Infant Bacterial Therapeutics AB (publ)'s (STO:IBT B) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Infant Bacterial Therapeutics will host its Annual General Meeting on 8th of May

- CEO Staffan Stromberg's total compensation includes salary of kr3.09m

- The total compensation is 80% higher than the average for the industry

- Infant Bacterial Therapeutics' three-year loss to shareholders was 5.2% while its EPS was down 19% over the past three years

In the past three years, shareholders of Infant Bacterial Therapeutics AB (publ) (STO:IBT B) have seen a loss on their investment. In addition, the company's per-share earnings growth is not looking good, despite growing revenues. Shareholders will have a chance to take their concerns to the board at the next AGM on 8th of May and vote on resolutions including executive compensation, which studies show may have an impact on company performance. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for Infant Bacterial Therapeutics

Comparing Infant Bacterial Therapeutics AB (publ)'s CEO Compensation With The Industry

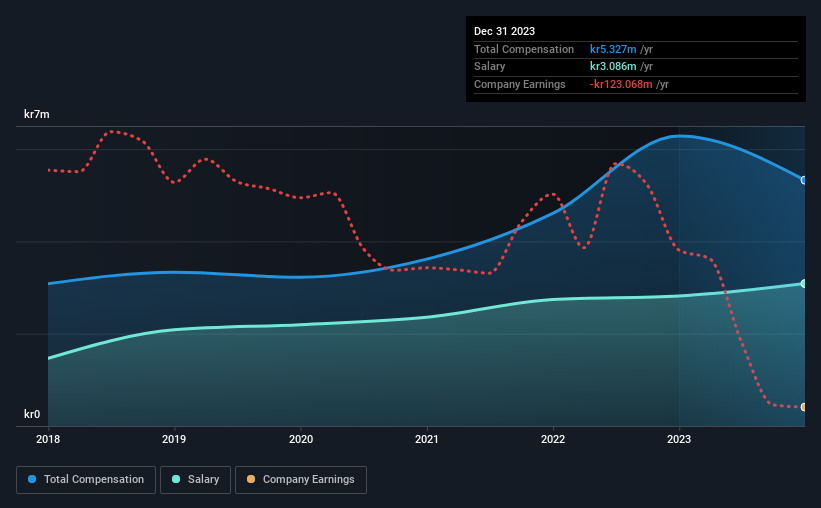

According to our data, Infant Bacterial Therapeutics AB (publ) has a market capitalization of kr1.2b, and paid its CEO total annual compensation worth kr5.3m over the year to December 2023. Notably, that's a decrease of 15% over the year before. We note that the salary of kr3.09m makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the Swedish Pharmaceuticals industry with market capitalizations under kr2.2b, the reported median total CEO compensation was kr3.0m. Hence, we can conclude that Staffan Stromberg is remunerated higher than the industry median. Moreover, Staffan Stromberg also holds kr9.4m worth of Infant Bacterial Therapeutics stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr3.1m | kr2.8m | 58% |

| Other | kr2.2m | kr3.5m | 42% |

| Total Compensation | kr5.3m | kr6.3m | 100% |

Talking in terms of the industry, salary represented approximately 63% of total compensation out of all the companies we analyzed, while other remuneration made up 37% of the pie. Although there is a difference in how total compensation is set, Infant Bacterial Therapeutics more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Infant Bacterial Therapeutics AB (publ)'s Growth

Infant Bacterial Therapeutics AB (publ) has reduced its earnings per share by 19% a year over the last three years. Its revenue is up 542% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Infant Bacterial Therapeutics AB (publ) Been A Good Investment?

Given the total shareholder loss of 5.2% over three years, many shareholders in Infant Bacterial Therapeutics AB (publ) are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

The company's earnings haven't grown and possibly because of that, the stock has performed poorly, resulting in a loss for the company's shareholders. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 3 warning signs for Infant Bacterial Therapeutics you should be aware of, and 2 of them are significant.

Important note: Infant Bacterial Therapeutics is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:IBT B

Infant Bacterial Therapeutics

Operates as a clinical stage pharmaceutical company develops and markets drugs to prevent serious neonatal diseases affecting premature infants in Sweden.

Flawless balance sheet slight.

Market Insights

Community Narratives