premises as part of its ongoing area development efforts.

- This project highlights Balder's focus on sustainable and inclusive neighbourhood growth, with long-term investment in both residential quality and local infrastructure.

- We'll consider how the renewed focus on sustainable development in Gothenburg could shape Balder's investment outlook and future growth assumptions.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

Fastighets AB Balder Investment Narrative Recap

For investors considering Fastighets AB Balder, the core belief centers on the company's ability to balance long-term, sustainable area development with prudent financial management, especially amid ongoing expansion in Sweden and Finland. The Granit rental housing project in Gothenburg is a strong signal of Balder’s ongoing commitment to organic growth, but it does not materially shift the main short-term catalyst, which remains tied to stabilizing interest costs and successful refinancing of existing short-term bank loans. The primary risk also remains unchanged: a high net debt to assets ratio of 49.4% that exposes Balder to liquidity pressures if refinancing conditions worsen.

Among recent announcements, the December 2024 acquisition of Doxa Fastigheter stands out as the most contextually relevant to the Granit project; both mark Balder’s continued prioritization of local expansion over new market entries, reinforcing the company’s reliance on revenue growth through acquisitions and development. However, this sustained expansion also magnifies its dependence on adequate access to cost-effective funding to support new projects when refinancing becomes less favorable...

Read the full narrative on Fastighets AB Balder (it's free!)

Fastighets AB Balder is projected to reach SEK15.1 billion in revenue and SEK7.0 billion in earnings by 2028. This outlook assumes a yearly revenue growth rate of 4.1% and an earnings increase of SEK0.4 billion from current earnings of SEK6.6 billion.

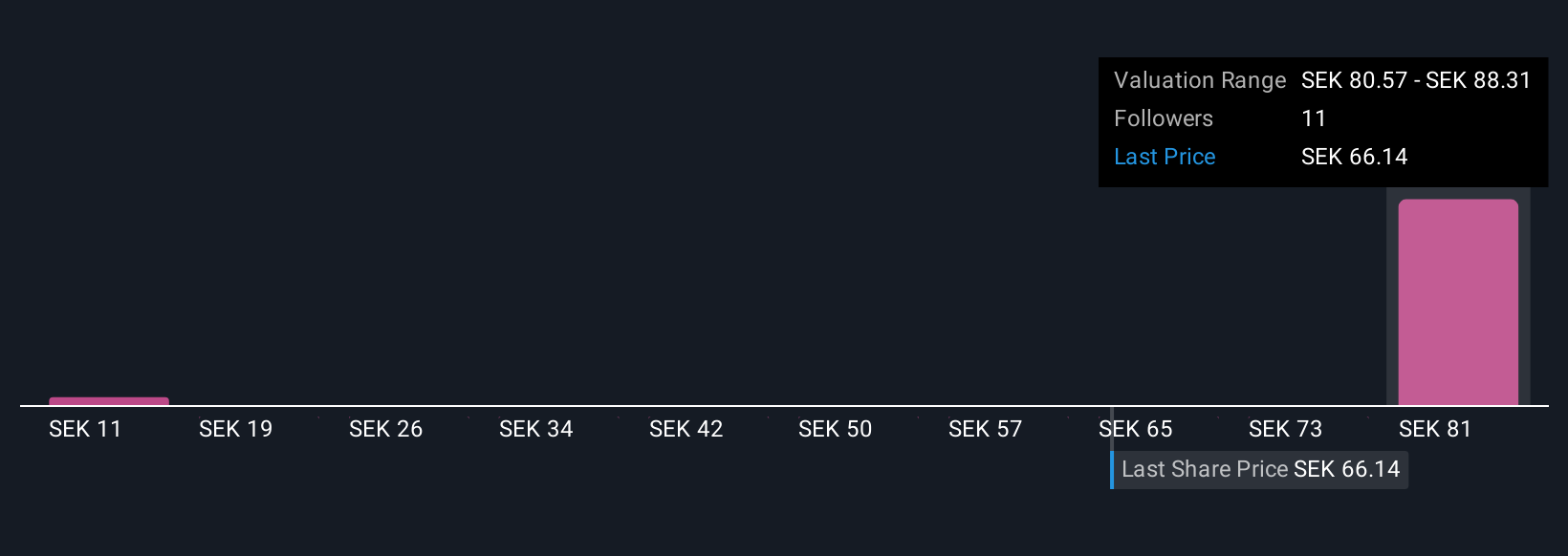

Uncover how Fastighets AB Balder's forecasts yield a SEK81.20 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 3 fair value estimates for Balder ranging from SEK10.95 to SEK88.31, showing broad differences in opinion. While some investors see opportunity, keep in mind that Balder’s high leverage and debt refinancing needs can affect future returns and resilience, check out what the wider community expects and review your own assumptions carefully.

Explore 3 other fair value estimates on Fastighets AB Balder - why the stock might be worth less than half the current price!

Build Your Own Fastighets AB Balder Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fastighets AB Balder research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fastighets AB Balder research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fastighets AB Balder's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BALD B

Fastighets AB Balder

Develops, owns, leases, and manages residential and commercial properties in Sweden, Denmark, Finland, Norway, Germany, and the United Kingdom.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives