Market Might Still Lack Some Conviction On Calliditas Therapeutics AB (publ) (STO:CALTX) Even After 42% Share Price Boost

Calliditas Therapeutics AB (publ) (STO:CALTX) shares have had a really impressive month, gaining 42% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 40% in the last year.

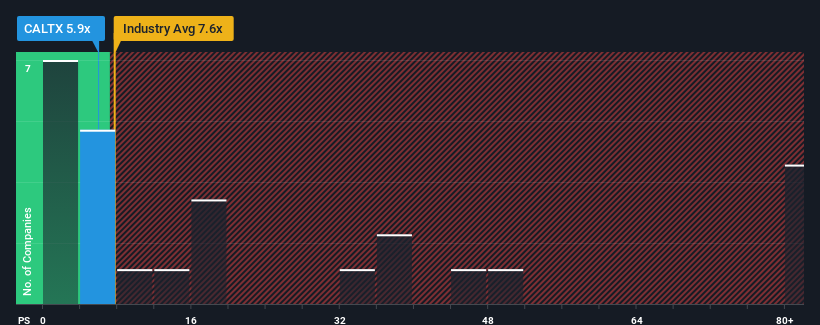

Although its price has surged higher, Calliditas Therapeutics may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 5.9x, considering almost half of all companies in the Pharmaceuticals industry in Sweden have P/S ratios greater than 7.6x and even P/S higher than 40x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Calliditas Therapeutics

How Calliditas Therapeutics Has Been Performing

Calliditas Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Calliditas Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

Calliditas Therapeutics' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 192% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 69% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 36% each year, which is noticeably less attractive.

With this information, we find it odd that Calliditas Therapeutics is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Despite Calliditas Therapeutics' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Calliditas Therapeutics' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Calliditas Therapeutics with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Calliditas Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CALTX

Calliditas Therapeutics

A commercial-stage bio-pharmaceutical company, focused on identifying, developing, and commercializing novel treatments in orphan indications with an initial focus on renal and hepatic diseases with significant unmet medical needs in the United States, Europe, and Asia.

Exceptional growth potential and undervalued.

Market Insights

Community Narratives