Here's Why Shareholders May Consider Paying Swedish Orphan Biovitrum AB (publ)'s (STO:SOBI) CEO A Little More

Key Insights

- Swedish Orphan Biovitrum's Annual General Meeting to take place on 14th of May

- Total pay for CEO Guido Oelkers includes kr12.3m salary

- The total compensation is 43% less than the average for the industry

- Over the past three years, Swedish Orphan Biovitrum's EPS fell by 12% and over the past three years, the total shareholder return was 108%

Shareholders will probably not be disappointed by the robust results at Swedish Orphan Biovitrum AB (publ) (STO:SOBI) recently and they will be keeping this in mind as they go into the AGM on 14th of May. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

View our latest analysis for Swedish Orphan Biovitrum

Comparing Swedish Orphan Biovitrum AB (publ)'s CEO Compensation With The Industry

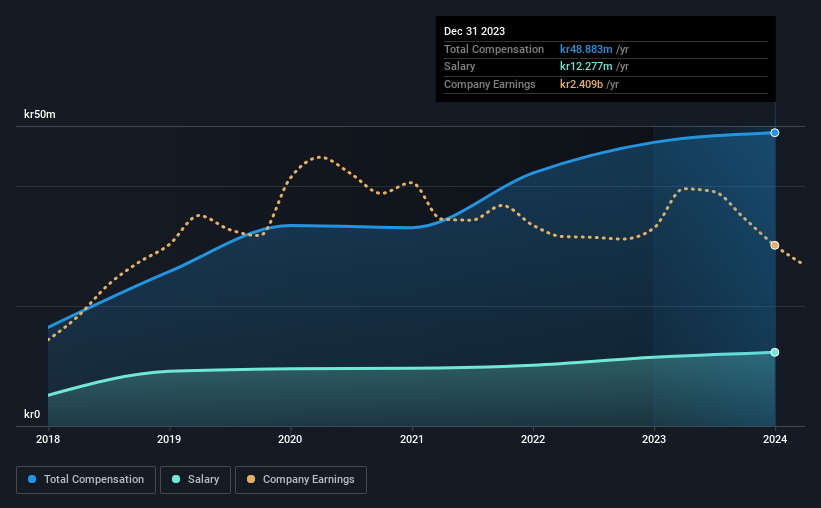

Our data indicates that Swedish Orphan Biovitrum AB (publ) has a market capitalization of kr95b, and total annual CEO compensation was reported as kr49m for the year to December 2023. That's just a smallish increase of 3.4% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at kr12m.

On comparing similar companies from the Swedish Biotechs industry with market caps ranging from kr43b to kr130b, we found that the median CEO total compensation was kr86m. In other words, Swedish Orphan Biovitrum pays its CEO lower than the industry median. Moreover, Guido Oelkers also holds kr105m worth of Swedish Orphan Biovitrum stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr12m | kr11m | 25% |

| Other | kr37m | kr36m | 75% |

| Total Compensation | kr49m | kr47m | 100% |

On an industry level, roughly 56% of total compensation represents salary and 44% is other remuneration. It's interesting to note that Swedish Orphan Biovitrum allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Swedish Orphan Biovitrum AB (publ)'s Growth Numbers

Over the last three years, Swedish Orphan Biovitrum AB (publ) has shrunk its earnings per share by 12% per year. Its revenue is up 21% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Swedish Orphan Biovitrum AB (publ) Been A Good Investment?

Most shareholders would probably be pleased with Swedish Orphan Biovitrum AB (publ) for providing a total return of 108% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's overall performance, while not bad, could be better. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for Swedish Orphan Biovitrum that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:SOBI

Swedish Orphan Biovitrum

An integrated biotechnology company, researches, develops, manufactures, and sells pharmaceuticals in the therapeutic areas of haematology, immunology, and specialty care in Europe, North America, the Middle East, Asia, and Australia.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives